CFTC Mission

To foster open, transparent, competitive, and financially sound markets; to avoid systemic risk; and to protect market users and their funds, consumers, and the public from fraud, manipulation, and abusive practices related to derivatives and other products that are subject to the Commodity Exchange Act.

Chairman’s

Transmittal Letter

Click on Read letter below to read the full Chairman’s Transmittal Letter.

U.S. Commodity Futures Trading Commission

Three Lafayette Centre, 1155 21st Street, NW, Washington, DC 20581

www.cftc.gov

Timothy G. Massad

Chairman

(202) 418-5050

(202) 418-5533 Facsimile

[email protected]

Chairman’s Transmittal Letter

February 2, 2015

The Honorable Thad Cochran

Chairman

Committee on Appropriations

U.S. Senate

Washington, D. C. 20510

The Honorable Barbara A. Mikulski

Ranking Member

Committee on Appropriations

U.S. Senate

Washington, D. C. 20510

The Honorable Harold Rogers

Chairman

Committee on Appropriations

U.S. House of Representatives

Washington, D. C. 20515

The Honorable Nita Lowey

Ranking Member

Committee on Appropriations

U.S. House of Representatives

Washington, D. C. 20515

Dear Chairman Cochran, Senator Mikulski, Chairman Rogers and Representative Lowey:

I am pleased to transmit the Commodity Futures Trading Commission (CFTC or Commission) Budget Estimate for fiscal year (FY) 2016. This budget request will substantially enhance the Commission’s ability to fulfill its responsibilities to oversee our nation’s futures, options and swaps markets.

The Commission and its predecessor agencies have overseen the derivatives markets since the 1920s, and in these markets, the Commission seeks to protect market participants from fraud, manipulation and abusive practices, and to protect the public and our economy from systemic risk related to derivatives. To fulfill these roles, the Commission requires adequate funding to oversee futures exchanges (referred to as designated contract markets, or DCMs), swap execution facilities (SEFs), derivatives clearing organizations (DCOs), swap dealers (SDs), swap data repositories (SDRs), futures commission merchants (FCMs) and other intermediaries.

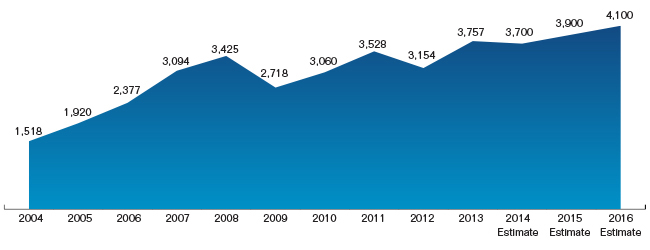

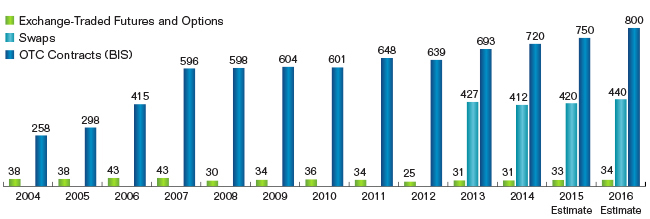

The Commission’s responsibilities were substantially increased by the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). This gave the Commission primary responsibility for oversight of the over-the-counter (OTC) swaps market, an over $400 trillion market in the United States, measured by notional amount. While the Commission’s budget has increased somewhat since that time, the increases have not been commensurate with the vast expansion of the Commission’s responsibilities and the increased challenges in light of market developments. Funding levels received in prior years have limited the Commission’s ability to fulfill its new responsibilities with respect to the swaps market while at the same time continuing to meet its traditional responsibilities for the futures and options markets.

In addition, the markets that the Commission has traditionally overseen have grown in technological sophistication and complexity. Trading is increasingly conducted in an automated, electronic fashion, and cybersecurity represents a major new threat to the integrity and smooth functioning of the critical market infrastructure that the Commission regulates. The Commission must substantially increase its own capabilities in order to fulfill its responsibilities.

In order to advance the goals and priorities of the Commission in FY 2016, the Commission is requesting a budget of $322 million and 895 full-time equivalents (FTE). This is an increase of $72 million and 149 FTE over the FY 2015 enacted level.

Approximately 39 percent of the requested $72 million increase is required for information technology investments that will enhance all of the Commission’s activities, including in particular, market surveillance, financial and risk surveillance, data collection and analysis, and enforcement. The other 61 percent of the funding request supports an increase in staffing and related support, specifically targeting highly critical areas such as enforcement, registration, economic and legal analysis, and examinations.

This request will enable the Commission to engage in the following activities, among others, in support of its mission:

- Enhance surveillance capabilities to keep pace with the increasing technological sophistication of the markets—in particular, the increasing use of automated trading—as well as the fact that the markets it oversees have expanded, and engage in the necessary level of surveillance and oversight to detect excessive risk, fraud, abusive practices, and manipulation.

- Increase its enforcement capabilities in light of the expanded markets now under the Commission’s authority, as well as the increasing complexity of all derivatives markets, so that the Commission is able to investigate and punish fraud, abusive practices and manipulation in all areas.

- Substantially expand its capabilities with respect to cybersecurity, which is probably the single most important threat to financial stability today. The Commission needs to conduct more frequent and comprehensive cybersecurity and business continuity examinations, particularly of critical market infrastructure such as clearinghouses, and be better equipped to deal with this increasingly dangerous threat.

- Examine the many new market participants under its jurisdiction, such as SDs and SEFs, as well as traditional market participants on a regular basis for compliance with the Commodity Exchange Act (CEA) and Commission regulations. This is of particular concern when it comes to monitoring critical infrastructure such as clearinghouses and exchanges, as well as FCMs and SDs, which the Commission seeks to review for adequacy of risk management, financial and operational resources, cybersecurity preparedness, business continuity and disaster recovery planning, compliance with customer protection rules, and other important issues.

- Ensure timely review of requests for rule approvals, requests for rule certifications, requests for new product approvals, and submissions for swap clearing and trading mandates.

- Provide a timely response to concerns of the public and users of the derivatives markets. Responding to such concerns is an important part of making sure the markets work efficiently and effectively to facilitate price discovery and allow the hedging of risk.

- Provide additional economists and other staff to perform critical analysis of market structure and developments and provide robust assistance in considering the costs and benefits of the Commission’s regulatory activities.

- Engage with international regulators to harmonize rules and supervision as much as possible and work together on enforcement matters. The task of harmonizing new rules to regulate the swaps market is a particular challenge that requires substantial resources. In addition, the increasing globalization of the markets means that in all areas of its work, the Commission must work with regulators in many other jurisdictions.

- Maintain and improve critically important information technology systems and resources that are vital to enforcement and oversight. This includes the ability to receive, store and analyze vast new quantities of data related to the swaps market, as well as enabling the review of rules based on changes in market technology. The Commission must substantially enhance its capabilities in order to increase its effectiveness.

The Commission has made much progress, but there are many other activities that the Commission must be able to perform regularly to oversee the markets under its jurisdiction. This budget request will help the Commission fulfill its statutory responsibility to protect the integrity of the markets and safeguard the American public.

Sincerely,

![]()

cc:

The Honorable John Boozman

Chairman

Subcommittee on Financial Services

and General Government

Committee on Appropriations

U.S. Senate

Washington, D. C. 20510

The Honorable Christopher A. Coons

Ranking Member

Subcommittee on Financial Services

and General Government

Committee on Appropriations

U.S. Senate

Washington, D. C. 20510

The Honorable Robert B. Aderholt

Chairman

Subcommittee on Agriculture, Rural

Development, Food and Drug

Administration, and Related Agencies

Committee on Appropriations

U.S. House of Representatives

Washington, D. C. 20515

The Honorable Sam Farr

Ranking Member

Subcommittee on Agriculture, Rural

Development, Food and Drug

Administration, and Related Agencies

Committee on Appropriations

U.S. House of Representatives

Washington, D. C. 20515

Executive Summary

The CFTC oversees our nation’s futures, options and swaps markets. The Commission’s mission is to foster transparent, open, competitive and financially sound derivatives markets. The Commission seeks to protect market participants from fraud, manipulation and abusive practices, and to protect the public and our economy from systemic risk related to derivatives. To fulfill these roles, the Commission oversees DCMs, SEFs, DCOs, FCMs, SDs, SDRs, and other intermediaries.

Although few Americans participate directly in the markets overseen by the Commission, they profoundly affect our economy and the prices American families pay for food, energy, transportation and most other goods and services bought each day. A wide variety of businesses—such as manufacturers, retailers, farmers and ranchers—use these markets to manage their routine commercial risk. For example, derivatives enable farmers to lock in a price for their crops, and utility companies or airlines to hedge the costs of fuel. They enable exporters and importers to manage fluctuations in foreign currency exchange rates, and businesses of all types to lock in their borrowing costs. In the simplest terms, derivatives markets enable businesses of all kinds to manage risk.

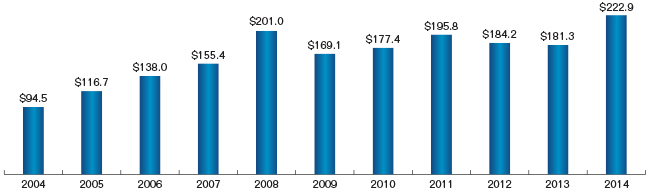

In order for the Commission to fulfill its responsibilities to oversee these vital markets in FY 2016, it is requesting $322 million and 895 FTE. This is an increase of $72 million and 149 FTE over the FY 2015 enacted level, and is consistent with the Commission’s post-Dodd-Frank Act steady-state funding level, which was estimated in the FY 2012 Budget Appendix to be $340 million.

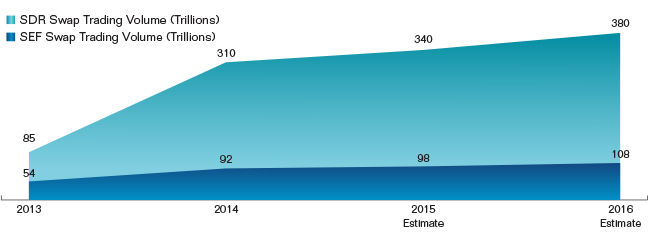

The Commission’s responsibilities were substantially increased by the Dodd-Frank Act. This gave the Commission primary responsibility for oversight of the OTC swaps market, a $700 trillion market globally, measured by notional amount. The Commission was directed to implement four basic goals: 1) clearing of standardized swaps through central counterparties (CCPs); 2) trading of swaps on transparent, regulated platforms; 3) oversight of SDs and major swap participants (MSPs); and 4) reporting of data on the swaps market to facilitate greater transparency and enhance regulatory efforts.

Prior to the enactment of the Dodd-Frank Act, the swaps market was unregulated across the globe, and excessive risk related to swaps was one of the causes of the 2008 financial crisis. That crisis—the worst the nation has experienced since the Great Depression—exacted a heavy toll on American families and our economy. We must never forget the true cost of that crisis: eight million jobs lost, millions of foreclosed homes, countless retirements and college educations deferred, and businesses shuttered.

The reform efforts are designed to bring the swaps market out of the shadows and prevent such excessive risk from recurring. The specific goals of the Dodd-Frank Act are consistent with those agreed to by all the G-20 nations to reform this market.

Although the CFTC’s budget has been increased since the passage of Dodd-Frank Act, the increase has not been commensurate with the vast expansion in the Commission’s responsibilities. Funding levels have limited the Commission’s ability to fulfill its new responsibilities with respect to the swaps market while at the same time continuing to meet its traditional responsibilities for the futures and options markets. In addition, the funding level has not enabled the Commission to keep pace with the increased technological complexity and globalization of the markets overseen by the Commission. The Commission’s resources continue to be stretched far too thinly over many important responsibilities. As a result, for example:

- The Commission needs to substantially expand its capacity to keep pace with the increasing technological sophistication of market participants and to address cybersecurity issues, the single most important threat to financial stability today. The Commission needs to conduct more frequent and comprehensive cybersecurity and business continuity examinations, particularly of critical market infrastructure, such as clearing houses.

- The Commission does not have the resources to examine FCMs, SDs, MSPs, DCOs, CCPs, SEFs, foreign boards of trade (FBOTs) and other market participants on a regular basis for compliance with the law and regulations. This is of particular concern when it comes to monitoring FCMs and SDs, as well as, critical infrastructure such as clearinghouses and exchanges, where the Commission seeks to review for adequacy of risk management, financial and operational resources, cybersecurity, business continuity recovery, compliance with customer protection rules, and other important issues.

- The Commission cannot engage in the necessary level of market surveillance, risk oversight and enforcement efforts, resulting in the risk that fraud, abusive practices and manipulation will go undetected and unpunished, and that customers, our markets and our economy generally may be exposed to excessive risk.

- The Commission does not have adequate resources to make sure that market participants registered with the Commission comply with its rules and fulfill their obligations to their customers.

- The Commission cannot respond in a timely and thorough manner to the concerns of the public and users of the derivatives markets. Responding to such concerns is an important part of making sure the markets work efficiently and effectively to facilitate price discovery and allow the hedging of risk.

- The Commission will not have enough economists to perform critical analysis of market developments and provide robust assistance in considering the relative costs and benefits of the Commission’s regulatory activities.

- The Commission cannot maintain and improve information technology systems and resources that are vital to its mission, including in particular its ability to receive, store and analyze vast new quantities of data related to the swaps market.

Approximately 39 percent of the requested $72 million increase is required for information technology investments that will enhance all of the Commission’s activities, including in particular market surveillance, financial and risk surveillance, data collection and analysis, and enforcement. The other 61 percent of the funding request supports an increase in staffing and related support, specifically targeting highly critical areas such as enforcement, economic and legal analysis, and examinations.

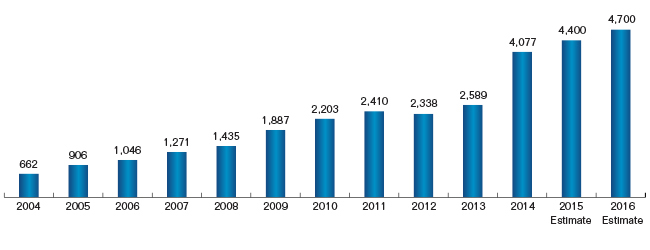

More entities, more markets and more products (including more complex products) are subject to CFTC regulation than ever before. The markets have increased substantially in technological complexity and sophistication, and are increasingly global. The industry is responding quickly to the competitive opportunities engendered by the shifting regulatory landscape—the introduction of futures contracts by DCMs that are economically equivalent to standardized swaps is one such example. Innovation in the industry, which is likely to increase in pace with the addition of new entrants, such as SEFs, will continue to add complexity in ways that are yet to become apparent. While these changes will impact all of the CFTC mission activities, the near-term impacts will fall most heavily on the registration, product reviews, examinations, enforcement and economic analysis mission critical activities.

The Commission is grateful for the increases it has received and will continue to carry out its responsibilities as best it can with the resources it has. But it simply cannot fulfill all of its new duties and continue to meet its traditional ones in the timely and thorough manner that the American people deserve with the current level of funding. In short, without additional resources, our markets cannot be well supervised, participants cannot be adequately protected, and market transparency and efficiency cannot be fully achieved.

2016 Increases by Mission Activity

Registration and Compliance

The Commission requests $17.8 million and 63 FTE for registration and compliance activities, an increase of $1.0 million and 3 FTE over the FY 2015 enacted level. The Commission performs a thorough review of the applications of all entities seeking to be registered or designated as DCMs, SEFs, FBOTs, DCOs, and SDRs, as well as oversight of the National Futures Association (NFA) and the registration of SDs, MSPs, FCMs, CPOs, and other intermediaries. The Commission expects to see continued increases in the trading of swaps on SEFs and DCMs, and the clearing of swaps on DCOs, which will further strain the Commission’s resources with respect to registration of market participants and the review of rule certifications and requests for rule approvals by DCOs, SEFs, and DCMs. Further, upon completion of an entity’s initial registration process, the CFTC continues to monitor the entity’s activities for compliance and may provide policy direction and legal interpretative guidance on an as-needed basis. Compliance oversight includes addressing both registrant-initiated and staff-initiated matters. Continued innovation will require continued evaluation of registrants (and the rules they implement) for compliance with the statutorily-mandated requirements and core principles. The Commission must ensure it has subject matter experts who can respond to rapid changes in the marketplace. The lack of adequate funding would prevent the Commission from fulfilling its mission in a timely and effective manner, and can result in delayed registrations, ineffective customer protection, regulatory uncertainty, poor compliance and risk management by registrants, higher legal and compliance costs for registrants, ineffective compliance oversight by self-regulatory organizations (SROs), and international disharmony.

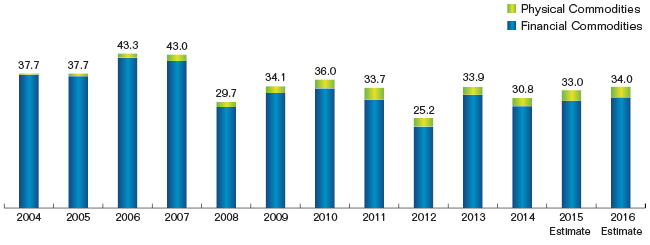

Product Reviews

The Commission requests $6.4 million and 23 FTE for product reviews, an increase of $0.9 million and one FTE from the FY 2015 enacted level. The Commission conducts due diligence reviews of new contract filings to ensure that the contracts are not readily susceptible to manipulation or price distortion, and that the contracts are subject to appropriate position limits or position accountability. The Commission also analyzes amendments to contract terms and conditions to ensure that the amendments do not render the contracts readily susceptible to manipulation and do not otherwise affect the value of existing positions. In addition, new swaps products are reviewed to determine whether they should be required to be cleared pursuant to a Commission clearing mandate. Proliferation of products by industry—which has increased in recent years—and the inherently greater complexity of swaps contracts will demand that we keep pace with industry’s innovations while maintaining existing capabilities.

Surveillance

The Commission requests $62.4 million and 163 FTE for market surveillance, an increase of $5.9 million and 42 FTE over the FY 2015 enacted level. During FY 2014, CFTC reviewed its highest priority sourcing requirements and determined a significant investment in technology is required to support this mission area. The increase in funding will also support information technology requirements to further develop the automated surveillance tools and data visualization. The CFTC continues to face a number of challenges with its new jurisdiction related to swaps; the types of data required by the Commission, the number of data sources providing data, the complexity of the data, and the volume of the data have each expanded significantly. The Commission monitors trading and positions of market participants on an on-going basis. Commission staff screen for potential market manipulations and disruptive trading practices, as well as trade practice violations. Such market surveillance is dependent on the ability to acquire large volumes of data and the development of sophisticated analytics to identify trends and/or outlying events that warrant further investigation, which can only be achieved through investment in technology and expert staff to process, analyze, and interpret the information. Without adequate funding, the Commission will be significantly impaired in its ability to analyze both traditional and new sources of market data, and will possess a limited ability to develop deep expertise over a broad spectrum of derivative instruments. The Commission also will be limited in its ability to surveil DCOs in a comprehensive and robust manner, which is critical to minimizing systemic risk.

Examinations

The Commission requests $35.4 million and 135 FTE for examinations, an increase of $6.7 million and 21 FTE over the FY 2015 enacted level. Examinations are formal, structured assessments of regulated entities’ operations or oversight programs designed to assess on-going compliance with statutory and regulatory requirements. Regular examinations are the most effective method of ensuring that the entities are complying with the core principles established in the CEA and the Commission’s rules. This level of funding is critical to maintaining a robust and effective examination program.

Examinations of market intermediaries, including FCMs and SDs, for compliance with applicable capital, segregation, risk management, and financial reporting requirements help ensure that funds belonging to customers are protected from loss. The complexity of examinations has increased in light of the increasing number and complexity of products and increasing technological sophistication of the markets.

Across the markets, oversight of the financial surveillance and compliance programs of designated self-regulatory organizations (DSROs) is designed to ensure that the DSROs are effectively monitoring the financial integrity of market intermediaries and protecting customer funds. Reviews of DSROs, DCMs, and SEFs focus on the structural sufficiency of their self-regulatory and compliance programs.

While Commission staff believes that it is important to perform routine annual examinations of the largest DCOs, DCMs and SEFs, with reviews of the smaller entities every two to three years, sufficient resources for such examinations will not be available without increased funding. Indeed, the Commission is required under Title VIII of the Dodd-Frank Act to examine, at least annually, DCOs that have been designated as “systemically important.” Examinations of systemically-important DCOs are a priority, and examinations of other DCOs are relegated to less frequent examinations, as resources permit.

Further, targeted examinations, such as the System Safeguards Examinations, focus on compliance and risk management by FCMs, SDs, DCMs, SEFs, SDRs, and DCOs with cybersecurity, automated system safeguards, and business continuity requirements. Given significant increases in the threat of cybersecurity attacks and other incidents in the financial markets, this oversight is critical.

Examinations are conducted by multi-disciplinary teams of auditors, attorneys, accountants, industry economists, risk analysts, trade practice analysts, systems risk analysts, and risk management specialists. The Commission currently is hampered from performing these examinations in sufficient depth and frequency without an increase in funding.

Enforcement

The Commission requests $70.0 million and 212 FTE for enforcement activities, an increase of $20.7 million and 48 FTE over the FY 2015 enacted level. Market integrity will continue to be one of the Commission’s key priorities. A strong compliance and enforcement function is vital to maintaining public confidence in the financial markets. This is critical to the participation of many Americans who depend on the futures and swaps marketplace—whether they are farmers, oil producers or exporters.

The Commission’s enforcement efforts can help rebuild and maintain public confidence and trust in the financial markets. The Commission has the authority to: 1) Shut down fraudulent operations and immediately preserve customer assets through asset freeze and receivership orders; 2) Terminate manipulative and disruptive schemes; 3) Bar defendants from trading and being registered in its markets; and 4) Seek restitution, disgorgement, and monetary penalties up to the greater of three times the amount of a defendant’s gain or a fixed statutory amount.

The Commission anticipates more time-intensive and inherently complex investigations due to innovative products and practices within the industry, including the use of automated and high frequency trading. Cases have been strengthened by recent amendments to the law, but the Commission cannot take full advantage of this authority at the current funding levels. In order to investigate and litigate market-wide violations, as well as those less complex but equally important retail fraud cases, additional funding is requested for increased specialized enforcement experts.

The Commission foresees an increase in multi-jurisdictional and multi-national investigations given the global nature of the swaps marketplace and the challenges associated with substitute compliance. The Commission is also experiencing an increase in international enforcement investigations in its traditional markets (the most significant being the international benchmark rate rigging cases). These cases are inherently more resource intensive due to increased costs for travel, translations and coordination.

Economic and Legal

The Commission requests $27.9 million and 94 FTE for economic and legal support activities in FY 2016, an increase of $5.8 million and 11 FTE over the FY 2015 enacted level.

Economic analysis plays an integral role in the development, implementation, and review of financial regulations to ensure that regulations are economically sound and have undergone a rigorous consideration of potential costs and benefits. The Commission is committed to integrating robust economic analysis into its regulatory activities. While Commission staff has established a network of well-renowned researchers and academics in quantitative financial methods, applied mathematics, econometrics, and statistics to augment resources, the Commission’s capacity should be enhanced to ensure that a high quality of economic analysis can be performed throughout the Commission.

The Commission’s Office of the General Counsel represents the Commission in Federal courts and before administrative bodies in litigation, including appeals of enforcement actions, challenges to agency actions, derivatives industry bankruptcies, employment lawsuits and other administrative matters. It also is responsible for reviews of proposed rules and staff interpretive and no-action letters to ensure consistency and compliance with the requirements of the CEA, a function that has been slowed by the current lack of resources.

The lack of adequate economic staff in the divisions, as well as adequate staff for the Office of General Counsel, has significantly impaired the ability of Commission staff to respond promptly to requests for relief or interpretations from regulated entities and market participants, such as end users. The increased funding would significantly improve the ability of staff to respond in a timely and appropriate manner.

International Policy

The Commission requests $4.9 million and 16 FTE for international support activities, an increase of $0.4 million over the FY 2015 enacted level. The global nature of the futures and swaps markets, including the presence of a growing number of foreign-based DCOs that are registered in both the United States and their home country, makes it imperative that the United States consult and coordinate with international authorities. The Commission is actively communicating internationally to avoid conflicting requirements and to engage in cooperative supervision, wherever possible. The Commission will work with leaders of authorities with responsibility for the regulation of the swaps markets in major market jurisdictions to support the adoption and enforcement of robust and consistent standards in and across jurisdictions and to develop concrete and practical solutions to conflicting application of rules, identify inconsistent or duplicative requirements and attempt to reduce the regulatory burdens associated with such requirements and identify gaps that could lead to regulatory arbitrage.

Data and Technology Support

Information technology costs, including information technology (IT) investments (e.g., hardware, software, and contractor services), FTE, and indirect costs, are directly attributed to the benefiting Mission Activity wherever possible. Any IT costs that are not directly attributed to another Mission Activity are captured in the Data and Technology Support Mission Activity as described below. A full breakout of the Commission’s IT Portfolio is located in Appendix 2.

The Commission requests $63.1 million and 59 FTE for enterprise-wide data and technology support activities, an increase of $26.9 million and 15 FTE over the FY 2015 enacted level. This mission activity supports the cross-agency data and technology infrastructure needs of the Commission. Data, and the ability to analyze and report data, are more important than ever in the derivatives markets and in CFTC’s ability to oversee those markets; therefore, data understanding and ingestion is the priority for the Commission’s resources. The CFTC has an imperative to aggregate various types of data from multiple industry sources, such as DCMs, SEFs, SDRs, and DCOs across multiple markets (e.g., futures, exchange-traded swaps, and off-exchange swaps). Under the Volcker Rule provisions of the Dodd-Frank Act, the CFTC must now also take in and analyze a whole new set of metrics data from its registrants. The new swaps data is an order of magnitude more complex than futures. The increasing complexity, volume, and interrelations of the data set will require significantly more powerful hardware such as high performance computing systems to support business analytics. Without the requested level of funds, the Commission will not have sufficient infrastructure to deploy mission systems to fulfill the critical mandates of the agency, directly impacting the Commission’s ability to protect market participants from fraud, manipulation and abusive practices, and to protect the public and the U.S. economy from systemic risk.

Overview of the

FY 2016 Budget

The Overview of the FY 2016 Budget presents the FY 2016 budget by program, mission activity, division, and object class; as well as a crosswalk from FY 2015 to FY 2016.

-

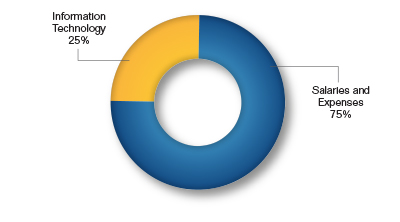

FY 2016 Budget Request by Program1, 2

Summary of FY 2014 to FY 2016 Budget Request by Program

Dollars in ThousandsFY 2014

Actual3FY 2015

EstimateFY 2016

RequestSalaries and Expenses $181,171 $198,900 $243,000 Information Technology 35,000 51,100 79,000 Total $216,171 $250,000 $322,000 $322.0 Million Budget Request by Program

1 The Commission considers the Salary and Expense and the Information Technology programs to be its sole programs, projects, and activities (PPAs). All other budget displays by Mission Activity, Division or any other depiction are for informational purposes only. (back to text)

2 Salaries and Expenses: The Salaries and Expenses program provides funding for all CEA-related activities. This includes funding for Federal staff salaries and benefits, leasing of facilities, travel, training, and general operations of the Commission.

Information Technology: The Information Technology program provides funding for information technology investments. This includes hardware, software, contractor support, and other related information technology requirements. (back to text)3 Costs include expenditures from all funds. (back to text)

-

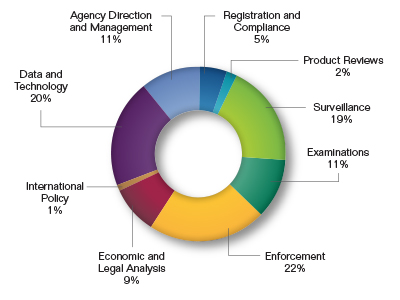

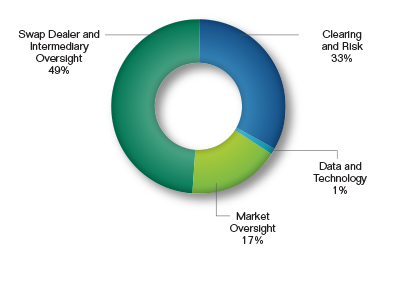

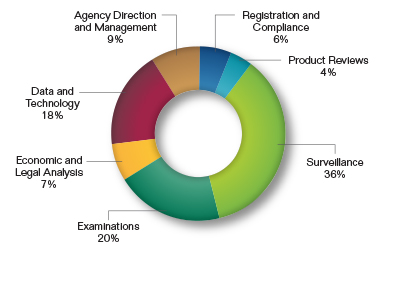

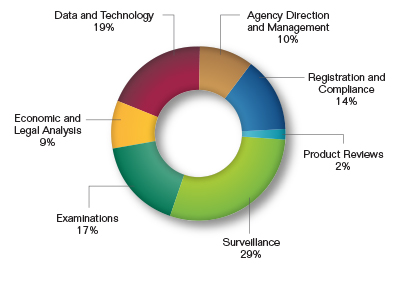

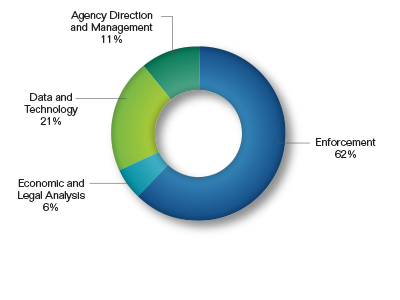

FY 2016 Budget Request by Mission Activity4

Summary of FY 2014 to FY 2016 Budget Request by Mission Activity

Dollars in ThousandsFY 2014

Actual5FY 2015

EstimateFY 2016

RequestFTE Budget FTE Budget FTE Budget Registration and Compliance 43 $11,202 60 $16,794 63 $17,807 Product Reviews 22 5,574 22 5,460 23 6,388 Surveillance 113 35,938 121 56,502 163 62,429 Examinations 93 24,213 114 28,676 135 35,365 Enforcement 148 50,515 164 49,332 212 69,993 Economic and Legal Analysis 73 20,134 83 22,102 94 27,949 International Policy 16 4,505 16 4,523 16 4,914 Data and Technology Support6 34 36,012 44 36,216 59 63,134 Agency Direction and Management 105 28,078 122 30,395 130 34,021 Total 647 $216,171 746 $250,000 895 $322,000

$322.0 Million Budget Request by Mission Activity

4 The Commission considers the Salary and Expense and the Information Technology programs to be its sole programs, projects, and activities (PPAs). All other budget displays by Mission Activity, Division or any other depiction are for informational purposes only. (back to text)

5 Costs include expenditures from all funds. (back to text)

6 Information Technology costs, including IT investments (e.g., hardware, software, contractor services), FTE, and indirect costs, are directly attributed to the benefiting Mission Activity wherever possible. Any IT costs that are not directly attributed to another Mission Activity are captured in the Data and Technology Support Mission Activity. Refer to Appendix 2 for a full breakout of IT funds. (back to text)

-

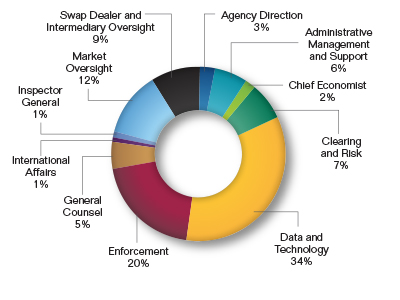

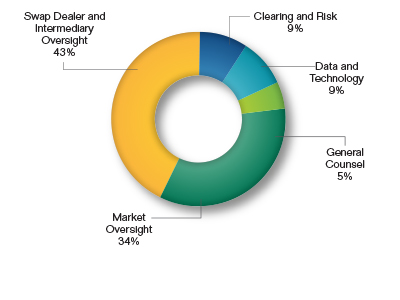

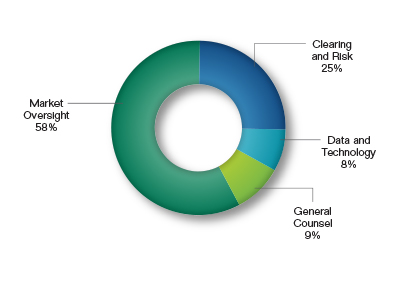

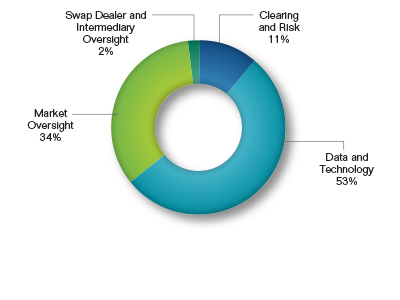

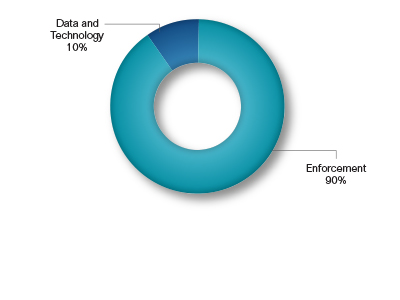

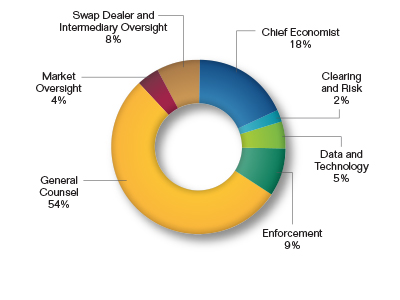

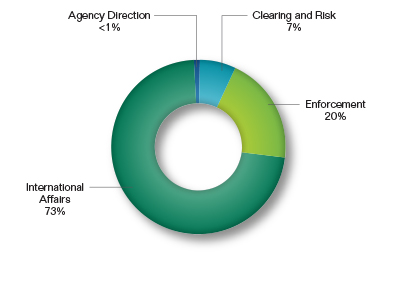

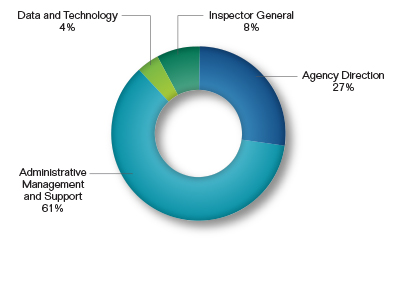

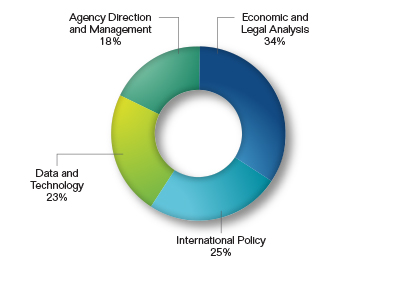

FY 2016 Budget Request by Division7

Summary of FY 2014 to FY 2016 Budget Request by Division

Dollars in ThousandsFY 2014

Actual8FY 2015

EstimateFY 2016

RequestFTE Budget FTE Budget FTE Budget Agency Direction9 22 $6,268 33 $8,515 35 $9,340 Administrative Management and Support 77 19,128 82 19,260 86 20,726 Chief Economist 9 2,380 12 2,911 18 5,164 Clearing and Risk 56 15,380 66 17,089 85 22,675 Data and Technology10 77 59,147 98 80,664 111 108,428 Enforcement 149 47,247 169 48,060 217 66,152 General Counsel 48 13,151 52 14,277 58 16,365 International Affairs 12 3,360 12 3,445 12 3,573 Inspector General 6 1,504 7 2,620 9 2,790 Market Oversight 110 27,412 121 29,649 153 38,253 Swap Dealer and Intermediary Oversight 81 21,194 94 23,510 111 28,534 Total 647 $216,171 746 $250,000 895 $322,000 $322.0 Million Budget Request by Division

7 The Commission considers the Salary and Expense and the Information Technology programs to be its sole programs, projects, and activities (PPAs). All other budget displays by Mission Activity, Division or any other depiction are for informational purposes only. (back to text)

8 Costs include expenditures from all funds. (back to text)

9 Transition of the Chairman, three Commissioners and related staff resulted in a lower FTE utilization in FY 2014. (back to text)

10 Data & Technology amounts include all costs funded by the Information Technology program, including FTE and indirect costs funded by the Salaries and Expenses program. (back to text)

-

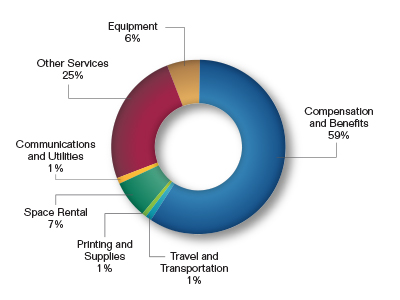

FY 2016 Budget Request by Object Class

Summary of FY 2014 to FY 2016 Budget Request by Object Class

Dollars in ThousandsFY 2014

Actual11FY 2015

EstimateFY 2016

Request11.0 Personnel Compensation $97,237 $116,483 $145,723 12.0 Personnel Benefits: Civilian 29,058 34,712 43,425 13.0 Benefits for Former Personnel 0 0 0 21.0 Travel and Transportation of Persons 1,361 1,600 2,908 22.0 Transportation of Things 36 69 75 23.2 Rental Payments to Others 21,761 21,700 22,935 23.3 Communication, Utilities and Miscellaneous 4,035 4,629 3,840 24.0 Printing and Reproduction 739 703 708 25.0 Other Services 54,915 61,207 81,857 26.0 Supplies and Materials 1,488 1,297 1,470 31.0 Equipment 5,541 7,600 19,044 32.0 Building and Fixed Equipment 0 0 15 Total $216,171 $250,000 $322,000 $322.0 Million Budget Request by Object Class

11 Costs include expenditures from all funds. (back to text)

-

Crosswalk from FY 2015 to FY 2016

Crosswalk from FY 2015 Estimate to FY 2016 Request

Dollars in ThousandsFY 2015

EstimateFY 2016

RequestChange Budget Authority (Dollars) $250,000 $322,000 $72,000 Full-Time Equivalents (FTEs) 746 895 +149 Explanation of Change FTE Dollars Current Services Increases: (Adjustments to FY 2015 Base) To provide for changes in personnel compensation and benefits: $6,464 To provide for the following changes in non-personnel costs: $446 —Space Rental/Communications/Utilities ($446) Program Increase: (Adjustments to FY 2016 Current Services) 149 $65,090 —Addition of 149 FTE ($31,489) —Travel/Transportation ($1,314) —Other Services ($20,650) —Supplies/Printing ($178) —Equipment ($11,459) Total Change +149 $72,000

Justification of the

FY 2016 Budget by

Mission Activity

The Justification of the FY 2016 Budget by Mission Activity section presents the following for each mission activity: resources overview, mission activity description, industry trends and emerging issues, justification of CFTC resource requirements, impact if not funded at requested level of resources, and breakout of budget request.

-

-

Registration and Compliance – Resource Overview

Summary of Registration and Compliance Budget Request FY 2014

ActualFY 2015

EstimateFY 2016

RequestChange BUDGET $11,201,577 $16,794,031 $17,806,731 +$1,012,700 FTE 43 60 63 +3 -

Registration and Compliance – Mission Activity Description

The Commission reviews the registration applications of all entities seeking to be registered as DCMs, DCOs, SEFs and SDRs. Review teams comprised of attorneys, industry economists, trade practice analysts and risk analysts ensure that the Commission undertakes a thorough analysis of such applications to assess compliance with the applicable statutory core principles and Commission regulations. Important to the application process is a site visit to the applicant, enabling Commission staff to fully evaluate the operational and managerial resources that will support regulatory compliance once the applicant is registered. For SDs, MSPs, FCMs, and other intermediaries, where registration responsibility has been delegated to the NFA, an SRO, the Commission provides registration regulatory guidance to the NFA and to provisional registrants and generally oversees the registration process. This oversight includes sample testing of NFA’s application reviews and periodic targeted reviews of the SRO registration procedures. Site visits may be required to validate needed technical and self-regulatory capabilities.

Upon completion of an entity’s initial registration process, the CFTC continues to monitor the entity’s activities for legal compliance and may provide policy direction and legal interpretative guidance to SROs and registrants on an as-needed basis. Compliance oversight includes addressing both registrant initiated and staff initiated activities in connection with registration issues and ongoing compliance following registration. Registrants often contact Commission staff to request interpretive guidance or no action relief for registration purposes or ongoing compliance and have the option to self-report compliance concerns or failures and seek staff assistance in remediating these issues. Furthermore, staff initiates compliance oversight activities such as reviews of registrant reports, horizontal registrant inquiries on specific compliance topics, and conducts on-site visits with registrants to observe compliance activities.

-

Registration and Compliance – Industry Trends and Emerging Issues

Over the next year, the Commission expects trading in swaps on SEFs and DCMs to increase. Likewise, consistent with market trends in recent years, the Commission expects the number of rule certifications and requests for rule approvals by SEFs and DCMs to increase. At the same time, the Commission expects the number of market participants that are subject to Commission jurisdiction to increase as they become a member of, or trade products on, a registered DCM or SEF. The Commission also must complete its review of the 22 SEFs that are currently or temporarily registered in order for them to become fully registered, and complete its evaluation of the two applications for DCM registration that currently are pending before the Commission. In addition, the Commission has 21 pending applications for FBOT registration, to date. The Commission has been limited in its ability to review these rule certifications and rule approval requests, as well as these SEF, DCM and FBOT applications for registration and make timely recommendations to the Commission on each. Over the next year, the Commission expects to receive two to three new applications for SEF registration and/or DCM designation.

As the Commission has worked to implement the Dodd-Frank Act’s clearing requirement for swaps, more foreign-based CCPs have expressed interest in clearing swaps for U.S. persons. In the past year, the Commission issued no-action letters to six foreign-based CCPs, permitting them to clear the proprietary swap transactions of U.S. persons for a limited time or until the CCP becomes either registered or exempt from registration as a DCO. In FY 2016, the Commission expects these and other foreign-based CCPs to either apply for registration with the Commission as a DCO or to petition the Commission for an exemption from registration. As with the review of applications for SEF, DCM and FBOT registration, the Commission has been historically limited in its ability to review these applications for DCO registration or petitions for exemption and make timely recommendations to the Commission.

At present, over 100 entities have provisionally registered as SDs or MSPs. Completing the review of these entities for permanent registration in a timely manner is also difficult with current resources. In addition to requiring that such entities register with the CFTC, the Dodd-Frank Act also requires that such entities comply on an ongoing basis with regulations governing business conduct standards, reporting and recordkeeping, risk management, conflicts of interest, and customer protections, among other requirements, but resources limit the ability of staff to conduct reviews of compliance. The Dodd-Frank Act requirements promote best practices for customer interaction, corporate governance, and recordkeeping, strengthening efficiencies while also promoting robust risk management capabilities. As the Commission has implemented these Dodd-Frank Act provisions, Commission staff has issued no-action letters and interpretive guidance to assist in the transition to full compliance by these provisionally registered SDs and MSPs, given that the new requirements require varying degrees of business processes and technological changes depending on the size and nature of an individual entity. These actions continue to be needed and often need to be provided in a timely manner to promote the smooth functioning of the markets. Additionally, the Commission anticipates that approximately 75 FCMs will be registered as of FY 2016, together with thousands of registered IBs, CPOs, CTAs, and other intermediaries. Within those entities, the Commission anticipates that there will be approximately 58,000 individuals registered as Associated Persons. The Commission’s ability to respond promptly to requests for no-action letters and interpretive guidance with respect to the new and existing statutory and regulatory requirements, and to provide prompt registration regulatory guidance to the NFA, has been limited by Commission staff resources.

-

Registration and Compliance – Justification of CFTC Resource Requirements

The FY 2016 request for $17,806,731 will support the Commission’s registration/designation and continuing compliance oversight mission. The request will enable the Commission to evaluate and act on applications for registration in a much more timely fashion. Limited resources over the last few years have significantly hindered the Commission’s ability to do so and resulted in delays in completing many such reviews. Additionally, the request will better enable the Commission to provide interpretative guidance promptly to SROs and registrants, and its obligation with respect to compliance oversight.

- Permanently registering temporarily-registered SEFs, as well as reviewing new applicants for DCM designation or SEF registration, will be an area of particular focus for the Commission.

- The Commission expects to receive and evaluate petitions from foreign-based CCPs for exemption from DCO registration.

- The Commission expects to receive and evaluate no-action requests from foreign-based swaps-trading platforms seeking relief from SEF registration.

- The Commission expects to encounter increases in workload given the dramatic increase in registered entities (SEFs, DCMs, SDRs, and DCOs) and the fact that such entities will continue to implement and refine their rules of operation under the new regulatory framework.

- In addition to guiding and overseeing the registration/designation of new U.S. and foreign-based entities, the Commission staff will perform periodic reviews to assess entity-legal compliance with the CEA’s statutory requirements and the Commission’s implementing regulations, as well as regulations promulgated by the Commission under Title VIII of the Dodd-Frank Act (relating to systemically important DCOs).

- On a day-to-day basis, registered entities are subject to Commission oversight, which includes review of registrants’ rules, operations, and procedures. The Commission will review daily, quarterly, annual, and event-specific reports and notices from DCOs, SDs, FCMs and other intermediaries, as well as DCMs and SEFs, to continually monitor and help ensure compliance with applicable financial and risk management regulations. Simultaneously, the Commission will oversee and coordinate with the NFA and other SROs and DSROs to provide on-going policy guidance, legal interpretation and other critical services necessary to execute its oversight mission.

- The Commission needs to work closely with the international regulatory community to establish agreements on substituted compliance matters central to overseeing the global activities of the derivatives industry and implementing key aspects of Dodd-Frank Act and other high priority initiatives. The objective of these cross-border activities is to better rationalize regulatory processes (e.g., financial reporting, risk management standards, swap data reporting, etc.) and other regulatory matters of common interest with other nations, and to strengthen and institutionalize cooperative oversight in ways that avoid unnecessary burdens on the industry.

- The Commission will continue on-going efforts to access, standardize, structure and integrate technology for the use of new and legacy data streams generated by the swap data reporting rules, Volcker Rule, enhanced customer protection rules, chief compliance officer annual reports, risk exposure reports and other regulatory changes. The Commission’s additional responsibilities for the swaps market as a result of the Dodd-Frank Act have created vast new quantities of data that must be received, loaded, and analyzed properly. The Commission must be able to do this in a timely and effective manner to fulfill its responsibilities with respect to compliance oversight, risk management, and registration.

- The Commission will seek to leverage and incorporate data harmonization efforts to develop and incorporate more effective and efficient data management tools and practices into the agency’s regulatory operations. Strengthening the agency’s understanding of transactional data, Volcker Rule data, and risk and chief compliance officer reports will generate new capabilities for guiding Commission policy making, registrant compliance and best practices, and assessing registration and compliance operations.

- The Commission also projects that in FY 2016 it will be completing and implementing rulemakings expected to be initiated in FY 2015. The rulemakings will address: 1) block trades, including their appropriate threshold sizes; 2) DCM Core Principle 9; 3) clean-up modifications to the Part 37 regulations for SEFs; 4) position limits and related requirements for all economically-equivalent derivatives across trading venues; and 5) clean-up modifications to the Part 45 regulations for swap reporting data standards.

- Key regulatory processes supported by the CFTC regulatory portal will need to be fully automated and integrated with the electronic records and document management system. The Commission needs to create dashboards to provide transparency and management visibility into the status of registrations.

-

Registration and Compliance – Impact if Not Funded at Requested Level of Resources

If the requested funding is not received, it can result in delayed registrations, poor compliance, ineffective customer protection, regulatory uncertainty, poor risk management by registrants, higher legal and compliance costs, ineffective compliance oversight by SROs, and deficient international coordination.

Registration and Compliance Oversight of DCMs, SEFs, and FBOTs. To the extent resources are unavailable, the Commission will be unable to ensure that DCM, SEF and FBOT applications are reviewed in a timely and comprehensive manner, which could slow the ability of those entities to offer their services to the market or allow inadequately-reviewed exchanges to begin operations and potentially jeopardize market participants and market integrity. In addition, comprehensive application reviews entail on-site visits, interviews with relevant exchange personnel, evaluation of systems safeguards, all of which may be impacted by reprioritization of funding. Likewise, insufficient resources could compromise the ability of the Commission to oversee DCMs, SEFs, and FBOTs on an ongoing basis to ensure that their rules, operations and procedures are compliant with Commission regulations and the CEA. Without adequate compliance oversight in this regard, the Commission cannot validate that exchanges are adequately carrying out their self-regulatory responsibilities. This shortcoming in performing critical oversight activities may put at risk not only the particular users of those markets, but also those portions of the broader economy that look to those exchanges for price discovery purposes.

Such consequences of not receiving the requested funding would also frustrate a central goal of the Dodd-Frank Act to move a broad class of swap products away from unregulated, non-transparent markets to an adequately monitored, transparent environment. Inadequate funding would delay the Commission’s efforts to continue the implementation of Dodd-Frank Act requirements, including efforts to evaluate possible adjustments to regulatory requirements in response to requests from market participants and changes in market structures. Further, the Commission’s continuing efforts to coordinate and proactively engage with foreign regulators and international organizations with respect to market oversight will be limited without adequate staffing.

Registration and Compliance Oversight of DCOs. With respect to DCO registration applications and petitions for exemptions, processing has historically been delayed due to limited staff resources. In addition, the Commission may be limited in its ability to conduct comprehensive site visits (a routine part of the application process), which will become more of an issue given the expectation that most DCO applicants will be based in foreign countries. The inability to conduct a thorough review and analysis of a DCO application undermines the efficacy of the application review process and the stature and significance of DCO registration. These delays will limit the number of CCPs available to U.S. persons for clearing and will frustrate the Dodd-Frank Act’s goal of mitigating systemic risk in the financial system.

Implementation of the Dodd-Frank Act and effective oversight of the derivatives markets requires greater cooperation and consultation with domestic and foreign regulators. In addition, the Dodd-Frank Act imposed an entirely new regime of systemically important DCO regulation, oversight and examination under Title VIII, which includes continued participation on various clearing related working groups and work streams of the Financial Stability Oversight Council (FSOC). Moreover, by migrating swaps to a cleared environment, significant counterparty risk has shifted to DCOs. This has, in turn, necessitated a more comprehensive program of DCO regulation and oversight with the goal of ensuring rigorous risk management while expanding access to global markets and promoting capital efficiency.

Adequate staffing is essential to effectively oversee DCOs and the futures and swaps markets. For example, without the requested resources, the Commission will be limited in its ability to proactively engage in thorough risk surveillance; to engage with DCO Chief Compliance Officers to facilitate more effective compliance programs across all DCOs; to carefully review self-certified rule submissions from DCOs; and to provide prompt responses to industry requests to address regulatory ambiguities. Without this effective oversight, there is a greater risk of DCO problems which would adversely affect U.S. financial markets. Moreover, adequate staffing allows the Commission to respond in a timely manner to market participants which can facilitate innovation or improvements that enhance liquidity or efficiency of our markets. Without adequate staffing, legal and risk management issues cannot always be addressed in a timely manner resulting in unnecessary uncertainty in the marketplace and delay in the introduction of products and services.

Staffing inadequacies likewise may impact DCOs that want to operate internationally, and in particular those DCOs that have sought to qualify as qualifying CCPs under the Basel Capital Framework, because the limitations on the Commission’s oversight of such DCOs may cause foreign regulators to be unwilling to permit DCOs to do business in their jurisdictions in reliance on the Commission’s oversight. If foreign regulators perceive CFTC supervision of U.S.-based entities as insufficient, they might not allow market participants in their jurisdictions to do business with U.S.-based entities, which will harm U.S. competitiveness. Similarly, banking regulators may come to doubt the wisdom of reliance on CFTC regulation to qualify DCOs as qualifying CCPs, which would create higher capital charges for participating firms and could, in turn, cause participating firms to transfer their derivatives business away from U.S.-based DCOs. In each instance, DCOs would face a competitive disadvantage in maximizing business opportunities and retaining members and customers.

Staffing inadequacies have historically impeded Commission efforts to provide timely information in response to requests from the FSOC, and other domestic and international regulators. These delays could further delay the FSOC’s ability to fulfill its responsibilities relating to financial market utilities (which include systemically-important DCOs) by, among other things, delaying efforts to identify and monitor potential threats or risks to U.S. financial stability that could be related to or mitigated through systemically important DCO activities. Staffing inadequacies and budget restrictions can also impede CFTC efforts to effectively coordinate the implementation of new regulations and address systemic concerns on a cross-border basis. These impediments could result in regulatory arbitrage and result in a competitive disadvantage to domestic market participants.

Staffing shortages may also delay amendments and updates to part 190 (the Commission’s bankruptcy rules), which are necessary to take into account changing market structures and valuable lessons learned from the MF Global and Peregrine bankruptcy proceedings. CFTC resource constraints may also delay amendments to Regulation 1.49 (permitted depositories). The Regulation 1.49 amendments are needed to respond to the globalization of the marketplace and regulatory changes in banking, as well as to address and take into account current market practices with respect to currencies and depositories. Revisions to Part 39 of the Commission’s regulations (DCO rules), which should be updated to reflect experience with implementation of the regulations which were adopted in October 2011, may also be delayed.

Registration and Compliance Oversight of SDs, MSPs, FCMs, and Other Intermediaries. Adequate funding is essential to facilitate fair competition among market participants, protect market participants from fraudulent practices, promote the integrity of derivatives transactions, prevent disruptions to markets, and minimize systemic risk. To the extent that resources are unavailable, the Commission will be limited in its ability to respond in a timely manner to requests for guidance from registered SDs, MSPs, FCMs, and other intermediaries. These requests for guidance, as well as the need to provide guidance on issues directly identified by the Commission and SROs, as part of their routine activities are expected to increase due to the continued implementation of the Dodd-Frank Act. Likewise, the Commission will be limited in its ability to evaluate possible adjustments to existing regulatory requirements in a timely manner.

As noted above, implementation of the Dodd-Frank Act and effective oversight of the derivatives markets requires greater cooperation and consultation with domestic and foreign regulators. For example, the Commission has provided substituted compliance for the activities of SDs and MSPs in certain foreign jurisdictions, with respect to certain business conduct standards mandated under the Dodd-Frank Act. Such efforts are essential to fulfilling the goal of promoting a coordinated, cooperative international regulatory framework for swaps. However, the Commission’s ability to fulfill that goal will be limited without the requested funding, resulting in delays in evaluating further requests for substituted compliance and proactively engaging with foreign regulators and international organizations.

Another essential component of the Commission’s registration and compliance activities is the compliance oversight of NFA’s activities as an SRO. Such compliance oversight is necessary to ensure that NFA’s activities with respect to registration, enforcement, and examinations, among other things, fulfill its responsibilities under the CEA. Such activities directly impact the protection of customers and the proper functioning of the marketplace. Without adequate funding, the Commission’s compliance oversight activities relating to NFA will be limited.

The lack of adequate funding also will impair the Commission’s ability to further implement data, systems, and processes that will improve the Commission’s compliance oversight of SDs, MSPs, FCMs, and other intermediaries, including with respect to compliance with such requirements as the Volcker Rule. Without adequate funding, enhancements to the Commission’s regulatory portal and business process automation will be delayed or deferred, reducing the effectiveness of Commission staff and the transparency of the compliance review process.

-

Breakout of Registration and Compliance Request12

Breakout of Registration and Compliance Request by Division

Dollars in ThousandsFTE Salaries and Expenses IT13 Total Clearing and Risk 6 $1,653 $0 $1,653 Data and Technology 0 0 1,575 1,575 General Counsel 3 842 0 842 Market Oversight 24 6,055 0 6,055 Swap Dealer and Intermediary Oversight 30 7,682 0 7,682 Total 63 $16,232 $1,575 $17,807

Registration and Compliance Request by Division

12 The Commission considers the Salary and Expense and the Information Technology programs to be its sole programs, projects, and activities (PPAs). The budget displays by Mission Activity are for informational purposes only, and do not represent a PPA. (back to text)

13 Information Technology costs, including IT investments (e.g., hardware, software, contractor services), FTE, and indirect costs, are directly attributed to the benefiting Mission Activity wherever possible. Any IT costs that are not directly attributed to another Mission Activity are captured in the Data and Technology Support Mission Activity. (back to text)

-

-

-

Product Reviews – Resource Overview

Summary of Product Reviews Budget Request FY 2014

ActualFY 2015

EstimateFY 2016

RequestChange BUDGET $5,574,222 $5,460,241 $6,387,650 +$927,409 FTE 22 22 23 +1 -

Product Reviews – Mission Activity Description

The Commission reviews new product filings by exchanges as well as no-action letters related to such product issues. The CFTC’s scope of work includes reviewing new futures, options and swap contract filings, reviewing contract amendment submissions, reviewing foreign stock index futures, and developing new rules and policies to accommodate innovations in the industry. The focus is primarily on verifying that derivatives contracts are not readily susceptible to manipulation or other price distortions, and that contracts are subject to appropriate position limits or position accountability standards. The Commission implemented a procedure that assigns greater review priority to contracts that have achieved certain thresholds of trading volume and open interest.

The Commission has the responsibility to review aggregate position limits for physical commodity derivatives. The Commission establishes uniform position limits and related requirements for all economically-equivalent derivatives across trading venues. Thus, in accordance with the Dodd-Frank Act, the Commission proposes rules to establish Federal position limits for specified core commodities and reviews periodically those Federal limits.

The Commission also evaluates transaction and pricing data collected by SDRs to determine appropriate block trade and large notional swap threshold levels that registered SEFs, DCMs, and market participants may use to delay public reporting of swap transaction data. The Commission also evaluates market data and contract characteristics to determine whether a swap contract should be subject to mandatory clearing and whether it is listed on a DCM or SEF and been “made available to trade.” Transactions in contracts that have been “made available to trade” must be conducted on a DCM or SEF.

Additionally, the Commission reviews whether these new products are suitable for clearing by DCOs and, with respect to swap contracts, whether they should be mandated for clearing.

-

Product Reviews – Industry Trends and Emerging Issues

One of the most significant trends that affect the Commission’s ability to carry out its regulatory duties with respect to product review is the speed with which exchanges list new products, and the diversity of commodities underlying those products. For example, from FY 2012 to FY 2014, the number of contract certifications received from DCMs and SEFs increased from 894 to 1,088, an increase of more than 20 percent and we expect increases to continue into FY 2016. Exchanges, looking to gain a competitive advantage in the marketplace, are more often seeking to develop both novel products as well as contracts intended to compete directly with contracts listed on competitor’s platforms. This influx of new product listings is expected to further tax the exchange’s and Commission’s staff to maintain a high quality analysis of product offerings. In addition, the Commission expects an influx of swaps made available to trade that will also require staff review.

New capital and uncleared margin requirements, which the Commission is currently seeking to finalize, will likely cause market participants to seek clearing of additional and more complex transactions. The proliferation of greater numbers of products by industry participants, and the inherently greater complexity of swap contracts, requires the Commission to keep pace with industry’s innovations, to evaluate whether these products are suitable for clearing by DCOs, and to evaluate whether they should be mandated for clearing. Additional requests for the portfolio margining of these complex products is also likely to reduce excess collateral needs for market participants.

-

Product Reviews – Justification of CFTC Resource Requirements

The FY 2016 request for $6,387,651 will support current activities and enhance the Commission’s capabilities related to products review and assessment of product-related rules, and enable the Commission to address problems that it has been unable to resolve due to limited funding.

- The Commission anticipates on-going product reviews during FY 2015 and FY 2016 as new contracts are created in response to changing market needs. The Commission will continue to review public comments and refine its position limit rulemaking. The Commission also anticipates completing its analysis of swap data for the purpose of implementing reporting delays for large notional value swaps.

- In addition, the Commission anticipates that it will begin to analyze, by asset class, the percentage and volume of previously non-transparent swaps now cleared, the level of risk transfer, the potential relative movement of institutions to new financial products, and the implied overall credit and market risk in FY 2016 to ensure that the Commission’s regulations reflect an appropriate understanding of the markets and potential for systemic risk.

- Key regulatory processes supported by the CFTC regulatory portal will be fully automated and integrated with the electronic records and document management system. Dashboards will provide transparency and management visibility into the status of reviews.

-

Product Reviews – Impact if Not Funded at Requested Level of Resources

The Commission has seen a significant increase in the number of contracts filed by DCMs and SEFs, with the number of contract certifications increasing by more than 20 percent over the past two years, with a continued expectation of increases into FY 2016. If this request is not funded, many contracts, even those that exhibit market significance, will not be reviewed in a timely manner to ensure compliance with the CEA. Moreover, the Commission will be unable to fulfill its responsibilities to establish appropriate position limits for certain physical commodities, determine appropriate large notional/block sizes for swaps, or properly evaluate whether certain swaps should be subject to mandatory clearing on a DCO and mandatory trading on a DCM or SEF.

To the extent that resources are unavailable to review product innovations and their related impact on margin methodology at DCOs, market participants will bear the burden of delays, or inability to complete, reviews of new products for clearing or trading, and new margin methodologies will take longer to be evaluated. Market participants will see increased margin and capital charges as a result of the lack of clearing or inefficient margin methodologies, and systemic risk that may otherwise have been minimized through clearing could increase. Liquidity of trading and product choice may also be adversely impacted.

Enhancements to the CFTC regulatory portal and business process automation will be delayed or deferred, reducing the effectiveness of staff and the transparency of the review process, and require continued use of manual paper-based processes.

-

Breakout of Product Reviews Request14

Breakout of Product Reviews Request by Division

Dollars in ThousandsFTE Salaries and Expenses IT15 Total Clearing and Risk 6 $1,592 $0 $1,592 Data and Technology 0 0 525 525 General Counsel 2 561 0 561 Market Oversight 15 3,710 0 3,710 Total 23 $5,863 $525 $6,388

Product Reviews Request by Division

14 The Commission considers the Salary and Expense and the Information Technology programs to be its sole programs, projects, and activities (PPAs). The budget displays by Mission Activity are for informational purposes only, and do not represent a PPA. (back to text)

15 Information Technology costs, including IT investments (e.g., hardware, software, contractor services), FTE, and indirect costs, are directly attributed to the benefiting Mission Activity wherever possible. Any IT costs that are not directly attributed to another Mission Activity are captured in the Data and Technology Support Mission Activity. (back to text)

-

-

-

Surveillance – Resource Overview

Summary of Surveillance Budget Request FY 2014

ActualFY 2015

EstimateFY 2016

RequestChange BUDGET $35,937,603 $56,501,694 $62,429,488 +$5,927,794 FTE 113 121 163 +42 -

Surveillance – Mission Activity Description

The Commission performs market surveillance and financial and risk surveillance, supported by business analytics.

Market Surveillance. The Commission monitors trading and positions of market participants on an on-going basis. Commission staff screen for potential market manipulations and disruptive trading practices, as well as trade practice violations.

Market oversight and surveillance activities are dependent on the ability to receive and load large volumes of data, coupled with the development of sophisticated systems to analyze that data and respond to outlying events or help identify trading or positions that warrant further inquiry. The combination of analysis of available data sets and Special Call authority leads to an understanding of market activities and possible violations of the CEA. It is anticipated that through the collection of shared data sets, including swaps data that is maintained at SDRs, the Commission will have the unique and essential ability to aggregate data received by all market participants by continuously improving data ingest, warehousing, and analytics systems and tools and implementing new systems and tools as needed or as innovative technology is adopted by industry participants. This ultimate aggregation will give the Commission a more encompassing view of futures, options and swaps transactions, which will, in turn, allow the Commission to conduct participant level surveillance for violations and abuses across markets. This capability is particularly important with the expansion of the Commission’s mandate in the disaggregated swaps markets, as market participants may have swaps data residing in multiple SDRs, and multiple DCOs. The increased complexity of swap instruments (versus futures and options) as well as the increased velocity of trading across these various instruments and trading venues makes it essential that the Commission have sufficient tools and resources to view data across the industry landscape in order to detect and deter market manipulation and disruptive trading practices.

Market surveillance monitoring is conducted to further understand structural market changes and support new regulatory requirements. Surveillance systems and tools will incorporate innovative surveillance approaches developed by staff into scheduled, regularly-run monitoring processes.

Financial and Risk Surveillance. Staff conducts risk and financial surveillance of DCOs, clearing FCMs, and other market participants, such as SDs, MSPs, and large traders, that may pose a risk to the clearing process.

As part of its financial and risk surveillance activities, the Commission is working to establish a specialized program to assess capital and margin models, both on an initial and ongoing basis, as part of the Dodd-Frank Act requirement to establish and implement margin and capital requirements for SDs and MSPs. The program would seek to leverage to the extent practicable, reviews and assessments performed by the prudential regulators, the Securities and Exchange Commission (SEC), and foreign regulators, and would include coordinating efforts with SROs.

Financial and risk surveillance technology allows identification of large traders whose positions may pose financial risk to the industry or a clearing firm, analyze an owner’s holdings and project the effect of market moves on these holdings, perform “what if” stress testing and risk scenarios to determine the effect of market movement on margin, and evaluate overall portfolio risk under different market conditions. Financial and risk surveillance technology also allows monitoring FCMs by storing and analyzing monthly financial statements and annual reports provided to the Commission to report net capital positions and other financial information.

Enhancing CFTC’s financial analysis tools is critical, as the Commission will be the only financial regulator that will be able to aggregate and evaluate risk across all DCOs. Each DCO’s view of risk is limited to market participants clearing at that DCO. Many market participants will have positions at multiple DCOs in more than one asset class. The Commission is enhancing its futures-specific risk surveillance program to include the ability to stress test positions in swaps for market participants and DCOs. These financial analysis tools, coupled with analysis of the swaps data that is maintained at SDRs, will also be used as part of oversight and reviews of FCMs and swaps dealers’ risk management controls.

Business Analytics. CFTC also maintains a business analytics platform that supports market surveillance and financial and risk surveillance. Platforms allow staff analyzing regulatory reporting and industry data to keep pace with the continuing growth in data volume and complexity and rapidly evaluate data, build specific work products for unique market and participant conditions, and develop innovative approaches to ongoing market and financial and risk monitoring.

-

Surveillance – Industry Trends and Emerging Issues

The implementation of the Dodd-Frank Act has increased the Commission’s surveillance responsibilities beyond the existing futures mandates to encompass oversight of new more complex products, product platforms, and registrants. As the market participants adapt and adjust to the fluid regulatory environment and develop technology based trading practices, the Commission’s understanding of new, more complex and sophisticated trading methods and technologies, as well as the interaction of physical and financial trading tools, is of paramount importance. Surveillance staff, in order to protect market integrity, must have access to a broad array of regulatory and market data and state-of-the-art technology. The Commission also continues to intensify surveillance efforts to protect against systemic risk and potential threats from market shocks or cybersecurity attacks.

The Dodd-Frank Act requires the Commission to adopt regulations imposing capital requirements on SDs and MSPs that are not subject to regulation by a U.S. prudential regulator. The Dodd-Frank Act also requires the Commission to adopt regulations setting minimum margin requirements for uncleared swap transactions that are entered into by SDs and MSPs that are not subject to margin rules of a U.S. prudential regulator. There currently are over 100 provisionally registered SDs and MSPs, and approximately 60 of these entities will be subject to the Commission’s capital and margin rules, as such SDs and MSPs are not subject to the capital or margin rules of a U.S. prudential regulator. Establishing capital and margin requirements is a central element for the Commission to achieve its regulatory objectives of reducing risks posed by swap transactions that are not centrally cleared and reducing overall system risk.

The Commission has proposed capital and margin rules for SDs and MSPs, and market participants have identified their ability to use internal capital and margin models as a critical issue of the proposals. Accordingly, the CFTC will seek to leverage the SD and MSP model reviews performed by domestic and foreign prudential regulators to the extent that such reviews covered the models used by the SDs and MSPs that are subject to the Commission’s jurisdiction. In addition, the Commission will work with the NFA to review models of other SDs and MSPs that have not had their models reviewed by prudential regulators.

-

Surveillance – Justification of CFTC Resource Requirements

The FY 2016 request for $62,429,488 will support the Commission’s activities related to surveillance. Additional funding is requested in light of the vastly expanded surveillance needs with the increase in the Commission’s responsibilities under the Dodd-Frank Act and the limited resources that have been available to those activities. The funding will, among other things, enable the Commission to begin regular surveillance of futures order message data to increase the scope of futures and cross-market surveillance; for increased data extraction, transformation, and loading to support a more encompassing view of futures, options, and swaps transactions; for increased data analytics support services to assist in the development and operationalization of innovative surveillance approaches; to enhance position limits monitoring systems; and to support the operations, maintenance, and incremental enhancement of market financial and risk surveillance systems and tools implemented to date.

Market Surveillance. The Commission anticipates building additional automated surveillance tools, and enhancing current tools, to adjust to evolving market dynamics and adopt state-of-the-art technology. As trading across the world’s marketplaces has moved almost entirely to electronic systems, the Commission must engage in substantial upgrades to its capabilities to handle unprecedented volumes of transactions in inter-related markets.