CFTC Mission

To foster open, transparent, competitive, and financially sound markets to avoid systemic risk; and to protect market users and their funds, consumers, and the public from fraud, manipulation, and abusive practices related to derivatives and other products that are subject to the Commodity Exchange Act.

Chairman’s

Transmittal Letter

Click on Read letter below to read the full Chairman’s Transmittal Letter.

U.S. Commodity Futures Trading Commission

Three Lafayette Centre, 1155 21st Street, NW, Washington, DC 20581

www.cftc.gov

Timothy G. Massad

Chairman

(202) 418-5050

(202) 418-5533 (fax)

[email protected]

Chairman’s Transmittal Letter

February 9, 2016

The Honorable Thad Cochran

Chairman

Committee on Appropriations

U.S. Senate

Washington, D. C. 20510

The Honorable Barbara A. Mikulski

Ranking Member

Committee on Appropriations

U.S. Senate

Washington, D. C. 20510

The Honorable Hal Rogers

Chairman

Committee on Appropriations

U.S. House of Representatives

Washington, D. C. 20515

The Honorable Nita M. Lowey

Ranking Member

Committee on Appropriations

U.S. House of Representatives

Washington, D. C. 20515

Dear Chairman Cochran, Ranking Member Mikulski, Chairman Rogers and Ranking Member Lowey:

I am pleased to transmit the U.S. Commodity Futures Trading Commission (CFTC or Commission) justification for the President’s fiscal year (FY) 2017 budget request. If fulfilled, this budget request would substantially enhance the Commission’s ability to oversee our nation’s futures, options and swaps markets.

The derivatives markets play an important role in the lives of American families, countless businesses and the broader U.S. economy. By providing farmers, ranchers and companies of all sizes with the ability to manage costs and hedge commercial risk, these markets shape the prices we pay for food, energy, and a host of other goods and services. As a result, the CFTC’s task of ensuring they are working properly is critically important.

The CFTC’s mission is to protect market participants from fraud, manipulation and abusive practices within the derivatives markets, and to protect the public and our economy from systemic risk. To do so, our agency requires increased funding to effectively oversee futures exchanges, swap execution facilities, derivatives clearinghouses, swap dealers, swap data repositories, futures commission merchants and other intermediaries.

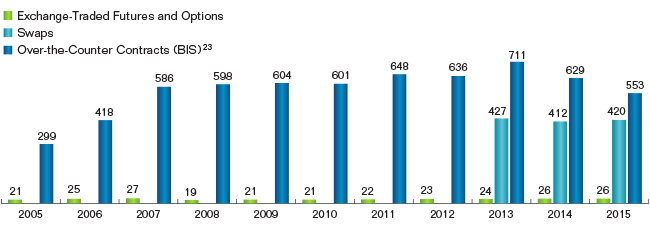

In the aftermath of the worst financial crisis since the Great Depression, which was devastating to America’s families, the Commission’s responsibilities were substantially increased by the Dodd-Frank Wall Street Reform and Consumer Protection Act. The Commission now has primary oversight over the over-the-counter swaps market, which is estimated at $400 to $600 trillion globally, as measured by notional amount. In addition, the futures and options markets that the Commission has traditionally overseen have grown substantially in size, sophistication and technological complexity.

But the CFTC’s budget has not kept pace with its expanded role and market growth. Though there have been modest increases, which we appreciate, they have not been sufficient for us to carry out these expanded responsibilities in the comprehensive and efficient manner that the American people deserve. For example, in fiscal year 2016, the Commission’s funding levels remained unchanged from the year prior.

In order for the Commission to fulfill its duty to oversee these vital markets in fiscal year 2017, the President is requesting $330 million and 897 full-time equivalents (FTE). This is an increase of $80 million and 183 FTE over the FY 2016 enacted level and is effectively the President’s FY 2016 Budget request, with adjustments for inflation.

Of this requested increase, approximately 36 percent will be dedicated to information technology investments. These investments will enhance the Commission’s effectiveness in every area, including market and risk surveillance, data collection and analysis, and enforcement. The remaining 64 percent supports an increase in staffing and related support, specifically needed for critical areas such as surveillance, enforcement, economic and legal analysis and examinations.

Fulfilling this request will allow this agency to engage in a number of important activities that will help ensure that U.S. derivatives markets continue to be global leaders. First, it will allow the Commission to improve surveillance capabilities to keep pace with advances in technological sophistication by market participants. This oversight will help detect excessive risk and prevent fraud, abusive practices and manipulation.

Second, this budget will increase the CFTC’s enforcement efforts, which are so important in light of its expanded responsibilities, market complexity, and the advent of new, complicated forms of illegal behavior, such as spoofing. Today, analyzing trading patterns involves sophisticated information technology (IT) capabilities and unique expertise. The Commission must have the necessary resources to investigate and punish abusive practices.

Third, it will allow the Commission to substantially bolster its examinations of the critical infrastructure in our markets, such as clearinghouses. Recent reforms have made these institutions even more important in the global financial system. In particular, this budget will better equip the agency to deal with the risk of cyberattacks to this critical infrastructure, which is probably the single most important threat to financial stability today. The CFTC needs to conduct more frequent and comprehensive cybersecurity and business continuity examinations, as well as regularly review the adequacy of risk management, financial and operational resources, compliance with customer protection rules, and other matters.

Fourth, additional resources are essential to maintain and improve the basic IT infrastructure and capabilities of the Commission. This includes the ability to receive, store and analyze vast new quantities of data in light of the expansion of our responsibilities and the increased use of automated trading. In addition, it will allow us to maintain our core hardware, software and telecommunication infrastructure.

Finally, additional resources will enable us to respond more quickly and efficiently to the concerns of market participants and, in particular, commercial end-users. The fundamental purpose of these markets is to allow commercial firms to hedge routine risk and engage in price discovery. Over the last 18 months, the Commission has placed a priority on looking at ways to fine-tune recent reforms and other rules to make sure commercial firms, which were not responsible for the financial crisis, can continue to use these markets efficiently and effectively. The additional staff that the requested budget increase would provide will help make sure all of our divisions have the capacity to address the concerns and suggestions of market participants more quickly and effectively.

The derivatives markets are propelled by the needs of the businesses that depend on them, and the ingenuity and creativity of our private sector. Sensible regulation—regulation that helps ensure transparency and integrity, that helps ensure customers are protected, and that helps prevent systemic risk—is essential to the well-being of these markets and their ability to attract participation from around the world. This budget request will go a long way toward helping the Commission make sure the United States derivatives markets continue to be the most robust, dynamic and respected in the world. Thank you for your consideration of our request.

Sincerely,

![]()

cc:

The Honorable John Boozman

Chairman

Subcommittee on Financial Services

and General Government

Committee on Appropriations

U.S. Senate

Washington, D. C. 20510

The Honorable Christopher A. Coons

Ranking Member

Subcommittee on Financial Services

and General Government

Committee on Appropriations

U.S. Senate

Washington, D. C. 20510

The Honorable Robert B. Aderholt

Chairman

Subcommittee on Agriculture, Rural

Development, Food and Drug

Administration, and Related Agencies

Committee on Appropriations

U.S. House of Representatives

Washington, D. C. 20515

The Honorable Sam Farr

Ranking Member

Subcommittee on Agriculture, Rural

Development, Food and Drug

Administration, and Related Agencies

Committee on Appropriations

U.S. House of Representatives

Washington, D. C. 20515

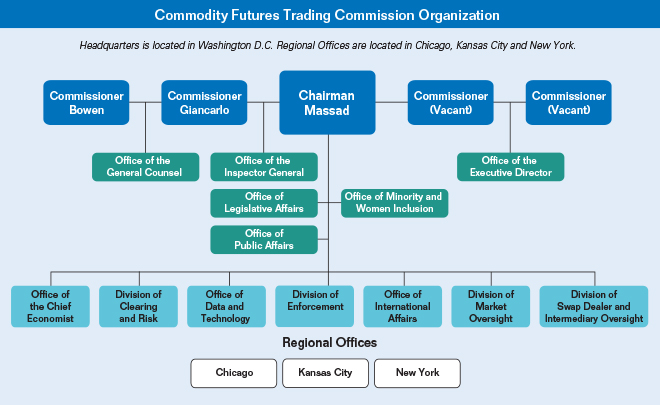

Executive Summary

The CFTC or Commission oversees the nation’s futures, options and swaps markets. The Commission’s mission is to foster open, transparent, competitive, and financially sound markets to avoid systemic risk; and to protect market users and their funds, consumers, and the public from fraud, manipulation, abusive practices related to derivatives and other products that are subject to the Commodity Exchange Act (CEA). To fulfill these roles, the Commission oversees various market intermediaries, including designated contract markets, swap execution facilities, derivatives clearing organizations, futures commission merchants, swap dealers, and swap data repositories.

Although few Americans participate directly in the markets overseen by the Commission, they profoundly affect the U.S. economy and the prices American families pay for food, energy, transportation and most other goods and services. A wide variety of businesses—such as manufacturers, retailers, farmers and ranchers—use these markets to manage routine commercial risk. For example, derivatives enable farmers to lock in a price for their crops, and utility companies or airlines to hedge the costs of fuel. They allow exporters and importers to manage fluctuations in foreign currency exchange rates, and businesses of all types to secure their borrowing costs.

In order for the Commission to fulfill its responsibilities to oversee these vital markets in FY 2017, it is requesting $330 million and 897 FTE. This is an increase of $80 million and 183 FTE over the FY 2016 enacted level and is a continuation of the FY 2016 President’s Budget request, making adjustments for inflation. This increase is necessary because the Commission has not received budgetary increases sufficient enough to allow full implementation of its responsibilities, which have expanded greatly due to changes and growth in the markets and the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) as well as growth in the markets.

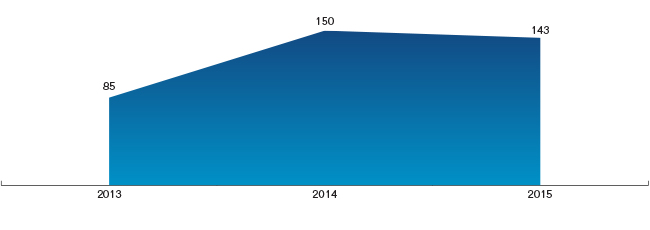

The traditional markets overseen by the Commission—that is, the futures and options markets—are vastly different today than when the Commission was established 40 years ago or even five years ago. They have grown dramatically in size, technological sophistication and complexity. The number of actively traded futures and option contracts has doubled since 2010 and increased six times over the last decade. The volume of contracts traded has grown dramatically as well. Moreover, today, almost all trading is electronic, and about 70 percent of trading is automated. This has given rise to significant cybersecurity concerns, and has dramatically changed how the Commission engages in market oversight, surveillance and enforcement. All of these developments mean that the Commission must substantially increase its own capabilities in order to fulfill its responsibilities.

The Dodd-Frank Act was enacted partly in response to a swaps market that was unregulated across the globe. Excessive swap risk contributed to the intensity of the 2008 financial crisis. That crisis—the worst the nation has experienced since the Great Depression—exacted a heavy toll on American families and the U.S. economy. We must never forget its true costs: eight million jobs lost, trillions in household wealth destroyed, millions of foreclosed homes, countless retirements and college educations deferred, and businesses shuttered. The reforms called for by the Dodd-Frank Act sought to bring the swaps market out of the shadows. The Dodd-Frank Act dramatically increased the Commission’s mission and duties, giving it the primary responsibility for oversight of the over-the-counter swaps market, which is estimated by the Bank for International Settlements at over $500 trillion globally, measured by notional amount. Under the Dodd-Frank Act, Congress directed the Commission to implement four basic goals: 1) clearing of standardized swaps through central counterparties or clearinghouses; 2) trading of swaps on transparent, regulated platforms; 3) oversight of swap dealers and major swap participants; and 4) reporting of data on the swaps market to facilitate greater transparency and enhance regulatory oversight.

Commission staff have worked tirelessly to meet this Congressional mandate. In the five years that have passed since the enactment of the Dodd-Frank Act, the CFTC has developed and adopted almost all of the rules required by Congress creating this new regulatory framework.

However, rules are meaningless without the resources available to implement and enforce them. Although the CFTC’s budget has increased since the passage of the Dodd-Frank Act, the increase has not been commensurate with the Commission’s expanded responsibilities and market growth. Funding levels have limited the Commission’s ability to fulfill both its new and traditional responsibilities. The Commission’s resources remain stretched far too thin over many important responsibilities. The consequences are significant. For example:

- The Commission has not kept pace with the increasing technological complexity and globalization of the markets and market participants it oversees. Moreover, its ability to address cybersecurity issues and technological risk generally, the single most important threat to financial stability today, is limited.

- The Commission needs to conduct more frequent and comprehensive cybersecurity and business continuity examinations, particularly of critical market infrastructure, such as clearing houses, exchanges, and swap data repositories. This is of particular concern because oversight must be conducted comprehensively. With market infrastructure, it is particularly important the Commission regularly reviews the adequacy of risk management, financial and operational resources, compliance with customer protection rules, and other important issues.

- The Commission cannot engage in the necessary level of market surveillance, risk surveillance and oversight, and enforcement efforts. This places customers, the market, and by extension the U.S. economy at increased risk of fraud, abusive practices and manipulation.

- The Commission is limited in its ability to improve its information technology systems that are vital to its mission. These include receiving, storing, and analyzing message data that have resulted from the growth in the electronic environment, as well as the vast new quantities emanating from the swaps market.

- The Commission does not have adequate resources to make sure that market participants registered with the Commission comply with its rules and fulfill participants’ obligations to their customers, which could expose customer funds to significant risk.

- The Commission cannot respond in a timely and thorough manner to the concerns of the public and users of the derivatives markets. Responding to such concerns is an important part of making sure the markets work effectively to facilitate price discovery and allow the hedging of risk.

- The Commission does not have enough economists to perform critical analysis of market developments and provide robust assistance in considering the relative costs and benefits of the Commission’s regulatory activities.

Approximately 36 percent of the requested $80 million increase is required for information technology investments that will enhance all of the Commission’s activities, such as market, financial and risk surveillance, data collection and analysis, and enforcement. The remaining 64 percent supports an increase in staffing and related support, with a particular focus on highly critical areas such as surveillance, enforcement, economic and legal analysis, and examinations.

More entities, more markets and more products are subject to CFTC regulation than ever before. Increased technology and sophistication has allowed the industry to respond quickly to the competitive opportunities engendered by the shifting regulatory landscape. Industry innovations, which will only increase with the addition of new entrants, such as swap execution facilities, will continue to add complexity in ways that are yet to become apparent. While these changes will impact all of the CFTC’s activities, the near-term impacts will fall most heavily on market and risk surveillance, examinations, enforcement and economic analysis. The CFTC needs to be poised to address emerging issues as they arise.

The Commission plays a vital role in market stability and must make sure that the new regulatory framework is working in practice. However, the CFTC will not be able to meet its statutory obligations in a timely and thorough manner that the American people deserve and expect if funding levels remain flat for a second year. In short, without additional resources, market participants will not be adequately protected, fraudulent actions will not be properly held accountable, and market transparency and efficiency will not be fully achieved.

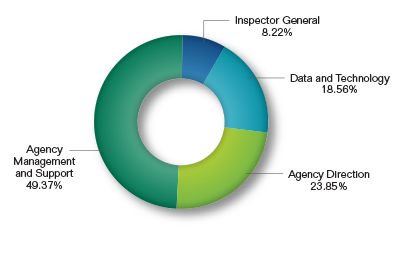

2017 Budget by Mission Activity

Enforcement

The Commission requests $68.7 million and 212 FTE for enforcement activities, an increase of $15.5 million and 51 FTE over the FY 2016 enacted level. Market integrity will continue to be one of the Commission’s key priorities. A strong compliance and enforcement function is vital to maintaining public confidence in the financial markets. This is critical to the participation of many Americans who depend on the futures and swaps marketplace—whether they are farmers, oil producers or exporters. As noted earlier, the markets the Commission oversees continue to grow in size and sophistication. The Commission’s challenge is that for each case it initiates, there are many that we cannot investigate because of resource constraints.

The Commission’s enforcement efforts are necessary for public confidence and trust in the financial markets. A lack of faith in these markets can have a devastating impact on the economy. The Commission uses its authority to: 1) shut down fraudulent operations and immediately preserve customer assets through asset freeze and receivership orders; 2) uncover and stop manipulative and disruptive trading; 3) ensure that markets, firms and participants subject to the Commission’s oversight meet their obligations, including applicable financial integrity and reporting obligations; 4) ban defendants from trading and being registered in its markets; and 5) obtain orders requiring defendants to pay restitution, disgorgement and civil monetary penalties. The Commission also engages in cooperative enforcement work with domestic, state and Federal, and international regulatory and criminal authorities.

The Commission not only has insufficient resources currently, it anticipates more time-intensive and inherently complex investigations due to innovative products and practices within the industry, including the use of automated and high frequency trading. Today, analyzing trading patterns involves sophisticated information technology (IT) capabilities and unique expertise. For example, the advent of new, complicated forms illegal behavior and manipulation, such as spoofing, requires looking at massive quantities of data.

The Commission is investigating more cases involving manipulation, false reporting of market information and disruptive trading practices, including spoofing. Often, these cases involve conduct spanning many years and multiple markets and products, and required forensic economic analysis of trading data. For example, a recent case involving alleged spoofing in connection with the May 2010 “Flash Crash” took years of intensive data analysis and other investigation. In addition, the Commission often faces defendants that will spare no resource in contesting charges. A recent case that arose from the Peregrine fraud, for example, lasted more than two years and required more than 4,800 hours of staff time. The MF Global litigation is ongoing, more than four years after the firm collapsed. The London Interbank Offered Rate (LIBOR) and foreign exchange benchmark cases were global in nature and required intensive reconstruction of communications and trades requiring substantial document, email and chat room reviews, analysis of trading data and books, outside experts and reconstructing timelines. Further, in order to investigate and litigate market-wide violations, as well as those less complex but equally important retail fraud cases, the Commission has increased need for specialized experts to work on enforcement cases.

The Commission is also dedicated to continuing to pursue as many retail fraud cases as its resources allow. In recent years, the Commission prosecuted wrongdoers for a wide range of fraudulent schemes, including Ponzi schemes that preyed upon the retail public’s hopes to participate in foreign exchange trading, precious metals speculation, and commodity pools. The Commission’s experience with fraudsters is that they gravitate towards, and flourish in, financial markets that are not “policed.” Therefore, the Commission must continue to devote significant resources to “walk the beat” of the financial markets within its jurisdiction and protect the retail public that wants to participate in them.

The Commission also foresees an increase in multi-jurisdictional and multi-national investigations given the global nature of the swaps marketplace and the challenges associated with substituted compliance. The Commission is experiencing an increase in international enforcement investigations in its traditional markets. These cases are inherently more resource intensive due to their cross-border nature and in particular coordination with foreign authorities.

Illustrative of those efforts are the Commission’s international benchmark rate rigging cases. With the enforcement cases filed during FY 2015, the Commission has imposed in total more than $4.7 billion in civil monetary penalties for manipulation and attempted manipulation of global benchmark rates. This includes $1.9 billion for misconduct relating to foreign exchange benchmarks and over $2.8 billion for misconduct relating to International Swaps and Derivatives Association Fix (ISDAFIX), LIBOR, Euro Interbank Offered Rate (Euribor), and other interest rate benchmarks. These benchmarks are an essential valuation tool for thousands upon thousands of derivatives across financial markets, including options on interest rate swaps, or swaptions; cross-currency swaps; foreign exchange swaps; spot transactions; forwards; options; and futures.

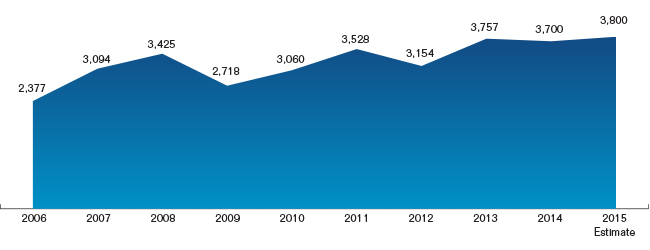

Although the effectiveness of the Commission’s enforcement efforts is best measured by the quality, breadth and effect of the cases pursued, quantitative metrics give some picture of the activity. The CFTC filed 69 new enforcement actions and opened more than 220 new investigations during fiscal year 2015. The agency obtained $3.2 billion in sanctions, including $3.14 billion in civil monetary penalties and more than $59 million in restitution and disgorgement, collecting over 90 percent of the sanctions imposed. The results of investing in the Commission and its enforcement can be viewed from another perspective; from 2010 through 2015, the Commission collected fines and penalties of approximately four times its cumulative budgets. In FY 2015 alone, the amount collected was over 12 times the enacted budget. This amount would support the Commission’s FY 2017 budget request for the next nine years. The Commission must be able to prevent and punish abusive and fraudulent behavior, especially preventing losses to consumers whose customer funds are misappropriated, to retirees whose savings are stolen through scams, or to the economy, when the efficiency and integrity of the markets are damaged by manipulation and fraudulent trading.

Surveillance

The Commission requests $62.8 million and 160 FTE for market surveillance, an increase of $25.7 million and 56 FTE over the FY 2016 enacted level. Over the past two years, CFTC reviewed its highest priority requirements and determined that a significant investment in technology is required. The funding requested in part supports investments in information technology to further develop the Commission’s automated surveillance and data visualization tools.

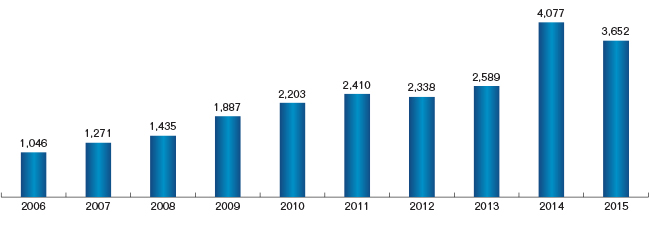

The CFTC is responsible for overseeing the markets in over 40 physical commodities, as well as a wide range of financial futures and options products based on interest rates, equities, and currencies. There are over 4,000 actively traded futures and options contracts. When all tenors and associated options are included, thousands more are subject to Commission oversight. On a typical day, there may be 750,000 transactions in Treasury futures and more than 700,000 in just the E-mini S&P 500 contract, the most active equity index future. And this does not include the approximately 7,000,000 open swaps reported to swap data repositories. Transactions are only part of the picture, however. In today’s high-speed, constantly evolving markets, manipulation and fraud are often conducted using complex strategies involving bids and offers, which far outnumber consummated transactions.

The CFTC continues to face a number of challenges with its new jurisdiction related to swaps. For example, the types of data required by the Commission, the number of data sources providing data, the complexity of the data, and the volume of the data have all expanded significantly. The swaps market presents different challenges than the futures and options market with respect to surveillance. This is because data must be analyzed across the multiple trading platforms that exist. There is also considerable voice-driven activity and complexity related to the execution and processing of trades that do not exist in the vertically integrated futures markets. These require different surveillance perspectives. Aggregating data to understand participants’ positions across futures and swaps markets, both cleared and uncleared, is particularly challenging.

The Commission monitors trading and positions of market participants on an ongoing basis. Staff screen for potential market manipulations and disruptive trading practices, as well as trade practice violations. Such market surveillance is critical, and dependent on the ability to acquire large volumes of data and develop of sophisticated analytics to identify trends and/or outlying events that warrant further investigation. This can only be achieved through investment in technology and expert staff to process, analyze, and interpret the information.

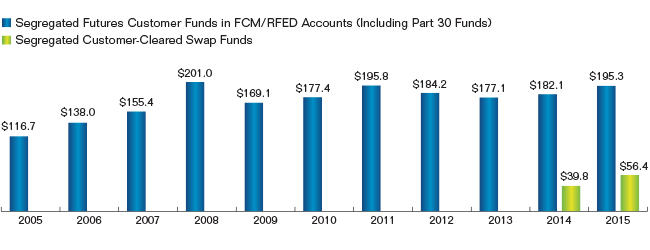

Commission staff must also review large customer positions being held at or managed by intermediaries. They also aggregate customer data across clearinghouses. Today, for example, 36 firms hold more than $500 million each in customer funds, with 10 of these firms holding more than $10 billion each. Failure or trouble at any one firm, particularly a larger firm, could seriously disrupt the American marketplace. On-site examinations are an important component of adequate surveillance, but the Commission is limited as to the frequency of these examinations given its constraints.

In the past, the Commission focused primarily, but not exclusively, on cleared products. Over the next ten months, staff plan to accelerate its efforts to integrate uncleared swaps into the program more fully. Developing and implementing this aspect of the program will help to address one of the most important risks that the Commission currently faces. The goal is to develop tools and procedures that will enable staff to analyze positions across cleared and uncleared markets in order to obtain a picture of the risks posed by large market participants to one another, and to the financial system. The Commission is uniquely situated to do this. Achieving this goal, however, will be challenging and it will require an increase in resources beyond its current base level of funding. The major challenges can be broadly categorized as follows: 1) developing and refining tools to sort and to filter the enormous amount of swap data in appropriate ways; 2) developing and refining tools to stress test swap positions in order to quantify potential risks; and 3) integrating uncleared swaps into the cleared program, and comparing data and analysis from surveillance of cleared products with data and analysis from surveillance of uncleared products in order to evaluate systemic risk across derivatives clearing organizations and across cleared and uncleared markets.

Examinations

The Commission requests $34.2 million and 128 FTE for examinations, an increase of $3.4 million and 13 FTE over the FY 2016 enacted level. Regular examinations, in concert with the Commission’s surveillance and other activities, are a highly effective method to maintain market integrity so that American businesses can rely on these markets. This activity includes direct examinations performed by Commission staff and oversight of examinations performed by self-regulatory organizations. This level of funding is critical to maintaining a robust and effective examination program.

Among the most important examinations that the Commission conducts are those of clearinghouses, which, as noted, have become critical single points of risk in the global financial system. The Commission already lacks the resources to engage in annual examinations of all clearinghouses, and to conduct a sufficient number of in-depth examinations. And yet, the number of clearinghouses, the scope and complexity of the examination issues and the importance of these examinations to overall financial stability are all increasing. Two clearinghouses under the Commission’s jurisdiction have been designated as systemically important by the Financial Stability Oversight Council. The Commission projects the numbers of registered clearinghouses will expand in FY 2017, as it is currently reviewing new applications. As of January 2016, six registered clearinghouses are located overseas, including some that are extremely important to the markets given the volume of swaps and futures cleared for U.S. persons. There are also many other foreign clearinghouses that are not registered but are permitted to engage in certain types of activity in the United States. Although the Commission relies principally on foreign authorities for oversight, it does engage in some monitoring and surveillance of such clearinghouses. Finally, the risk of cyber-attacks is of particular concern with clearinghouses and warrants examinations specifically dedicated to that subject. For all these reasons, the Commission needs to increase its capability to conduct examinations and provide oversight. The examination program is an integral part of the ongoing effort to strengthen clearinghouses and increase transparency.

The Commission must also engage in regular examinations of clearing firms by overseeing the delegated intermediary examination activities of the National Futures Association (NFA) and other self-regulatory organizations by conducting certain direct examinations of certain registrants. In addition, CFTC examination teams must monitor the firms on an ongoing basis, and in particular in situations where a firm may be facing stresses, difficulties or where registrant’s customer assets may be at a risk of loss. Unfortunately, market conditions such as low interest rates, low volatility, and other factors have contributed to a net reduction in CFTC registrants holding customer funds. This resulting concentration in the industry means that only 20 firms hold $235 billion in customer funds, or approximately 93 percent of total customer funds for the futures and cleared swaps industries. Should this trend continue, the potential impact of a major firm crisis on the markets will continue to grow, making the Commission’s oversight even more important.

Clearing firms are just one example of registrants that the Commission oversees. The Commission also oversees over 100 registered swap dealers, as well as nearly 4,100 commodity trading advisors and commodity pool operators.

In light of its budget limitations, the Commission has asked the NFA to take on greater responsibility for certain examinations, including in particular the examinations of swap dealers. However, the Commission must still oversee the NFA’s activity, and in addition to CFTC directly conducts “for cause” reviews, “horizontal” examinations and other examination reviews essential to making sure laws and regulations are observed and customers are protected. Although the Commission will continue to strengthen the role of the NFA, oversight of clearing firm and swap dealer examinations remains an area where additional investment is warranted. In addition, the CFTC will continue to do targeted examinations of certain registrants with respect to key issues. For example, the Commission is working with the other banking agencies and U.S. Securities Exchange Commission (SEC) to determine responsibilities for those entities that are part of banking organizations and subject to the so-called “Volcker Rule.” Because of the way the “Volcker” law was written, the CFTC will have primary audit responsibility for certain registrants that are not otherwise subject to another primary prudential regulatory.

Registration and Compliance

The Commission requests $18.0 million and 62 FTE for registration and compliance activities, an increase of $3.5 million and 10 FTE over the FY 2016 enacted level. The Commission’s ability to analyze registrations in a timely and thorough manner is critical to market efficiency and confidence. The agency’s responsibilities have greatly expanded in this area. The new swap regulatory framework resulted in the temporary registrations of 23 swap execution facilities and over 100 swap dealers, plus four provisionally registered swap data repositories. While the Commission recently completed the permanent registration reviews of 18 swap execution facilities, it still has a significant backlog as a result of the new requirements. In light of the increasing globalization of the markets and changes made by the Dodd-Frank Act, the Commission also has applications for pending registration from 19 foreign boards of trade. It is also considering applications for registration from a number of derivatives clearing organizations, and is in the process of reviewing petitions for exemption from derivatives clearing organization registration from several foreign clearinghouses in FY 2015. The Commission expects additional applications in FY 2017 and beyond.

The Commission performs a thorough review of the applications of all entities seeking to be registered or designated as a designated contract market, swap execution facility, foreign board of trade, clearinghouse, or swap data repository. It also oversees the work of the NFA in regard to the registration of swap dealers, major swap participants, futures commission merchants, Commodity Pool Operators, and other intermediaries. Further, upon completion of an entity’s initial registration process, the CFTC continues to monitor the entity’s activities for compliance and may provide policy direction and legal interpretative guidance when necessary.

The Commission must also be able to respond to product and market innovation by carrying out registration reviews efficiently. A lack of adequate funding impairs the Commission’s ability to attract and retain the experts who understand the markets and who have the capability to review registrations and carry out compliance oversight in a timely and thoughtful manner. Failing to do so can result in delays, ineffective customer protection, regulatory uncertainty, and higher legal and compliance costs for registrants. All of these factors severely impact the efficiency, integrity, and attractiveness of the nation’s markets.

Product Reviews

The Commission requests $6.3 million and 22 FTE for product reviews, a slight increase of $0.8 million and two FTE above the FY 2016 enacted level. The Commission conducts reviews of new contract filings, to ensure that the contracts are not readily susceptible to manipulation or price distortion, and are subject to appropriate position limits or position accountability. For similar reasons, the Commission also analyzes amendments to contract terms and conditions. In addition, new swaps products are reviewed to determine whether they should be required to be cleared pursuant to a clearing mandate. Proliferation of products by industry, which has increased in recent years, and the inherently greater complexity of swaps contracts necessitates an increase in staffing if the Commission is to keep pace with industry’s innovations and act in a timely and efficient manner.

Data and Technology Support

Information Technology (IT) costs include IT investments (e.g., hardware, software, and contractor services), FTE, and indirect costs that are directly attributable to the benefiting mission activity. The Commission requests $61.1 million and 60 FTE for enterprise-wide data and technology support activities, an increase of $17.1 million and 11 FTE above the FY 2016 enacted level. This mission activity supports the cross-agency data and technology infrastructure needs of the Commission. This amount represents a portion of the $113.4 million IT Portfolio, which includes $79 million in investments from the IT program and $34.4 million for IT staff and operating expenses from the Salaries and Expenses program. The total IT Portfolio of $113.4 million is located in Appendix 2.

Data, and the ability to analyze and report data, are more important than ever in the derivatives markets, and in CFTC’s ability to oversee those markets. As a result, it is essential that the Commission continuously invest in its data analysis capabilities.

The CFTC must be able to aggregate various types of data from multiple industry sources that have grown dramatically more complex. For example, legacy structured end-of-day position data for the futures and options markets contained less than two dozen fields per record from a structure derived from punch cards. Now, some swap data required to be analyzed by the CFTC contains over 1,000 fields per record. Analysis of data that is this complex requires a new generation of more powerful, high performance computing hardware and analysis techniques in order to understand the volume, interrelations, and market risks being described. In addition to ingesting and aggregating these complex types of data, the Commission must safeguard the data of a wide variety of registered entities, to ensure it is maintained in a safe, secure environment, and is properly available to support compliance/surveillance activities, and enforcement investigations.

Infrastructure and services must also be expanded to support the growth in the agency. This includes basic computing, data communications, expansion of storage, network capacity; implementation of DHS-mandated cybersecurity measures; and a refresh of end-of-life equipment. Operations, platforms, and systems across all divisions must also be enhanced. This includes legal, technology systems, and forensics support systems for enforcement as well as surveillance systems.

Effectively aggregating and distilling the extensive set of data reported by market participants and correlating it with other market and financial data is an extensive, long-term undertaking that requires dedicated resources. As the activity increases on the registered entities, it expands the Commission’s responsibility and requires continuing investment in the Commission’s technology infrastructure and analytical capability. Enforcement investigations, examinations, and compliance, rule and new product reviews all depend on having access to expanding sets of data and increases the need for analytical requirements.

Economic and Legal

The Commission requests $31.4 million and 103 FTE for economic and legal support activities in FY 2017, an increase of $6.2 million and 18 FTE over the FY 2016 enacted level.

Economic analysis plays an integral role in the development, implementation, and review of financial regulations to ensure they are economically sound and have undergone a rigorous consideration of potential costs and benefits. The Commission is committed to integrating robust economic analysis into its regulatory activities. But its capacity should be augmented to ensure that consistent, thorough, high-quality economic analysis can be performed throughout the Commission. In addition, with the goal of enhancing the Office of the Chief Economist’s resources on a project-by-project basis, staff have been striving to develop a network of external researchers and academics in quantitative financial methods, applied mathematics, econometrics, and statistics. But progress is dependent on availability of additional in-house economists.

The Commission’s Office of the General Counsel (OGC) represents the Commission in Federal courts and before administrative bodies in litigation, including appeals of enforcement actions, challenges to agency actions, derivatives industry bankruptcies, employment lawsuits and other administrative matters. It also is responsible for reviews of proposed rules, as well as staff interpretive and no-action letters to ensure consistency and compliance with the requirements of the Commodity Exchange Act (CEA). Unfortunately, this is a function that has been slowed by the current lack of resources.

The lack of adequate economic staff in the divisions, as well as adequate staff for the OGC, has significantly impaired the ability of Commission staff to respond promptly to requests for relief or interpretations from regulated entities and market participants, such as end-users. Increased funding would significantly improve the ability of staff to respond in a timely and appropriate manner.

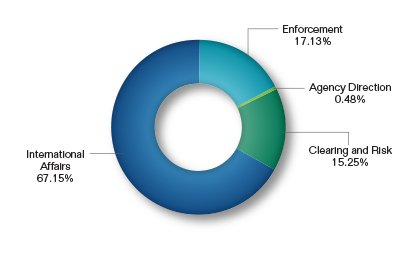

International Policy

The Commission requests $5.2 million and 18 FTE for international support activities in FY 2017, an increase of $1.0 million and five FTE over the FY 2016 enacted level. The global nature of the futures and swaps markets, including the presence of a growing number of foreign-based clearinghouses that are registered, or are requesting registration, in both the United States and their home country, makes it imperative that the Commission consult and coordinate with international authorities in both bilateral and multilateral proceedings. The Commission is actively working with international regulators to avoid conflicting requirements and to engage in cooperative supervision, wherever possible. The Commission will work with international authorities with responsibility for the regulation of the swaps markets in major market jurisdictions to support the adoption and enforcement of robust and consistent standards in and across jurisdictions. It will also work with these authorities to develop concrete and practical solutions to conflicting application of rules, identify inconsistent or duplicative requirements and attempt to reduce the regulatory burdens associated with such requirements, and identify gaps that could lead to regulatory arbitrage.

Overview of the

FY 2017 Budget

The Overview of the FY 2017 Budget presents the FY 2017 budget by program, mission activity, division, and object class; as well as a crosswalk from FY 2016 to FY 2017.

-

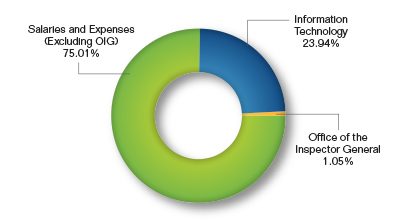

FY 2017 Budget Request by Program1, 2, 3

Summary of FY 2015 to FY 2017 Budget Request by Program

Dollars in ThousandsFY 2015

ActualFY 2016

EnactedFY 2017

RequestChange Salaries and Expenses (Excluding OIG) $196,854 $197,380 $247,538 $50,158 Office of the Inspector General $2,598 $2,620 $3,462 $842 Information Technology $50,621 $50,000 $79,000 $29,000 Total $250,073 $250,000 $330,000 $80,000 Column totals may not add due to rounding

$330.0 Million Budget Request by Program

1 Salaries and Expenses: The Salaries and Expenses program provides funding for all CEA-related activities. This includes funding for Federal staff salaries and benefits, leasing of facilities, travel, training, and general operations of the Commission.

Information Technology: The Information Technology program provides funding for information technology investments. This includes hardware, software, contractor support, and other related information technology requirements. (back to text)2 The Commission considers the Salary and Expenses, Information Technology, and Office of the Inspector General programs to be its sole programs, projects, and activities (PPAs). All other budget displays by mission activity, division or any other depiction are for informational purposes only. (back to text)

3 The OIG program provides audits, investigations, reviews, inspections, and other activities to evaluate the operations and programs of the Commission. (back to text)

-

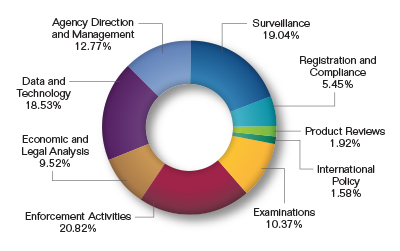

FY 2017 Budget Request by Mission Activity4

Summary of FY 2015 to FY 2017 Budget Request by Mission Activity

Dollars in ThousandsFY 2015

ActualFY 2016

EnactedFY 2017

RequestChange FTE Budget FTE Budget FTE Budget FTE Budget Agency Direction and Management 119 $41,968 115 $35,495 132 $42,135 17 $6,640 Data and Technology Support 49 $40,874 49 $44,004 60 $61,136 11 $17,131 Economic and Legal Analysis 75 $22,475 85 $25,227 103 $31,423 18 $6,196 Enforcement Activities 155 $50,976 161 $53,188 212 $68,720 51 $15,532 Examinations 99 $26,386 115 $30,785 128 $34,216 13 $3,431 International Policy 13 $3,941 13 $4,175 18 $5,226 5 $1,052 Product Reviews 16 $4,644 20 $5,501 22 $6,349 2 $849 Registration and Compliance 46 $13,682 52 $14,489 62 $17,975 10 $3,486 Surveillance 119 $45,127 104 $37,135 160 $62,819 56 $25,684 Total 690 $250,073 714 $250,000 897 $330,000 183 $80,000 Column totals may not add due to rounding

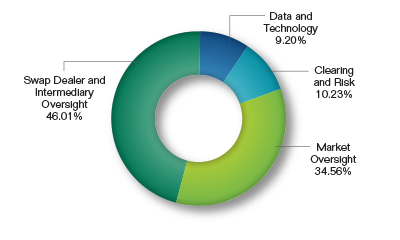

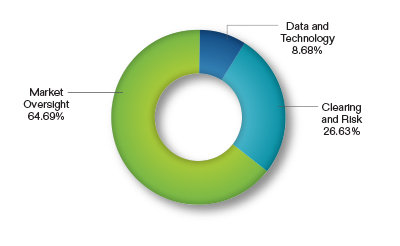

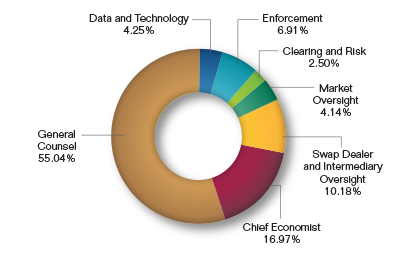

$330.0 Million Budget Request by Mission Activity

4 The Commission considers the Salary and Expenses, Information Technology, and Office of the Inspector General programs to be its sole programs, projects, and activities (PPAs). All other budget displays by mission activity, division or any other depiction are for informational purposes only. (back to text)

-

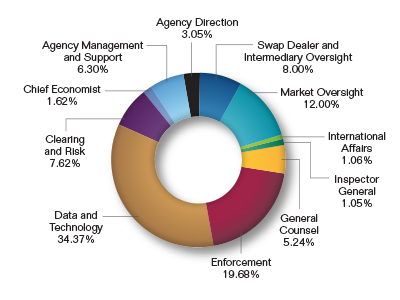

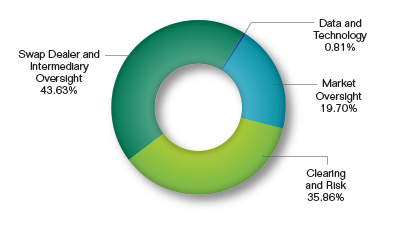

FY 2017 Budget Request by Division5

Summary of FY 2015 to FY 2017 Budget Request by Division

Dollars in ThousandsFY 2015

ActualFY 2016

EnactedFY 2017

RequestChange FTE Budget FTE Budget FTE Budget FTE Budget Agency Direction 33 $9,001 28 $8,003 37 $10,075 9 $2,073 Administrative Management and Support 78 $19,368 74 $18,342 84 $20,802 10 $2,460 Chief Economist 11 $3,154 12 $3,036 18 $5,334 6 $2,298 Clearing and Risk 62 $16,757 72 $19,642 95 $25,138 23 $5,495 Data and Technology 92 $83,229 95 $78,605 113 $113,433 18 $34,828 Enforcement 158 $48,767 164 $49,623 217 $64,940 53 $15,316 General Counsel 46 $13,523 47 $13,872 58 $17,295 11 $3,424 Inspector General 8 $2,598 10 $2,620 11 $3,462 1 $842 International Affairs 10 $3,054 10 $3,215 12 $3,509 2 $294 Market Oversight 107 $27,608 115 $29,961 153 $39,613 38 $9,652 Swap Dealer and Intermediary Oversight 85 $23,013 87 $23,082 99 $26,400 12 $3,318 Total 690 $250,073 714 $250,000 897 $330,000 183 $80,000 Column totals may not add due to rounding

$330.0 Million Budget Request by Division

5 The Commission considers the Salary and Expenses, Information Technology, and Office of the Inspector General programs to be its sole programs, projects, and activities (PPAs). All other budget displays by mission activity, division or any other depiction are for informational purposes only. (back to text)

-

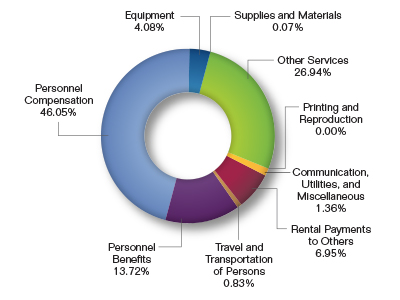

FY 2017 Budget Request by Object Class

Summary of FY 2015 to FY 2017 Budget Request by Object Class

Dollars in ThousandsFY 2015

ActualFY 2016

EnactedFY 2017

RequestChange 11.0 Personnel Compensation $107,149 $118,717 $151,955 $33,238 12.0 Personnel Benefits $33,413 $35,378 $45,283 $9,905 21.0 Travel and Transportation of Persons $2,104 $1,886 $2,753 $868 22.0 Transportation of Things $121 $0 $0 $0 23.2 Rental Payments to Others $21,325 $15,411 $22,949 $7,538 23.3 Communication, Utilities, and Miscellaneous $4,407 $2,622 $4,472 $1,850 24.0 Printing and Reproduction $581 $0 $15 $15 25.0 Other Services $72,526 $63,550 $88,899 $25,349 26.0 Supplies and Materials $1,961 $250 $220 ($30) 31.0 Equipment $6,461 $12,186 $13,453 $1,267 32.0 Building and Fixed Equipment $26 $0 $0 $0 Total $250,073 $250,000 $330,000 $80,000 Column totals may not add due to rounding

$330.0 Million Budget Request by Object Class

-

Crosswalk from FY 2016 to FY 2017

Crosswalk from FY 2016 Estimate to FY 2017 Request

Dollars in ThousandsFY 2016

EstimateFY 2017

RequestChange Budget Authority (Dollars) $250,000 $330,000 $80,000 Full-Time Equivalents (FTEs) 714 897 +183 Explanation of Change FTE Dollars Current Services Increases: (Adjustments to FY 2016 Base) To provide for changes in personnel compensation and benefits: $3,711 To provide for the following changes in non-personnel costs: $9,388 —Space Rental/Communications/Utilities ($9,388) Program Increase: (Adjustments to FY 2017 Current Services) +183 $66,900 —Addition of 183 FTE ($39,495) —Travel/Transportation ($868) —Other Services ($25,285) —Supplies/Printing (-$15) —Equipment ($1,267) Total Change +183 $80,000 Column totals may not add due to rounding

Justification of the

FY 2017 Budget by

Mission Activity

The Justification of the FY 2017 Budget by Mission Activity section presents the following for each mission activity: resource overview, mission activity description, justification of CFTC request by function, and breakout of budget request.

-

-

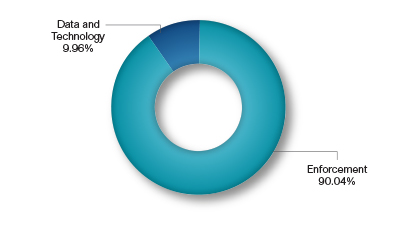

Enforcement – Resource Overview

Summary of Enforcement Budget Request FY 2015

ActualFY 2016

EnactedFY 2017

RequestChange BUDGET $50,975,777 $53,188,374 $68,720,431 +$15,532,056 FTE 155 161 212 +51 -

Enforcement – Mission Activity Description

The Commission is responsible for protecting market participants and other members of the public from fraud, manipulation and other abusive practices in the futures and swaps markets. Its cases range from quick strike actions against Ponzi enterprises that victimize investors across the country, to actions concerning sophisticated manipulative and disruptive trading schemes in markets the Commission regulates, including financial instruments, oil, gas, precious metals and agricultural goods.

-

Enforcement – Justification of CFTC Request by Function

Enforcement

The Commission will utilize the requested resources to maintain a robust enforcement program, which is necessary to protect both customers and the integrity of the markets. With the Commission’s new authority and responsibility granted by Congress in the Dodd-Frank Act, and in light of the continued growth in the markets it oversees, the Commission must maintain and expand its enforcement program in order to fulfill its mandate. These vital resources enable the Commission to, among other things: 1) shut down fraudulent schemes and seek to immediately preserve customer assets through asset freezes and receivership orders; 2) uncover and stop manipulative and disruptive trading; 3) ensure that markets, firms and participants subject to the Commission’s oversight meet their obligations, including their financial integrity and reporting obligations, as applicable; 4) ban defendants from trading and being registered in its markets; and 5) obtain orders requiring defendants to pay restitution, disgorgement and civil monetary penalties.

With the increasing complexity and interconnectivity of the financial markets, these resources are also necessary for the Commission to maintain the force multiplying benefit of the enforcement program’s cooperative enforcement work with domestic, state and Federal, and international regulatory and criminal authorities.

Impact if Not Funded at Requested Level of Resources. The Commission is committed to making good use of its resources, responding in a timely manner to market events and acting swiftly where customers are at risk. If the requested funding level is not received, the decrease in resources will make it increasingly difficult for the Commission to quickly investigate and prosecute wrong-doers. This vulnerability could significantly sap confidence in the markets and undermine the Commission’s regulatory oversight.

For example, new forms of manipulation, such as spoofing, are complicated and constantly evolving. Moreover, trading in our markets today is largely automated. As a result, analyzing trading patterns involves looking at massive quantities of data, which requires sophisticated IT capabilities and unique expertise.

In addition, the integrity of benchmark rates, which are used by individuals and firms across the globe, remains a priority for the Commission. Over the last two years, we imposed penalties of $4.6 billion in the investigation of manipulation of global benchmark rates, $1.8 billion in penalties on six banks for misconduct relating to foreign exchange benchmarks, and over $2.7 billion for misconduct relating to ISDAFIX, LIBOR, Euribor, and other interest rate benchmarks. A decrease in resources would compromise the Commission’s ability to maintain its oversight on the thousands of contracts used in the markets and also limit the enforcement program’s capacity to investigate these matters.

Anti-fraud enforcement also remains a core commitment of the CFTC’s enforcement program. During the past year, the Commission prosecuted wrongdoers for a wide range of fraudulent schemes, including Ponzi schemes that preyed upon the retail public’s hopes to participate in forex trading, precious metals speculation, and commodity pools. The Commission’s experience with fraudsters is that they gravitate towards, and flourish in, financial markets that are not “policed.” Therefore, the Commission must continue to devote significant resources to “walk the beat” of the financial markets within its jurisdiction and protect the retail public that wants to participate in them. A decrease in resources allocated to the enforcement program would encourage further misconduct and abuse of individual investors.

In protecting the markets and market participants, the Commission engages in investigations and takes enforcement action, when necessary, to make sure that firms maintain their financial integrity and that markets, firms and significant market participants fulfill their regulatory obligations, including reporting obligations. Commission registered firms are required to meet standards for their capitalization and handling of funds, which standards are intended to safeguard against market disruption and abuse from imprudent practices or intentional misconduct and to protect customers. The reporting requirements for markets, firms and significant market participants, which include obligations related to swaps transactions, are essential to the CFTC’s ability to conduct effective surveillance of the markets that it regulates. With the Dodd-Frank Act’s expansion of the Commission’s responsibility, the Commission will need to expend additional resources to ensure that the markets, firms and significant market participants in the trillion dollar swaps marketplace uphold these essential obligations. A decrease in resources would jeopardize the Commission’s ability to ensure that persons who are subject to regulatory requirements meet those obligations and thus would place at risk the Commission’s ability to ensure the integrity of the markets.

Data and Technology

Continuing to enhance eLaw technology and support (e.g., case assessment and management, document review, eDiscovery, forensics, searching, audio analytics, and data analytics) will help address rising case volumes, complex enforcement actions, and keep pace with extensive use of technology by opposing counsel. Providing enforcement staff with sufficient resources for technical support increases their ability to focus on investigation and litigation.

Robust enforcement is critical in protecting the public. The eLaw technology system is an integral part of that effort. Several components of this system will continue to be enhanced in FY 2017. Data storage capacity will be increased, to support ever-growing volumes of digital evidence and analytic support databases. Computer forensics will be enhanced, to examine new types of digital evidence. Technical support services for staff will be increased, to ensure that technical and logistical activities minimally constrain the critical timelines of enforcement actions.

Impact If Not Funded at Requested Level of Resources. Without the requested resources, we will be unable to continue to keep forensics, investigation, and litigation support tools current and provide staff with sufficient legal technology services. This will constrain the number of investigations and enforcement actions the Commission is able to conduct.

-

Breakout of Enforcement Request6

Breakout of Enforcement Request by Division

Dollars in ThousandsFTE Salaries and Expenses IT Total Enforcement 207 $61,874 $0 $61,874 Data and Technology 5 $1,254 $5,592 $6,846 Total 212 $63,128 $5,592 $68,720 Column totals may not add due to rounding

Enforcement Request by Division

6 The Commission considers the Salary and Expenses, Information Technology, and Office of the Inspector General programs to be its sole programs, projects, and activities (PPAs). The budget displays by mission activity are for informational purposes only, and do not represent a PPA. (back to text)

-

-

-

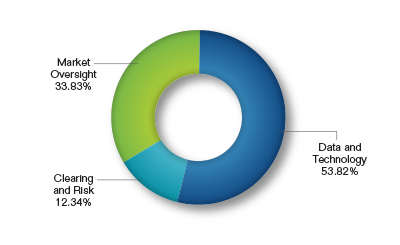

Surveillance – Resource Overview

Summary of Surveillance Budget Request FY 2015

ActualFY 2016

EnactedFY 2017

RequestChange BUDGET $45,127,231 $37,135,432 $62,819,162 +$25,683,730 FTE 119 104 160 +56 -

Surveillance – Mission Activity Description

The Commission monitors trading and positions of market participants on a daily and ongoing basis. Surveillance of complex markets and sophisticated trading instruments requires a depth of practical industry knowledge in the commercial use of the physical, futures and derivative products by industry. New surveillance requirements stemming from Dodd-Frank Act have altered the basic characteristic of the work executed by Commission staff. Years ago, CFTC staff were primarily concerned with physical commodities and the squeezing commodity futures contracts, detecting customer abuse by floor traders and the reporting of fundamentals to the Commission. Today, the Commission is focused on analyzing, aggregating and monitoring diverse data sources, which help uncover market abuses and non-compliance with Commission rules and regulations.

Market Surveillance. The Commission monitors trading and positions of market participants on an ongoing basis. Commission staff screen for potential market manipulations and disruptive trading practices, as well as trade practice violations.

In addition to its traditional markets, the CFTC also needs to monitor swap markets for both compliance and manipulation abuses. The Commission has extended surveillance to small exchanges, (non-core) products or newly traded products. It monitors futures options markets for fraud. And it provides “deep dive” analysis and reviews of a market participants or traders’ portfolio of positions and transactions in physical and financial products for potential manipulations and lesser potential violations.

Surveillance staff are frequently called upon as subject matter experts to provide an understanding of commercial practices, analyze market events and recapitulate fundamentals. This often goes beyond the confines of briefing agency personnel or Commissioners. Surveillance staff are often asked to provide briefings to other departments and agencies throughout the United States, as well as to international agencies across the globe.

Market surveillance monitoring is conducted to further understand structural market changes and support new regulatory requirements. Surveillance systems and tools will incorporate innovative surveillance approaches developed by staff into scheduled, regularly-run monitoring processes.

Financial and Risk Surveillance. Staff conducts risk and financial surveillance of derivatives clearing organizations, clearing futures, futures commission merchants, and other market participants, such as swap dealers, major swap participants, and large traders, that may pose a risk to the clearing process.

Staff look at market risk, liquidity risk, credit risk and concentration risk. The Commission has extensive daily margin and position reporting requirements that enable it to engage in daily risk surveillance. Our program includes daily review of the positions of clearing members and large traders. Staff engage in analysis of margin models, stress testing of positions, back testing of margin coverage, and in-depth compliance examinations. Staff seek to identify who is at risk, the magnitude of that risk, and how that risk compares to available financial resources. Staff also require clearinghouses to oversee the risk management policies and practices of their members.

Staff routinely detects traders with risk that appears to be potentially excessive, and may take a range of different actions. The Commission may seek account statements or other financial documentation. If concerns remain, staff often interviews clearing member or trader staff. These interviews focus on the trader’s financial resources, trading strategy, trading techniques, and trading experience.

The Commission has conducted on-site risk reviews with traders ranging from the largest hedge fund operators to individuals. It routinely discusses risk practices with clearing members. Staff also produces a number of internal reports to track industry trends affecting clearing members. Some daily reports track which clearing members had large variation margin payments across clearinghouses, or strings of consecutive days with variation margin losses. Other reports show which clearing members’ risks are increasing at particular clearinghouse or across clearinghouses and which clearing members’ risks are decreasing.

Staff has also been conducting FCM compliance reviews regarding Regulation 1.73, which requires registered FCMs to conduct screening of orders, to stress test customer and proprietary positions, to evaluate their ability to meet initial margin requirements and make variation margin payments, and to evaluate their ability to liquidate positions quickly.

In addition, over the next ten months, staff plan to accelerate its efforts to integrate uncleared swaps more fully into its risk surveillance program. In the past, the Commission focused primarily, but not exclusively, on cleared products.

Developing and implementing this aspect of the program will help to address one of the most important risks that the Commission currently faces. The goal is to develop tools and procedures that will enable staff to analyze positions across cleared and uncleared markets in order to obtain a picture of the risks posed by large market participants to one another, and to the financial system.

Achieving this goal, however, will be challenging and it will require an increase in resources beyond its current base level of funding. The major challenges can be broadly categorized as follows: 1) developing and refining tools to sort and to filter the enormous amount of swap data in appropriate ways; 2) developing and refining tools to stress test swap positions in order to quantify potential risks; and 3) integrating uncleared swaps into the cleared program, and comparing data and analysis from surveillance of cleared products with data and analysis from surveillance of uncleared products in order to evaluate systemic risk across derivatives clearing organizations and across cleared and uncleared markets.

Business Analytics. CFTC also maintains a business analytics platform that supports market surveillance and financial and risk surveillance. Platforms allow staff analyzing regulatory reporting and industry data to keep pace with the continuing growth in data volume and complexity and rapidly evaluate data, build specific work products for unique market and participant conditions, and develop innovative approaches to ongoing market and financial and risk monitoring.

-

Surveillance – Justification of CFTC Request by Function

Market Oversight

Market oversight and surveillance activities are dependent on the ability to receive and analyze large trade volumes of data. As such, the continuing development of sophisticated systems to analyze that data and respond to outlying events or help identify trading or positions that warrant further inquiry is essential for robust surveillance. Currently, staff conduct limited forensic analysis involving data sent to the Commission to uncover potential market abuses and to protect market integrity by participants. In addition, in real-time, Surveillance staff enter into dialogues with market participants and with the exchanges, about market participant activities in all phases of trading as commodity situations of interest arise.

Through collection of shared data sets, including swaps data that is maintained at swap data repositories, the Commission has the unique and essential ability to aggregate data received from all market participants by continuously improving data ingest, warehousing, and analytics systems and tools and implementing new systems and tools as needed or as innovative technology is adopted by industry participants. This ultimate aggregation will give the Commission a more encompassing view of futures, options and swaps transactions, which will, in turn, allow the Commission to conduct participant level surveillance for violations and abuses across markets. This capability is particularly important with the expansion of the Commission’s mandate in the disaggregated swaps markets, as market participants may have swaps data residing in multiple swap data repositories, and multiple derivatives clearing organizations. The increased complexity of swap instruments (versus futures and options) as well as the increased velocity of trading across these various instruments and trading venues makes it essential that the Commission have sufficient tools and resources to view data across the industry landscape in order to detect and deter market manipulation and disruptive trading practices.

Impact if Not Funded at Requested Level of Resources. Without adequate funding, the Commission will be significantly impaired in its ability to analyze both traditional and new sources of market data, and as a result, will be unable to analyze market anomalies or detect and analyze potential market abuses sufficiently, or develop and implement analysis-based tools. The impact to the core activity of market surveillance is compromising to the Commission’s mission of protecting market integrity and detecting and deterring market abuses. Market manipulation, price distortion and compliance violations detection will be hampered and abuses will escape discovery without the requested funding. The lack of a comprehensive understanding of market events and participant trading behaviors will significantly increase the likelihood that major market risks or illegal activities will go undetected. Additionally, the Commission would have to abandon forensic evaluations, postpone surveillance tool development, and provide surface-only examination of swaps data for potential abuses, thereby significantly increasing the costs to be borne by other market participants and the broader U.S. economy. Examples of other deficiencies would include, but are not limited to: 1) an inability to aggregate various data used to oversee reporting requirements; 2) a decreased ability to detect and deter market manipulation and trade practice concerns; 3) an inability to invest in and deploy automated trading violation and surveillance alerts; 4) a deteriorated comprehension of market structure changes; and, 5) a limited ability to develop and implement sophisticated analysis-based surveillance tools.

Clearing and Risk

Risk surveillance is a technology-intensive task. Commission use internally developed applications and commercially available software. Since implementation of the Dodd-Frank rulemakings, RSB has been analyzing a huge amount of data from a variety of sources. The Commission’s ability to continue to function effectively is dependent on its ability to process this data.

Enhancing CFTC’s financial analysis tools is critical, as the Commission will be the only financial regulator that will be able to aggregate and evaluate risk across all derivatives clearing organizations. Each derivative clearing organization’s view of risk is limited to market participants clearing at that particular organization. Many market participants will have positions at multiple clearinghouses in more than one asset class. The Commission is enhancing its futures-specific risk surveillance program to include the ability to stress test positions in swaps for market participants and derivatives clearing organizations. These financial analysis tools, coupled with analysis of the swaps data maintained at swap data repositories, will also be used as part of oversight and reviews of futures commission merchants and swaps dealers’ risk management controls.

For futures, the only variables are the price, delivery month, and identity as a buyer or a seller. For an interest rate swap, there may be many more variables that can be customized. These include, among others, the notional amount, the currency, the fixed rate, the index to which the floating rate is tied, and the maturity. As a result, derivatives clearing organizations clear many more swap products than futures. For example, the CME currently lists approximately 105 individual interest rate futures; by contrast, LCH currently carries cleared positions in over 900,000 individual interest rate swaps.

Moreover, for uncleared swaps, substantial work is still needed to ensure that the data is complete and accurate. Currently, much of the data from swap data repositories are is incomplete or contain inaccurate values in key fields. This limits staff’s ability to calculate the value of positions and to conduct stress testing. In addition, many swaps are not properly terminated, which may result in double-counting of positions.

Once data validation is completed, further work is then needed to develop tools to sort and to filter the data in a variety of appropriate ways. For example, work is needed to sort by beneficial owner, by affiliate group, and by clearing member, if applicable.

Complex analysis is necessary to determine the extent to which a trader’s positions across multiple products, trading venues, and derivatives clearing organizations have risks that are offsetting or compounding. Even more complex analysis is necessary to quantify such risk. Having quantified risk, one must then assess whether the relevant parties (traders, clearing members, derivatives clearing organizations) are taking appropriate steps to manage the risk. The complexity of the interconnections increases when uncleared products are included.

In addition, resources are needed to review new derivatives clearing organization margin models and changes to existing margin models. Many derivatives clearing organizations clear the same asset class, but each uses its own margin model to calculate margin requirements. In some instances the requirements for the same positions will not be the same at multiple derivatives clearing organizations. The Commission must compare and contrast these models in order to analyze differences and to ensure appropriate coverage.

Moreover, resources are also needed to review swap dealer models for margining uncleared swaps, to address this, the Commission is working to establish a specialized activity to assess capital and margin models, both on an initial and ongoing basis, as part of the Dodd-Frank Act’s requirement to establish and implement margin and capital requirements for swap dealers and major swap participants.

The Commission would seek to leverage to the extent practicable, reviews and assessments performed by the prudential regulators, the SEC, and foreign regulators, and would include coordinating efforts with self-regulatory organizations.

Impact if Not Funded at Requested Level of Resources. If the Commission is not funded at the requested level it would not have the resources to further evaluate risk across derivatives clearing organizations. The Commission also will not have the resources to incorporate uncleared swaps into its risk surveillance. This function is critical to risk management oversight of derivatives clearing organizations, and the Commission is the only entity with the data and capabilities to perform this function. Additionally, the Commission will be unable to develop the proactive swap evaluation as planned. Given the increasing concentration in the industry, it is crucial that the Commission have the ability to identify and to address risks at an early stage in order to prevent extreme market disruption or the loss of customer funds.

For all aspects of surveillance activities, receipt of accurate comprehensive data is important. The CFTC will be receiving data from new market participants and for new, complex derivatives such as IRS swaptions. Without the requested level of funding, the CFTC will have great difficulty integrating this data into its risk surveillance program.

Data and Technology

CFTC’s data management is crucial to effective oversight of an increasingly complex and diverse electronic marketplace. Commission systems work to ensure data harmonization, integration, and quality. Commission staff have established an agency-wide data governance group that reviews agency-wide data needs and steers data strategy.

- The CFTC is enforcing common data standards and services among the swap data repositories to ensure data interchange and interoperability. The CFTC is also establishing a unified set of master data and reference data using legal entity identifiers as a linchpin. The Commission is increasing the use of data feeds from industry and government system-based data services in order to reduce the latency between market events and staff ability to analyze correlated data from diverse sources.

- The Commission will increase analytics support to assist staff with the manipulation of large and complex data sets, data analysis, data validation, and data aggregation. The Commission will continue to build capabilities for staff to access these large and complex data sets seamlessly, regardless of the source of market data reported to the Commission or to the data repositories such as swap data repositories.

- Commission staff are proactively engaged in the developing and adopting harmonized standards for swaps data. This harmonization exercise is both international and domestic. The Commission will continue to make progress to harmonize the form, manner and content of the swaps data by engaging with standard-setters, industry and international regulatory organizations to ensure that swaps data is ever more usable in monitoring a global market.

CFTC also maintains business analytics platforms for performing data analysis. Platforms allow staff analyzing industry data to keep pace with the continuing growth in industry data volume and complexity.

The Commission must conduct market, financial, risk and economic analysis based on the most current data. Business analytics platforms empower staff to quickly evaluate data and build specific work products for unique business situations.

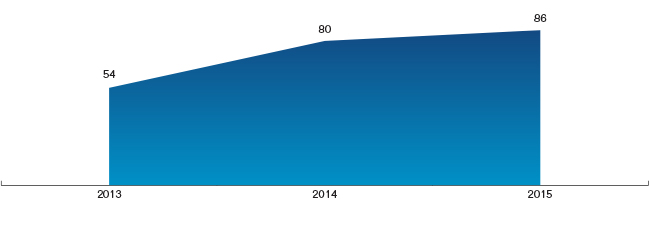

The Commission will continue to implement new processes and analytics focused on swaps data collection and aggregation. Currently, the Commission receives approximately 300 million data records per day from clearing organizations, exchanges, and large trading organizations. Over 50 automated processes are performed daily to gather and organize the data for use by analytical tools and applications that support surveillance, investigation and analysis efforts. The unique sources of data required to perform our mission have increased by over 150 percent since 2013; we expect continued growth in the amount of data required to understand increasingly complex markets and products. Additional efforts are required to ensure that new sources of information are of high quality, and that the Commission’s systems are capable of handling large amounts of data. Investments in “Big Data” technologies will improve the Commission’s ability to conduct surveillance, investigations, and economic analysis. Additional computing power is required when performing activities such as market reconstructions and simulation, complex swap valuation, risk analysis, and analyzing high frequency and algorithmic trading using large data sets. These improvements will allow staff to quickly gather subsets of enterprise data for analysis, optimize the analytics performance, and reduce extraction, transformation and loading times for very data sets.

The Commission will continue to support risk management technology by providing a platform, which allows analysts to assess the inherent risk in existing large trader positions using real time prices. Continued support of this software will enable staff to help market participants proactively mitigate portfolio risk by expanding pricing to the entirety of derivatives clearing organizations.

Statistical analysis and high-performance computing platforms will be integrated, expanded, and enhanced. Resources will be used to develop flexible dashboards to increase dynamic visibility into key sets of data, allowing surveillance staff to quickly identify key areas for investigation. Data aggregation methods will be established and refined. CFTC data storage will be expanded to handle the continuing growth of analytical data.