CFTC Mission

To protect market users and the public from fraud, manipulation, abusive practices and systemic risk related to derivatives that are subject to the Commodity Exchange Act,

and to foster open, competitive, and financially sound markets.

A Message from

the Chairman

I am pleased to present the Agency Financial Report for Fiscal Year (FY) 2014. This has been a year of remarkable progress in bringing transparency, access and competition to the swaps market and continuing our efforts to insure that the futures and options markets operate with integrity. This report presents our performance accomplishments and audited financial statements for the just ended fiscal year.

The Commodity Futures Trading Commission (CFTC or Commission) oversees U.S. derivatives markets—commodity futures, options, and swaps. Although most Americans do not participate directly in the derivatives markets, they profoundly affect the prices we all pay for food, energy, and most other goods and services we buy each day. They are the key source of price discovery and are used by many businesses, farmers and ranchers to manage routine commercial risk. Their complexity has continued to evolve rapidly with new technologies, globalization, product innovation, and greater competition, which makes our work even more important.

These markets are vital to our economy, and the work of the CFTC is vital to making sure that these markets operate as they should. Our mission is to protect market participants from fraud, manipulation and abusive practices and to ensure the protection of customer funds. We aim to foster transparent, open, competitive and financially sound markets. And we seek to protect the public from the possibility that these markets will create the types of excessive risks that contributed to making the 2008 financial crisis the worst since the Great Depression.

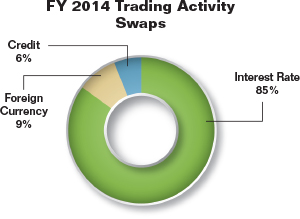

The financial crisis made clear the need for reform of the derivatives markets. During the last year, we have continued to make progress implementing the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act) and bringing the swaps market out of the shadows. For example, clearing is now required for most interest rate and credit default swaps. In terms of oversight and market development, we have more than 100 swap dealers (SDs) provisionally registered, and we require them to observe strong risk management practices and business conduct standards. There are more than 20 swap execution facilities (SEFs) temporarily registered. SEF trading has begun and is growing. We also have four swap data repositories (SDRs) provisionally registered, collecting and disseminating market data. We and the public have much more information regarding the swaps marketplace as a result.

In addition, we continue to oversee the futures and options markets. We are doing all we can to make sure these markets operate safely and with integrity.

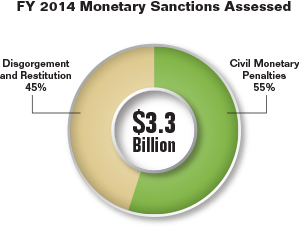

Enforcement has been a key area as well. Robust enforcement is vital to maintaining the integrity of our markets, and will remain a priority going forward. The Commission filed 67 enforcement actions in FY 2014, initiated more than 240 new investigations, and obtained more than $3.27 billion in sanctions, including orders imposing more than $1.8 billion in civil monetary penalties and more than $1.4 billion in restitution and disgorgement, despite a three percent decrease in enforcement staff.

How far we have come is a credit to the hardworking professional staff of the CFTC. Their efforts have been tireless and are highlighted in the pages that follow.

While we have made much progress, much work remains to be done.

Our accomplishments and aspirations have been constrained by a lack of sufficient financial resources. The Dodd-Frank Act greatly expanded the CFTC’s responsibilities. The size of the swaps market we are now tasked to oversee is vast and many times larger than the futures and options markets we also must supervise. Our budget has not kept pace and limits our ability to fulfill our responsibilities in a way that the public deserves.

We will continue to do all we can with the resources we have. But without additional resources, our markets cannot be as well supervised; participants cannot be as well protected; and market transparency and efficiency cannot be as fully achieved.

The CFTC places a strong emphasis on being an effective steward of its operating funds. I am pleased to report that for the tenth consecutive year, the Commission has received an unmodified opinion on its financial statements. Our auditor, the public accounting firm, KPMG LLP, on behalf of our Inspector General, was able to affirm that the financial statements, included in this report, were presented fairly, in all material respects, and in conformity with U.S. generally accepted accounting principles (GAAP).

I can also report that the CFTC had no material internal control weaknesses and that the financial and performance data in this report are reliable and complete under the Office of Management and Budget (OMB) guidance. You can read about the operation of our internal controls in the Financial Section of this report, which also highlights key management assurances.

The CFTC worked hard during FY 2014 on behalf of the American public. The markets we oversee are stronger, more transparent, and more competitive as a result.

![]()

Timothy G. Massad

Chairman

November 14, 2014

Commission at a Glance

The Commission at a Glance presents a high-level summary of CFTC. See below for an overview of CFTC, why the Commission exists, how it operates, and the staff and resources during FY 2014.

-

Who We Are

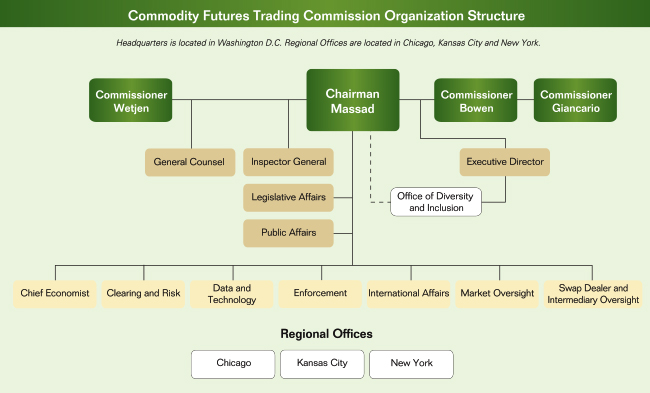

The Commission consists of five Commissioners. The President appoints and the Senate confirms the CFTC Commissioners to serve staggered five-year terms. No more than three sitting Commissioners may be from the same political party. With the advice and consent of the Senate, the President designates one of the Commissioners to serve as Chairman.

The Office of the Chairman oversees the Commission’s principal divisions and offices that administer and enforce the CEA and the regulations, policies, and guidance thereunder.

The Commission is organized largely along functional lines. The four divisions—the Division of Clearing and Risk (DCR), Division of Enforcement (DOE), Division of Market Oversight (DMO), and the Division of Swap Dealer and Intermediary Oversight (DSIO)—are supported by, a number of offices, including the Office of the Chief Economist (OCE), Office of Data and Technology (ODT), Office of the Executive Director (OED), Office of the General Counsel (OGC), and the Office of International Affairs (OIA). The Office of the Inspector General (OIG) is an independent office of the Commission.

The Dodd-Frank Act established the CFTC Customer Protection Fund (CPF) for the payment of awards to whistleblowers, through the whistleblower program, and the funding of customer education initiatives, designed to help customers protect themselves against fraud or other violations of the CEA or the rules or regulations thereunder. In 2012, the Commission established the Whistleblower Office (WBO) and the Office of Consumer Outreach (OCO) to administer the whistleblower and customer education programs.

The Commission is headquartered in Washington D.C. Regional offices are located in Chicago, Kansas City and New York. The CFTC organization chart is also located on the Commission’s website at http://www.cftc.gov.

-

Why We Exist

CFTC Mission

To protect market users and the public from fraud, manipulation, abusive practices and systemic risk related to derivatives that are subject to the Commodity Exchange Act, and to foster open, competitive, and financially sound markets.

The Commission administers the CEA, 7 U.S.C. section 1, et seq. The 1974 Act brought under Federal regulation futures trading in all goods, articles, services, rights and interests; commodity options trading; leverage trading in gold and silver bullion and coins; and otherwise strengthened the regulation of the commodity futures trading industry. The Commission’s mandate has been renewed and expanded several time since then, most recently by the 2010 Dodd-Frank Act.

Derivatives first began trading in the United States before the Civil War, when grain merchants came together and created this new marketplace. When the Commission was founded in 1974, the majority of derivatives trading consisted of futures trading in agricultural sector products. These contracts gave farmers, ranchers, distributors, and end-users of products ranging from corn to cattle an efficient and effective set of tools to hedge against price risk.

The Commission construes the definition of a futures contract broadly, but it is an agreement to purchase or sell a commodity for delivery in the future: 1) at a price that is determined at initiation of the contract; 2) that obligates each party to the contract to fulfill the contract at the specified price; 3) that is used to assume or shift price risk; and 4) that may be satisfied by delivery or offset. The CEA generally requires futures contracts to be traded on regulated exchanges, with futures trades cleared and settled with clearinghouses. To that end, futures contracts are standardized to facilitate exchange trading and clearing.

Although a futures contract agreement is set today, the person selling (for example, a farmer marketing bushels of wheat) will not receive payment and the buyer (in this case a bakery) will not receive goods purchased until the predetermined delivery date agreed to in the contract. The farmer benefits from this agreement because he is certain as to the amount of money he will earn from the farming operation, even if the price of wheat changes between today and November 1. Similarly, the bakery buying the wheat also benefits by knowing how much the wheat will cost on November 1 and it will be better positioned to estimate its baking costs and set prices for their products. Finally, even though the actual price of wheat on November 1 (when the contract is fulfilled) may be greater or less than the pricing in the November 1 contract, the price is fixed and both farmer and bakery are bound by the price agreed to when they entered into the agreement. Most futures contracts are not settled with the actual physical delivery of the commodity, but by the purchase of opposite (offsetting) futures contracts, which serve to close out the original positions, with profits or losses dependent on the direction in which the price of the contracts have moved relative to those positions.

Speculators may also buy or sell such futures contracts. The speculator buying a futures contract for November wheat believes the value of the wheat in November will be higher than the price he is paying for the contract today. As time passes, and November draws closer, people may try to estimate whether the cost of November wheat will rise or fall, and may cause the value of that futures contract to fluctuate. For example, if people expect there to be an especially bad harvest in November, then the price of November wheat will rise, and the speculator may sell that futures contract for November wheat for even more (or less) than he or she paid.

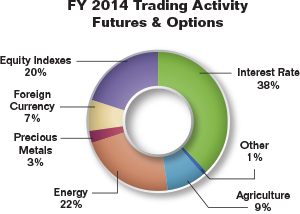

Over the years, the futures industry has become increasingly diversified. Highly complex financial contracts based on interest rates, foreign currencies, Treasury bonds, security indexes, and other products have far outgrown the agricultural contracts in trading volume.

Electronic integration of cross-border markets and firms, as well as cross-border alliances, mergers and other business activities have transformed the futures markets and firms into a global industry. With the passage of the Dodd-Frank Act, the Commission was tasked with bringing regulatory reform to the swaps marketplace. Swaps, which had not previously been regulated in the United States, formed a collective global trading market valued in trillions of dollars.

Generally speaking, a swap is an exchange of one asset or liability for a similar asset or liability for the purpose of, inter alia, shifting risks, where the value of those payments is determined in the future based on some previously agreed measure. With a swap, counterparties agree to exchange future cash flows at regular intervals, with each cash flow calculated on a different (previously agreed-upon) basis. Before the Dodd-Frank Act, swaps were, for the most part, traded over-the-counter (also called bilaterally), which means that swaps were not traded on regulated derivatives exchanges or cleared through clearinghouses. Swaps are tools for hedging risks associated with, among other things, interest rates, currency fluctuations, and the cost of energy products, such as oil and natural gas. The value of a swap is derived from the value of the underlying asset or rate that serves as the basis for each (or both) legs of the exchange.

For example, two people may agree to swap the cost of a fixed interest rate on a $100,000 mortgage for a variable interest rate on a $100,000 mortgage. Person A agrees to pay a fixed interest rate of five percent to Person B, every month for a year. In exchange, Person B agrees to pay Person A variable interest rate based on the prime rate (currently 3.25 percent) plus 1.75 percent. Because these two interest rates equal each other at the time the swap is agreed, neither person owes anything to the other. If, however, the prime rate rises, then Person B will owe more money to Person A. Thus, at the time the swap is agreed, Person A is assuming interest rates will rise, whereas Person B is hoping interest rates will fall.

In normal times, these markets create substantial, but largely unseen, benefits for American families. During the recent financial crisis, however, they created just the opposite. It was during the financial crisis that many Americans first heard the word derivatives. That was because over-the-counter swaps—a large, unregulated part of these otherwise strong markets—accelerated and intensified the crisis. The government was then required to take actions that today still stagger the imagination: for example, largely because of excessive swap risk, the government committed $182 billion to prevent the collapse of a single company—AIG—because its failure at that time, in those circumstances, could have caused our economy to fall into another Great Depression.

It is hard for most Americans to fathom how this could have happened. While derivatives were just one of many things that caused or contributed to the crisis, the structure of some of these products created significant risk in an economic downturn. In addition, the extensive, bilateral transactions between our largest banks and other institutions meant that trouble at one institution could cascade quickly through the financial system like a waterfall. And, the opaque nature of this market meant that regulators did not know what was going on or who was at risk.

Dodd-Frank Act: A New Regulatory Environment

On July 21, 2010, the Dodd-Frank Act was enacted and the CEA was amended to establish a comprehensive new regulatory framework to include swaps, as well as enhanced authorities over historically regulated entities.

The Dodd-Frank Act that was put in place agreed to do four basic things: 1) require regulatory oversight of the major market players; 2) require clearing of standardized transactions through regulated clearinghouses known as CCPs; 3) require more transparent trading of standardized transactions; and 4) require regular reporting so that market participants would have an accurate picture of what is going on in the market.

Oversight. The first of the major directives Congress gave to the CFTC was to create a framework for the registration and regulation of SDs and MSPs. The Commission has done this. As of September 2014, there are 104 SDs and two MSPs provisionally registered with the CFTC.

The Commission has adopted rules requiring strong risk management. The Commission will also be making periodic examinations to assess risk and compliance. The new framework requires registered SDs and MSPs to comply with various business conduct requirements. These include strong standards for documentation and confirmation of transactions, as well as dispute resolution processes. They include requirements to reduce risk of multiple transactions through what is known as portfolio reconciliation and portfolio compression. In addition, SDs are required to make sure their counterparties are eligible to enter into swaps, and to make appropriate disclosures to those counterparties of risks and conflicts of interest.

As directed by Congress, the Commission has worked with the U.S. Securities and Exchange Commission (SEC), other U.S. regulators, and its international counterparts to establish this framework. The Commission will continue to work with them to achieve as much consistency as possible. The Commission will also look to make sure these rules work to achieve their objectives, and fine-tune them as needed where they do not.

Clearing. A second commitment of the Dodd-Frank Act was to require clearing of standardized transactions at CCPs. Clearinghouses reduce the risk that one entity’s failure could adversely impact the public, by standing in between two parties to a transaction—as the buyer to every seller and the seller to every buyer—and maintaining financial resources to cover defaults. Clearinghouses value positions daily and require parties to post adequate margin on a regular basis. A “margin” is collateral that the holder of a financial instrument has to deposit to cover some or all of the credit risk of their counterparty (most often their broker or an exchange). The collateral can be in the form of cash or securities, and it is deposited in a margin account.

The use of CCPs in financial markets is commonplace and has been around for over one hundred years. The idea is simple: if many participants are trading standardized products on a regular basis, the tangled, hidden web created by thousands of private two-way trades can be replaced with a more transparent and orderly structure, like the spokes of a wheel, with the CCP at the center interacting with other market participants. The CCP monitors the overall risk and positions of each participant.

The CFTC was the first of the G-20 nations’ regulators to implement clearing mandates. The Commission has required clearing for interest rate swaps denominated in U.S. dollars, Euros, Pounds and Yen, as well as credit default swaps (CDS) on certain North American and European indices. Based on CFTC analysis of data reported to SDRs, as of August 2014, measured by notional value, 60 percent of all outstanding transactions were cleared. This is compared to estimates by the International Swaps and Derivatives Association (ISDA) of only 16 percent in December 2007. With regard to index CDS, most new transactions are being cleared—85 percent of notional value during the month of August.

The Commission’s rules for clearing swaps were patterned after the successful regulatory framework the Commission has had in place for many years in the futures market. The Commission does not require that clearing take place in the United States, even if the swap is in U.S. dollars and between U.S. persons. But the Commission does require that clearing occurs through registered CCPs that meet certain standards—a comprehensive set of core principles that ensures each clearinghouse is appropriately managing the risk of its members, and monitoring its members for compliance with important rules.

Of course, central clearing by itself is not a panacea. CCPs do not eliminate the risks inherent in the swaps market. The Commission must therefore be vigilant. The Commission must do all it can to ensure that CCPs have financial resources, risk management systems, settlement procedures, and all the necessary standards and safeguards consistent with the core principles to operate in a fair, transparent and efficient manner. The Commission must also make sure that CCP contingency planning is sufficient.

Trading. The third area for reform under the Dodd-Frank Act was to require more transparent trading of standardized products. In the Dodd-Frank Act, Congress provided that certain swaps must be traded on a swap execution facility (SEF) or other regulated exchange. The Dodd Frank Act defined a SEF as “a trading system or platform in which multiple participants have the ability to execute or trade swaps by accepting bids and offers made by multiple participants.” The trading requirement was designed to facilitate a more open, transparent and competitive marketplace, benefiting commercial end-users seeking to lock in a price or hedge risk.

The CFTC finalized its rules for SEFs in June 2013. Twenty-two SEFs have temporarily registered with the CFTC, and two applications are pending. These SEFs are diverse, but each will be required to operate in accordance with the same core principles. These core principles provide a framework that includes obligations to establish and enforce rules, as well as policies and procedures that enable transparent and efficient trading. SEFs must make trading information publicly available, put into place system safeguards, and maintain financial, operational and managerial resources to discharge their responsibilities.

Trading on SEFs began in October 2013. Beginning February 2014, specified interest rate swaps and credit default swaps must be traded on a SEF or other regulated exchange. Notional value executed on SEFs has generally been in excess of $1.5 trillion weekly. It is important to remember that trading of swaps on SEFs is still in its infancy. SEFs are still developing best practices under the new regulatory regime. The new technologies that SEF trading requires are likewise being refined. Additionally, other jurisdictions have not yet implemented trading mandates, which has slowed the development of cross-border platforms. There will be issues as SEF trading continues to mature. The Commission will need to work through these to fully achieve the goals of efficiency and transparency SEFs are meant to provide.

Data Reporting. The fourth Dodd-Frank Act reform commitment was to require ongoing reporting of swap activity. Having rules that require oversight, clearing, and transparent trading is not enough. The Commission must have an accurate, ongoing picture of what is going on in the marketplace to achieve greater transparency and to address potential systemic risk. Title VII of the Dodd-Frank Act assigns the responsibility for collecting and maintaining swap data to swap data repositories (SDRs), a new type of entity necessitated by these reforms. All swaps, whether cleared or uncleared, must be reported to SDRs. There are currently four SDRs that are provisionally registered with the CFTC.

The collection and public dissemination of swap data by SDRs helps regulators and the public. It provides regulators with information that can facilitate informed oversight and surveillance of the market and implementation of the Commission’s statutory responsibilities. Dissemination, especially in real-time, also provides the public with information that can contribute to price discovery and market efficiency. While the Commission has accomplished a lot, much work remains. The task of collecting and analyzing data concerning this marketplace requires intensely collaborative and technical work by industry and the Commission’s staff. Going forward, it must continue to be one of the Commission’s chief priorities.

There are three general areas of activity. The Commission must have data reporting rules and standards that are specific and clear, and that are harmonized as much as possible across jurisdictions. The CFTC is leading the international effort in this area. It is an enormous task that will take time. The Commission must also make sure the SDRs collect, maintain, and publicly disseminate data in the manner that supports effective market oversight and transparency. Finally, market participants must live up to their reporting obligations. Ultimately, they bear the responsibility to make sure that the data is accurate and reported promptly.

Guiding Principles

A few core principles must motivate the Commission’s work in implementing the Dodd-Frank Act. The first is that the Commission must never forget the cost of the financial crisis to American families, and it must do all it can to address the causes of that crisis in a responsible way. The second is that the United States has the best financial markets in the world. They are the strongest, most dynamic, most innovative, most competitive and transparent. They have been a significant engine of U.S. economic growth and prosperity. The Commission’s work should strengthen U.S. markets and enhance those qualities in a way that does not place unnecessary burdens on the dynamic and innovative capacity of the industry.

-

Industry Oversight—Marketplace

Marketplace Oversight

The purpose of the CEA is to serve the public interest through a system of effective regulation of trading facilities, clearing systems, market participants, and market professionals under the oversight of the Commission.

Growth in the futures and swaps marketplace carries an accompanying, potential increase of fraud for market users and the public. More entities, more markets and more products (including complex products) are subject to CFTC regulation than ever before. In response to the influx of new data from new and existing registrants, the Commission is building its own infrastructure and analytical capabilities to support its responsibilities as a first line regulator.

1 In 2013, the CFTC began publishing weekly and semi-annual swaps reports. The 2014 estimates are based on data from SDRs reported in the swaps reports. The CFTC Swaps Reports currently include only interest rates and credit, but the Commission expects to include additional asset classes in the near future. The CFTC Swaps Report currently incorporates data from four SDRs; however data from additional SDRs could be incorporated in the future. (back to text)

-

Industry Oversight—Clearing

Lowering Risk and Promoting Access

Clearinghouses reduce the risk that one entity’s failure could adversely impact the public, by standing in between two parties to a transaction—as the buyer to every seller and the seller to every buyer—and maintaining financial resources to cover defaults. Clearinghouses value positions daily and require parties to post adequate margin on a regular basis. Clearing also fosters access for the broad market as it ensures that each individual participant does not have to be concerned about its counterparty’s credit-worthiness circumstances.

Clearing has existed in the United States since the 1880s. Clearing through a CCP lowers risk to the market and promotes competition in and broadens access to the market by eliminating the need for market participants to individually determine counterparty credit risk, as now clearinghouses stand between buyers and sellers. The Commission oversees the clearing of futures, options, options on futures, and swaps by DCOs, and it oversees other market participants that may pose a risk to the clearing process including FCMs, SDs, MSPs, and large traders.

FY 2014 Regulated Entities Trading Entities Designated Contract Market (DCM) 15 Swap Execution Facility (SEF) 22 Clearing Entities Derivatives Clearing Organization (DCO) 15 Clearing Members 191 Systemically Important DCO (SIDCO) 2 Data Repositories Swap Data Repository (SDR) 4 Registrants Futures Commission Merchant (FCM) 78 Swap Dealer (SD) 104 Major Swap Participant (MSP) 2 Retail Foreign Exchange Dealer (RFED) 7 Commodity Trading Advisor (CTA) 2,525 Commodity Pool Operator (CPO) 1,774 Introducing Broker (IB) 1,359 Floor Broker (FB) 4,433 Floor Trader (FT) 813 Associated Person (AP) 57,578

-

Industry Oversight—Enforcement

Protecting Market Users and the Public

The Commission investigates and prosecutes alleged violations of the CEA and Commission regulations. The Commission takes enforcement actions against individuals and firms registered with the Commission, those who are engaged in commodity futures, option and swaps trading on designated domestic exchanges, and those who improperly market futures, option and swaps contracts.

The Commission protects market participants and other members of the public from fraud, manipulation and other abusive practices in the commodities, futures and swaps markets. Its cases range from quick strike actions against Ponzi enterprises that victimize investors across the country, to sophisticated manipulative and disruptive trading schemes in markets the Commission regulates including financial instruments, oil, gas, precious metals and agricultural goods.

-

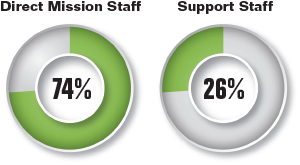

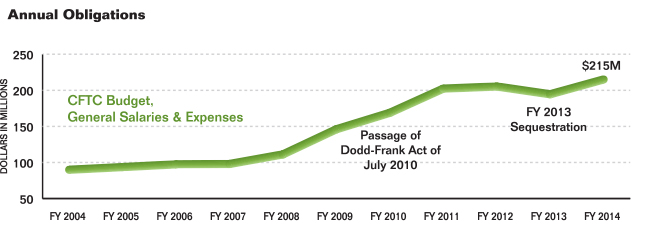

Our People

Collectively, the Commission employs 665 full-time permanent employees that comprise 491 direct mission staff (attorneys, economists, auditors, risk and trade analysts, and other financial specialists) and 174 management and support staff to accomplish five strategic goals and nine key mission activities in the regulation of commodity futures, options, and swaps.

Personnel by Position Type2

Among the full-time personnel, the majority of Commission staff is analytical professionals with strong academic records and specialized skills in the commodities industry.

Attorneys across the CFTC’s divisions and offices represent the Commission in administrative and civil proceedings, assist U.S. Attorneys in criminal proceedings involving violations of the CEA, develop regulations and policies governing clearinghouses, exchanges and intermediaries, and monitor compliance with applicable rules.

Auditors, Investigators, Risk Analysts, and Trade Practice Analysts examine records and operations of derivatives exchanges, clearinghouses, and intermediaries for compliance with the provisions of the CEA and the Commission’s regulations.

Economists and Data Analysts monitor trading activities and price relationships in derivatives markets to detect and deter price manipulation and other potential market disruptions. Economists also analyze the economic effect of various Commission and industry actions and events, evaluate policy issues and advise the Commission accordingly.

Management Professionals support the CFTC mission by performing strategic planning, information technology, human resources, staffing, training, accounting, budgeting, contracting, procurement, and other management operations.

2 Includes five full-time permanent employees in the Consumer Outreach and Whistleblower Offices. The Consumer Outreach and Whistleblower Offices are funded by the CFTC Customer Protection Fund, a revolving fund, established under Section 748 of the Dodd-Frank Act. (back to text)

-

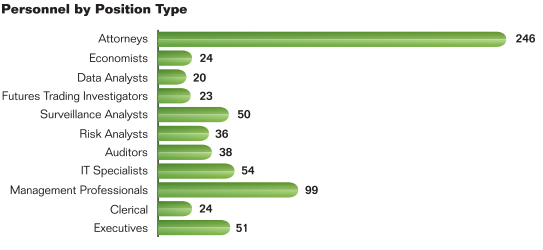

Our Resources

FY 2014 CFTC Budgetary Resources

FY 2014

CFTC Customer Protection Fund:

$274.9 MillionThe CFTC CPF is a revolving fund established under Section 748 of the Dodd-Frank Act for the payment of awards to whistleblowers, through the whistleblower program, and the funding of customer education initiatives designed to help customers protect themselves against fraud or other violations of the CEA or the rules or regulations thereunder.

FY 2014

CFTC Appropriation:

$215.0 MillionAppropriations for the CFTC fund the annual salaries and expenses of the agency. A portion of the appropriation is earmarked by Congress for IT investments and for the Office of the Inspector General.

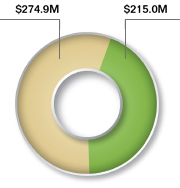

Summary of CFTC Appropriations

10-Year Appropriation Trends

The following graph shows trending data for appropriated funding from FY 2004 to FY 2014.

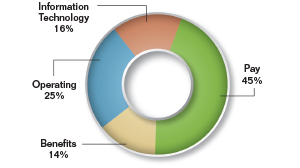

Breakout of FY 2014 Obligations by Fund Type

Personnel costs were 59 percent of the Commission’s total obligations in FY 2014. The Commission obligated 16 percent for information technology investments.

Summary of CFTC Customer Protection Fund Obligations

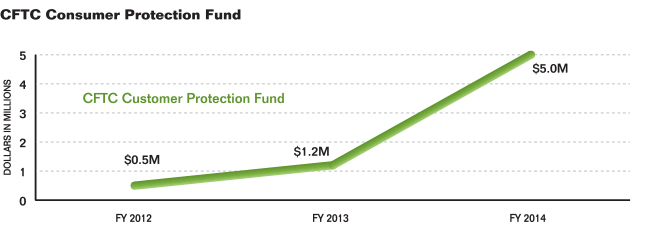

3-Year Obligation Trends (Revolving Fund)

The CFTC CPF is a revolving fund established under Section 748 of the Dodd-Frank Act for the payment of awards to whistleblowers and the funding of customer education initiatives designed to help customers protect themselves against fraud or other violations of this Act, or the rules and regulations thereunder.

The following graph shows trending data for total obligations from FY 2012 to FY 2014. The Whistleblower and Customer Outreach Offices were established in FY 2011 and began operating in FY 2012. In FY 2014, the Commission made its first award to a whistleblower for providing valuable information about violations of the CEA.

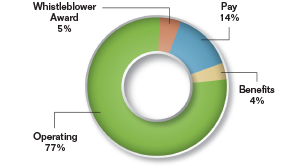

Breakout of FY 2014 Obligations by Fund Type

The chart to the right shows the CFTC CPF total obligations for FY 2014.

Performance Highlights

The Performance Highlights present a high-level summary of CFTC's FY 2014 performance. See below for a summary of performance results, overview of the Strategic Plan, five strategic goals, as well as the tactical goal for Dodd-Frank Act rule making.

-

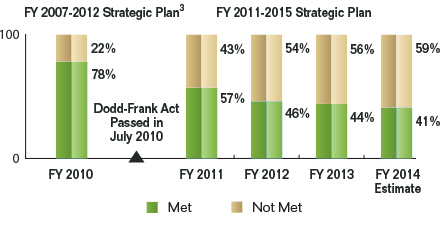

Summary of Performance Results

The bar graph to the right presents the ratings distribution for performance results reported from FYs 2010 through 2014. Preliminary results for FY 2014 indicate that the Commission met 41 percent of its performance targets. This represents a three percent decrease over FY 2013. Performance targets were set in FY 2011 in light of the expanded responsibilities given to the Commission under the Dodd-Frank Act.

3 Expired performance measures were under the FY 2007-2012 Strategic Plan.(back to text)

-

Strategic Plan Overview

FY 2011 – 2015 Strategic Goals Goal 1 Protect the public and market participants by ensuring market integrity, promoting transparency, competition and fairness and lowering risk in the system. Goal 2 Protect the public and market participants by ensuring the financial integrity of derivatives transactions, mitigation of systemic risk, and the fitness and soundness of intermediaries and other registrants. Goal 3 Protect the public and market participants through a robust enforcement program. Goal 4 Enhance integrity of U.S. markets by engaging in cross-border cooperation, promoting strong international regulatory standards, and encouraging ongoing convergence of laws and regulation worldwide. Goal 5 Promote Commission excellence through executive direction and leadership, organizational and individual performance management, and effective management of resources. The FY 2011 - 2015 Strategic Plan, released in February 2011, incorporated the Dodd-Frank Act, which gave CFTC unprecedented oversight responsibility of the swaps marketplace. This new responsibility expanded CFTC’s mission of ensuring the fair, open, and efficient functioning of the futures market and represents approximately an eight times growth to the CFTC’s regulatory portfolio. The FY 2011 - 2015 Strategic Plan addressed the regulation of swaps and the resource growth accompanied with this new mission.

-

Strategic Goals and Key Results

The following section includes a high-level discussion of each of the five strategic goals, as well as a tactical goal for Dodd-Frank Act rule making, and the related key results. The CFTC has largely moved beyond rule writing and initial compliance dates and is now focused on registering entities and ensuring they fully comply with relevant regulations.

The selected accomplishments described below demonstrate progress made in FY 2014 toward the achievement of the Commission’s mission and strategic goals. Progress continues to be hampered due to limited resources being allocated across existing authorities and new Dodd-Frank Act authorities. A new Strategic Plan spanning FY 2014 to FY 2018 will be introduced starting in the FY 2015 performance cycle and will contain a new set of performance goals. In order to provide better and more frequent assessments to leadership, the CFTC plans to monitor and analyze the progress of these performance goals on a quarterly basis.

The Commission’s FY 2014 APR, to be issued in February 2015 as part of its Congressional Budget Justification in conjunction with the President’s Budget, will present more detailed analysis of the following performance results.

-

Objective 0.1 Financial Reform Legislation

The focused rule writing effort required by the Dodd-Frank Act is a tactical goal that has an Objective, Strategy and Performance Measure. Where proposed and interim final rules have been issued, the Commission continues to afford as much opportunity as practicable for public comment both through written submissions and through public meetings. The Commission fully considers the comments and continues to offer this opportunity as additional proposed rules are developed. The CFTC has and will continue to work with the SEC and other regulators to maximize consistency, minimize overlap or duplication, and develop the best possible final rules.

Objective 0.1 Key Results

The Dodd-Frank Act set a timeframe of 360 days (or less in a few instances) for completion of the rules. The Dodd-Frank Act was signed by the President on July 21, 2010, making July 16, 2011, the target date for completion of all the rules. While the Commission has completed the majority of rules required under the Dodd-Frank Act, a few remain to be finalized. The Commission actively seeks and takes into full consideration public comments regarding the costs, benefits, and economic effects of proposed rules. Given the significance of the rules and heightened public interest and participation in the rulemaking, it takes substantial time and resources to get to final Commission action on a rule. Several other variables often contribute to a longer process.

- To ensure development and implementation of rules that are well balanced between risk mitigation and cost to the industry and public, additional meetings and opportunities for public input with Congress, industry, and the public are often necessary and appropriate; and

- While some rules are fairly straight forward, many are intricate and raise interrelated and complex issues. Staff members require the appropriate time to analyze, summarize, and consider the additional public input that has been sought, and develop draft final rules for deliberation by the Commission.

Despite the above challenges, the Commission has achieved the following record of Dodd-Frank Act related rulemaking through September 30, 2014:

- Issued 74 proposed rules and issued 64 final rules;

- Received, reviewed, and analyzed approximately 36,000 comments; and

- Held 16 technical conferences/roundtables.

-

Strategic Goal One – Market Integrity

2014 Accomplishments

- Completed and began implementing the rules providing registration and operation requirements for SEFs that became effective on May 16, 2013, and provisionally registered 22 SEFs by May 9, 2014.

- Completed reviews of 80 new product certifications, nine exempt market filings, 932 rule filings, 24 foreign security index certifications, and one FBOT no-action request.

- Finalized the Volcker Rule with the Federal Reserve Board, Office of the Comptroller of the Currency, Federal Deposit Insurance Corporations, and SEC, and developed the data base systems and worked with the other agencies and banking entities to prepare for and begin receiving the required Volcker reporting metrics data in a standardized format.

-

Strategic Goal Two – Clearing Integrity

2014 Accomplishments

- Completed annual examinations of systemically important DCOs where the Commission has been named the Supervisory Agency. The Commission selected the system safeguards core principle, with an emphasis on information security, for one systemically important DCO examination and selected seven core principles for the second examination.

- Adopted new regulations and amended existing regulations to require enhanced customer protections, risk management programs, internal monitoring and controls, capital and liquidity standards, customer disclosures, and auditing and examination programs for futures commission merchants.

- Issued proposed rules that would set margin requirements for uncleared swaps, on September 17, 2014. The rules are very similar to international standards that were issued in September 2013 and to rules that were recently proposed by the U.S. prudential regulators.

-

Strategic Goal Three – Robust Enforcement

2014 Accomplishments

- Filed 67 new enforcement actions and opened more than 240 new investigations in FY 2014. In addition, the Commission obtained more than $3.27 billion in sanctions, including orders imposing more than $1.8 billion in civil monetary penalties and more than $1.4 billion in restitution and disgorgement.

- Continued to investigate whether certain banks and interdealer brokers have manipulated or attempted to manipulate or made false reports concerning global benchmark interest rates, including LIBOR. To date, the Commission has filed and settled five actions, against Barclays, UBS, RBS, Rabobank and ICAP imposing penalties of nearly $1.8 billion.

- Won on a liability verdict after trial against a major off-exchange metals company on fraud charges in connection with financed transactions in precious metals that resulted in millions of dollars in customer losses. Along with the other precious metals cases, this action was a prime example of how the Commission is using its new authority under the Dodd-Frank Act to pursue wrong-doers who prey on investors looking to make investments in commodities like gold and silver.

-

Strategic Goal Four – Cross-Border Cooperation

2014 Accomplishments

- Worked with international authorities with responsibility for the regulation of the OTC derivatives markets in major market jurisdictions to support the adoption and enforcement of rigorous and consistent standards, develop concrete and practical solutions to conflicting application of rules, and identify inconsistent or duplicative requirements.

- Worked throughout the year with foreign authorities, including the European Commission, European Securities Market Authority, and other foreign regulators to coordinate policies that will be needed to implement final Commission Dodd-Frank rules for market infrastructure and participants (e.g., with regard to SDRs, SDs, DCOs, and SEFs).

-

Strategic Goal Five – Organizational and Management Excellence

2014 Accomplishments

- Upgraded its core financial system in FY 2014. The upgrade provides for stronger validation rules, improved functionality, and improved system integration. The result is better oversight and safeguard of taxpayer resources and improved accountability.

- Broadened the privacy threshold analysis process to alert the Program Leaders about anticipated data collections, new technologies, or changes to technology that may raise information governance risks, e.g., privacy, records, e-discovery, Freedom of Information Act, legal or human resources risks. This new “InfoGov Questionnaire” process is working well, and the Program Leaders have provided feedback on over a dozen projects to minimize the risk to the CFTC.

- Successfully completed all planned FY 2014 business continuity test activities. Audio analytics enhancements provide enforcement staff with expanded metadata searching capabilities, expanded file tagging capabilities, and more efficient file handling.

Financial Highlights

The Financial Highlights present a high-level summary of CFTC's FY 2014 financials. See below for the message from the Chief Financial Officer and other financial highlights including an overview of the financial statements.

-

A Message from the Chief Financial Officer

I am honored to join Chairman Massad in presenting the FY 2014 Agency Financial Report (AFR) for the Commodity Futures Trading Commission (CFTC or Commission). This report provides financial and high-level performance information to the American taxpayer and the Commission’s stakeholders to enable them to understand and evaluate how the Commission accomplishes its mission. This Financial Section includes the Commission’s principal financial statements—Balance Sheets, Statements of Net Cost, Statements of Changes in Net Position, Statements of Budgetary Resources, and Statements of Custodial Activity—as well as accompanying notes that are integral to fully understanding the Commission’s position and operations for FY 2014.

I am pleased to report that our independent auditor, KPMG LLP, on behalf of the Commission’s Office of the Inspector General, has issued an unmodified or “clean” opinion on our financial statements for FY 2014. This means that the Commission’s financial statements are presented fairly, in all material respects, and are in conformity with generally accepted accounting principles (GAAP). This year, the Commission received no audit findings, and for the eighth consecutive year had no material weaknesses in internal controls; this means that neither the Commission nor its auditors have identified a deficiency, or a combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected, on a timely basis.

Since FY 2007, the CFTC has leveraged a financial management systems platform operated by the U.S. Department of Transportation’s (DOT) Enterprise Services Center (ESC), an Office of Management and Budget (OMB) designated financial management service provider. As a result, the CFTC is able to accumulate, analyze, and present reliable financial information, and provide reliable, timely information for managing current operations and timely reporting of financial information to central agencies. In FY 2014, ESC upgraded the financial management system (DELPHI), resulting in improved functionality and controls. The Commission’s financial management systems strategy for FY 2015 includes continued monitoring and oversight of the financial management system operated by its shared service provider; no major upgrades are planned for the near future. DELPHI is in substantial compliance with the Federal Financial Management Improvement Act (FFMIA) of 1996 (although CFTC is not required to comply with FFMIA, it has so elected).

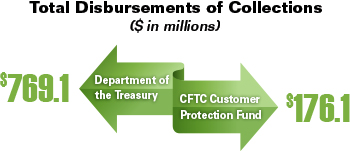

The Commission requested a Government Accountability Office (GAO) opinion regarding the availability of certain collections to the CFTC Customer Protection Fund (CPF). In response, GAO issued a decision (Decision B-324469 – U.S. Commodity Futures Trading Commission—Customer Protection Fund) indicating that collections that are eligible to be deposited in the CPF should be kept intact and deposited in full into the fund as long as the fund balance is below $100 million at the time of collection. As a result, as reported in Note 1V to the financial statements, the Commission recovered $176.1 million from the U.S. Department of the Treasury (Treasury) in the third quarter of FY 2014 and transferred the full amount into the CPF. The balance in the CPF as of September 30, 2014, now reflects the balance of the Fund as if the full $200 million collection received in FY 2012 had been transferred into the Fund at that time. This collection significantly increased the Commission’s net position for FY 2014. These funds have been invested and are reserved for expenses of the Commission’s Whistleblower and Consumer Outreach offices, including payments to eligible whistleblowers.

In response to another FY 2014 GAO decision related to CFTC’s ability to transfer funds from the Information Technology fund to the Salaries and Expense fund in FY 2013 (Decision B-325351 – Commodity Futures Trading Commission—Fiscal Year 2013 Transfer Authority), the CFTC will be submitting a report to the President and the Congress on an Anti-deficiency Act (ADA) violation. In its decision, GAO concluded that the Consolidated and Further Continuing Appropriations Act, 2013 (P.L. 113-6) did not carry forward certain transfer authority provisions that had been available to the CFTC during the first Continuing Resolution, Continuing Appropriations of 2013, (P.L. 112-175). The CFTC had effected a transfer in FY 2013 after the passage of P.L. 113-6 and the reversal of this transaction resulted in the ADA violation. This violation was not a result of internal controls deficiencies, and the system of administrative controls in place at the CFTC is operating effectively to ensure that funds are expended as authorized and apportioned under normal circumstances.

We are pleased with our FY 2014 results and will continue to focus efforts to improve the efficiency and effectiveness of agency operations and strive to ensure that the Commission will be well-positioned to respond to additional challenges as they arise.

Mary Jean Buhler

Chief Financial Officer

November 14, 2014 -

Summary of Audit and Management Assurances

Summary of FY 2014 Financial Statement Audit

Summary of Financial Statement Audit Audit Opinion: Unmodified Restatement: No Material Weakness Beginning Balance New Resolved Consolidated Ending Balance 0 0 0 Summary of Management Assurances

Effectiveness of Internal Control over Financial Reporting (FMFIA § 2) Statement of Assurance: Unqualified Material Weakness Beginning Balance New Resolved Consolidated Reassessed Ending Balance 0 0 0 Effectiveness of Internal Control over Operations (FMFIA § 2) Statement of Assurance: Unqualified Material Weakness Beginning Balance New Resolved Consolidated Reassessed Ending Balance 0 0 0 Conformance with Financial Management System Requirements (FMFIA § 4) Statement of Assurance: Systems conform to financial management system requirements Non-Conformance Beginning Balance New Resolved Consolidated Reassessed Ending Balance 0 0 0 Compliance with Federal Financial Management Improvement Act (FFMIA) Agency Auditor 1. System Requirements No noncompliance noted No noncompliance noted 2. Accounting Standards No noncompliance noted No noncompliance noted 3. USSGL at Transaction Level No noncompliance noted No noncompliance noted -

5-Year Financial Summary

The table below presents trend information for each major component of the Commission’s balance sheets and statements of net cost for FY 2010 through FY 2014. The table is immediately followed by a discussion and analysis of the Commission’s major financial highlights for FY 2014.

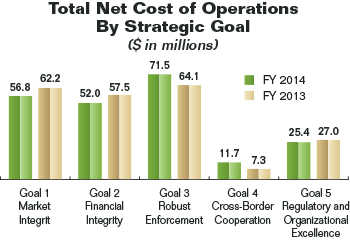

CFTC Financial Highlights Highlights 2014 2013 2012 2011 2010 Condensed Balance Sheet Data Fund Balance with Treasury $47,070,343 $36,467,970 $82,557,690 $81,785,717 $44,321,898 Investments 270,000,000 95,000,000 77,135,901 – – Accounts Receivable 11,112 13,252 20,976 59,226 4,836 Prepayments 1,712,871 1,541,681 1,803,497 1,109,626 641,957 Custodial Receivables, Net 4,218,788 69,744,626 4,140,347 2,574,173 2,319,934 General Property, Plant, and Equipment, Net 54,464,549 58,251,172 53,410,435 42,346,895 25,203,787 Deferred Costs 64,201 220,953 1,234,223 6,254,873 6,303,367 TOTAL ASSETS $377,541,864 $261,239,654 $220,303,069 $134,130,510 $78,795,779 Accounts Payable $5,483,221 $5,092,410 $7,217,772 $7,092,349 $7,650,033 FECA Liabilities 549,734 596,353 764,243 528,512 256,801 Accrued Payroll and Annual Leave 13,007,491 11,651,586 16,477,676 15,464,338 14,460,136 Custodial Liabilities 4,218,788 69,744,626 4,140,347 2,574,173 2,319,934 Depost Fund Liabilities 134,683 83,997 77,098 57,127 22,226 Deferred Lease Liabilities 25,961,973 25,241,114 24,808,042 21,974,782 12,174,352 Contingent Liabilities 85,000 – – – – Other 11,699 19,600 19,050 19,649 7,226 TOTAL LIABILITIES $49,452,589 $112,429,686 $53,504,228 $47,710,930 $36,890,708 Unexpended Appropriations – All Other Funds 35,420,980 25,006,039 46,349,473 44,666,156 30,449,492 Cumulative Results of Operations – Funds from Dedicated Collections 274,315,312 99,904,291 99,996,749 23,755,000 – Cumulative Results of Operations – All Other Funds 18,352,983 23,899,638 20,452,619 17,998,424 11,455,579 Total Net Position 328,089,275 148,809,968 166,798,841 86,419,580 41,905,071 TOTAL LIABILITIES AND NET POSITION $377,541,864 $261,239,654 $220,303,069 $134,130,510 $78,795,779 Condensed Statements of Net Cost Gross Costs $217,450,008 $218,155,538 $207,618,265 $187,648,360 $169,540,777 Earned Revenue (31,375) (49,483) (227,504) (88,720) (71,840) TOTAL NET COST OF OPERATIONS $217,418,633 $218,106,055 $207,390,761 $187,559,640 $169,468,937 Net Cost of Operations by Strategic Goal Goal One – Market Integrity $56,746,263 $62,225,658 $59,168,584 $48,390,387 $43,172,212 Goal Two – Clearing Integrity 51,963,054 57,470,946 54,647,465 43,701,396 39,081,231 Goal Three – Robust Enforcement 71,530,730 64,123,179 60,972,883 61,144,442 54,902,851 Goal Four – Cross-Border Cooperation 11,740,606 7,306,553 6,947,591 8,440,184 7,488,832 Goal Five – Organizational and Management Excellence 25,437,980 26,979,719 25,654,238 25,883,231 24,823,811 $217,418,633 $218,106,055 $207,390,761 $187,559,640 $169,468,937 -

Financial Discussion and Analysis

The CFTC prepares annual financial statements in accordance with U.S. generally accepted accounting principles (GAAP) for Federal government entities and subjects the statements to an independent audit to ensure their integrity and reliability in assessing performance.

Management recognizes the need for performance and accountability reporting, and regularly assesses risk factors that could have an impact on the Commission’s ability to effectively report. Improved reporting enables managers to be accountable and supports the concepts of the Government Performance and Results Act (GPRA), which requires the Commission to: 1) establish a strategic plan with programmatic goals and objectives; 2) develop appropriate measurement indicators; and 3) measure performance in achieving those goals.

The financial summary as shown on the preceding page highlights changes in financial position between September 30, 2014, and September 30, 2013. This overview is supplemented with brief descriptions of the nature of each required financial statement and its relevance. Certain significant balances or conditions featured in the graphic presentation are explained in these sections to help clarify their relationship to Commission operations. Readers are encouraged to gain a deeper understanding by reviewing the Commission’s financial statements and notes to the accompanying audit report presented in the Financial Section of this report.

-

Understanding the Financial Statements

The CFTC presents financial statements and notes in the format required for the current year by OMB Circular A-136, Financial Reporting Requirements, which is revised annually by OMB in coordination with the U.S. Chief Financial Officers Council. The CFTC’s current year and prior year financial statements and notes are presented in a comparative format.

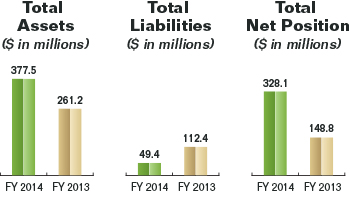

The chart below presents changes in key financial statement line items, as of and for, the fiscal year ended September 30, 2014, compared to September 30, 2013.

Changes in Key Financial Statement Line Items Key Financial Statement Line Items 2014 2013 $ Change % Change Total Assets $377,541,864 $261,239,654 $116,302,210 44.52% Total Liabilities $49,452,589 $112,429,686 $(62,977,097) (56.01)% Total Net Position $328,089,275 $148,809,968 $179,279,307 120.48% Transfers-In/Out Without Reimbursement $176,110,604 $817,435 $175,293,169 21,444.29% Spending Authority from Offsetting Collections $176,261,959 $440,453 $175,821,506 39,918.34% Total Budgetary Resources $496,899,396 $308,237,483 $188,661,913 61.21% Apportioned $29,637,561 $13,847,564 $15,789,997 114.03% Unapportioned $245,911,560 $91,120,922 $154,790,638 169.87% Gross Outlays $(204,693,512) $(223,042,111) $18,348,599 (8.23)% Actual Offsetting Collections $(176,466,655) $(1,066,145) $(175,400,510) 16,451.84% Custodial Receivables/Liabilities $4,218,788 $69,677,626 $(65,525,838) (93.95)% -

Balance Sheet

The Balance Sheet presents, as of a specific point in time, the economic value of assets and liabilities retained or managed by the Commission. The difference between assets and liabilities represents the net position of the Commission.

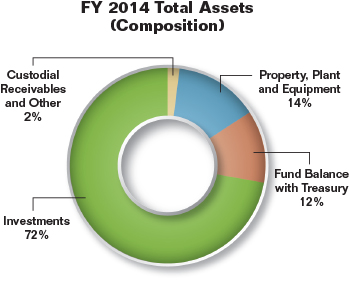

Total Assets. For the year ended September 30, 2014, the Balance Sheet reflects total assets of $377.5 million. This is an increase of $116.3 million, or 44.5 percent, over FY 2013. The increase is primarily due to a $175.0 million increase in Investments and a $10.6 million increase in Fund Balance With Treasury, offset by a $65.5 million decrease in Custodial Receivables and a $3.8 million decrease in Property, Plant, and Equipment.

CFTC began investing funds in the CFTC Customer Protection Fund (CPF) in overnight short-term Treasury securities in FY 2012. The $175.0 million, or 184.2 percent, increase in Investments occurred when an additional $175.0 million was invested in the fourth quarter of FY 2014 as the result of a $176.1 million recovery from the Treasury at the end of the third quarter of FY 2014. This money was recovered after the Government Accountability Office (GAO) issued a formal decision in FY 2014 (B-324469) that collections of civil monetary sanctions should be kept intact and deposited in full into the CPF as long as the CPF fund balance is below $100 million at the time of collection. This FY 2014 recovery was transferred to the CPF, and $175.0 million was subsequently invested. The balance of the CPF as of September 30, 2014, now reflects the balance as if the full $200 million civil monetary sanctions collection received from Barclays in FY 2012 had been transferred into the CPF at that time.

The $10.6 million, or 29.1 percent, increase in Fund Balance With Treasury was primarily due to the excess of appropriations of $215 million over gross outlays of $204.7 million.

The $65.5 million, or 94.0 percent, decrease in Custodial Receivables was the direct result of a $65 million custodial receivable that was established in September 2013 for a LIBOR-related enforcement action against ICAP Europe Limited and subsequently collected in October 2013.

The $3.8 million, or 6.5 percent, decrease in Property, Plant, and Equipment is due to a loss on the disposal of fixed assets of $1.1 million and accumulated depreciation and amortization of fixed assets of $14.2 million in excess of fixed asset purchases of $10.5 million.

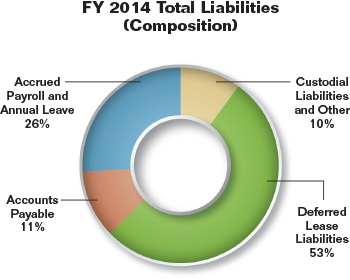

Total Liabilities: For the year ended September 30, 2014, the Balance Sheet reflects total liabilities of $49.4 million. This is a decrease of $63.0 million, or 56.0 percent, over FY 2013. The decrease is primarily due to a $65.5 million decrease in Custodial Liabilities offset by a $1.3 million increase in Accrued Payroll and Annual Leave, a $721 thousand increase in Deferred Lease Liabilities, and a $472 thousand increase in remaining liabilities.

The $4.2 million in Custodial Liabilities as of September 30, 2014, represents a $65.5 million, or 94.0 percent, decrease over FY 2013 primarily due to the collection of the related receivable for ICAP Europe Limited discussed above.

The $1.3 million, or 11.6 percent, increase in Accrued Payroll and Annual Leave is due to one additional workday accrued in the year-end payroll accrual coupled with increased annual leave balances, on average of 12 hours, per employee. This increase was expected, as the Commission provided leave awards in lieu of salary increases in FY 2013; as a result, employees used the awarded leave instead of using accrued leave.

The Commission enters into long-term commercial leases for its headquarters and regional offices. These leasing arrangements allow for the deferral of monthly rent payments to future periods as well as provide for landlord contributions to space renovations and other rent abatements. In order to recognize rent expense in line with the utility of its office space, the Commission records the amount of expense in excess of actual payments to date as Deferred Lease Liabilities on the Balance Sheet. The $721 thousand, or 2.9 percent, increase in Deferred Lease Liabilities is primarily due to two additional rent abatements received by the Commission in FY 2014.

Additionally, a $391 thousand, or 7.7 percent, increase in amounts accrued for Accounts Payable at year-end, and an $85 thousand contingent liability, make up the majority of the remaining change in CFTC liabilities.

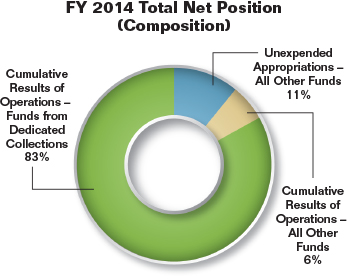

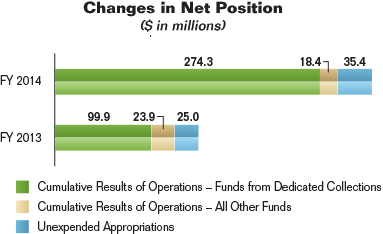

Total Net Position: For the year ended September 30, 2014, the Balance Sheet reflects a total net position of $328.1 million. This is an increase of $179.3 million, or 120.5 percent, over FY 2013. The increase is primarily due to a $174.4 million increase in Cumulative Results of Operations—Funds from Dedicated Collections and a $10.4 million increase in Unexpended Appropriations—All Other Funds, offset by a $5.5 million decrease in Cumulative Results of Operations—All Other Funds.

The $174.4 million, or 174.6 percent, increase in Cumulative Results of Operations—Funds from Dedicated Collections is primarily due to the $176.1 million civil monetary sanctions collection recovered from Treasury in the third quarter of FY 2014 and transferred into the CPF, offset by FY 2014 CPF expenses of $1.7 million.

The $10.4 million, or 41.7 percent, increase in Unexpended Appropriations—All Other Funds is primarily due to FY 2014 appropriations in excess of net outlays (i.e., more cash coming in than going out due to the timing of actual payments).

The $5.5 million, or 23.2 percent, decrease in Cumulative Results of Operations – All Other Funds is primarily due to an increase in unfunded liabilities of $882 thousand (e.g., accruals for annual leave and Federal Employees’ Compensation Act expenses and contingent liabilities), net disposal of fixed assets of $1.1 million, and accumulated depreciation and amortization of fixed assets of $14.2 million in excess of fixed asset purchases of $10.5 million.

-

Statement of Net Cost

This statement is designed to present the components of the Commission’s net cost of operations. Net cost is the gross cost incurred less any revenues earned from Commission activities. The Commission experienced a 0.3 percent decrease in the total net cost of operations during FY 2014.

The Statement of Net Cost is categorized by the Commission’s five strategic goals:

- Strategic Goal One, which tracks activities related to ensuring market integrity; promoting transparency, competition and fairness; and lowering risk, continues to require a significant share of Commission resources at 26.1 percent of total net cost of operations in FY 2014. The $56.8 million net cost of operations reflects a continuation of management’s effort to address market volatility.

- Strategic Goal Two is representative of efforts to protect market participants and the public by ensuring the financial integrity of derivatives transactions, mitigation of systemic risk, and the fitness and soundness of intermediaries and other registrants. In FY 2014, the net cost of operations for this goal was $52.0 million or 23.9 percent of total net cost of operations. The funding for this goal is primarily to support new and ongoing investigations in response to market activity. Investigations into crude oil and related derivative contracts, and suspected Ponzi schemes have been extremely resource intensive.

- Strategic Goal Three is representative of efforts to protect the public and market participants through a robust enforcement program. In FY 2014, the net cost of operations for this goal was $71.5 million, or 32.9 percent of total net cost of operations, reflecting the Commission’s continued efforts to develop concrete measures that will bring transparency, openness and competition to the swaps markets while lowering the risk they pose to the American public.

- Strategic Goal Four is representative of efforts to increase cross-border cooperation, promote strong international regulatory standards, and encourage ongoing convergence of laws and regulations worldwide. In FY 2014, the net cost of operations for this goal was $11.7 million, or 5.4 percent of total net cost of operations. The CFTC is continuing to expand its cross-border presence through cooperative agreements and active participation on international standards-setting organization committees.

- Strategic Goal Five is representative of efforts to achieve organizational excellence and accountability. Included in this goal are the efforts of the Chairman, Commissioners, and related staff to ensure more transparency in the commodity markets, and lay the groundwork for the future. Additionally, these costs are reflective of the planning and execution of human capital, financial management, and technology initiatives. In FY 2014, the net cost of operations for this goal was $25.4 million, or 11.7 percent of total net cost of operations.

-

Statement of Changes in Net Position

The Statement of Changes in Net Position presents the Commission’s cumulative net results of operation and unexpended appropriations for the fiscal year. The CFTC’s Net Position increased by $179.3 million, or 120.5 percent in FY 2014. The increase is attributed to an increase in Cumulative Results of Operations—Funds from Dedicated Collections of $174.4 million, or 174.6 percent, and an increase in Total Unexpended Appropriations—All Other Funds of $10.4 million, or 41.7 percent, partially offset by an increase in Total Cumulative Results of Operations—All Other Funds of $5.5 million, or 23.2 percent.

As explained in the Total Net Position discussion in the Balance Sheet section above, the $174.4 million, or 174.6 percent, increase in Cumulative Results of Operations—Funds from Dedicated Collections is primarily due to the $176.1 million civil monetary sanctions collection recovered from Treasury in the third quarter of FY 2014 and transferred into the CPF (Transfers-In/Out Without Reimbursement), offset by FY 2014 CPF expenses of $1.7 million.

The $10.4 million, or 41.7 percent, increase in Unexpended Appropriations—All Other Funds is primarily due to FY 2014 appropriations in excess of net outlays due to the timing of actual cash payments.

The $5.5 million, or 23.2 percent, decrease in Cumulative Results of Operations—All Other Funds is primarily due to unfunded expenses of $882 thousand (e.g., accruals for annual leave and Federal Employees’ Compensation Act expenses and contingent liabilities), a loss on the disposal of fixed assets of $1.1 million, and accumulated depreciation and amortization of fixed assets of $14.2 million in excess of fixed asset purchases of $10.5 million.

-

Statement of Budgetary Resources

This statement provides information about the provision of budgetary resources and its status as of the end of the year. Information in this statement is consistent with budget execution information and the information reported in the Budget of the U.S. Government, FY 2014.

The Commission’s Total Budgetary Resources increased by $188.7 million, or 61.2 percent, primarily due to an increase in Spending Authority from Offsetting Collections of $175.8 million and an increase in Appropriations of $20.4 million, offset by a decrease in Unobligated Balance Brought Forward, October 1 of $5.2 million.

The $175.8 million, or 39,918.3 percent, increase in Spending Authority from Offsetting Collections was primarily due to the $176.1 million recovery from the Treasury at the end of the third quarter of FY 2014. This money was recovered after the GAO issued a formal decision in FY 2014 (B-324469) that collections of civil monetary sanctions should be kept intact and deposited in full into the CPF as long as the CPF fund balance is below $100 million at the time of the collection.

FY 2014 Appropriations increased by $20.4 million, or 10.5 percent, because the FY 2014 amount appropriated by Congress was $9.7 million higher than the FY 2013 appropriated amount, and the final FY 2013 appropriation amount of $205.3 million was reduced to $194.6 million after rescission and sequestration of $10.7 million.

The $5.2 million, or 4.7 percent, reduction in the Unobligated Balance Brought Forward, October 1, was the result of reduced carryover funds in FY 2014.

Apportioned amounts increased by $15.8 million, or 114.0 percent, primarily due to amounts apportioned for CPF in excess of obligations. In addition to estimated operating expenses, the apportioned amount for CPF includes an allowance for the payment of whistleblower awards; one award was paid in FY 2014.

The Unapportioned amounts increased by $154.8 million or 169.9 percent, primarily due to the $176.1 civil monetary sanctions collection recovered from Treasury in excess of the amount apportioned for CPF.

Gross Outlays decreased by $18.3 million, or 8.2 percent, due to less funds spent in FY 2014 then in FY 2013, primarily due to $5.9 million in carryover funds from the FY 2012/2013 appropriation that were subsequently spent in FY 2013, reduced contract costs in FY 2014 due to the government shutdown, and $7.9 million reduction in payroll payments due to approximately 30 fewer employees in FY 2014 and one additional pay period in FY 2013.

Actual Offsetting Collections increased by $175.4 million, or 16,451.8 percent, primarily due to the $176.1 million civil monetary sanctions collection recovered from the Treasury discussed above.

-

Statement of Custodial Activity

Total Cash Collections

($ in millions)Registration and Filing Fees $2.1 Fines, Penalties, and Forfeitures $943.1 General Proprietary Receipts $–* Total Cash Collections $945.2 * Total cash collections include $39 thousand, or <$1, in general proprietary receipts. (back to text)

This statement provides information about the sources and disposition of collections. CFTC transfers eligible funds from dedicated collections to the CPF when the balance falls below $100 million and other non-exchange revenue to the Treasury general fund. Collections primarily consist of fines, penalties, and forfeitures assessed and levied against businesses and individuals for violations of the CEA or Commission regulations. They also include non-exchange revenues such as registration, filing, appeal fees, and general receipts. The Statement of Custodial Activity reflects total cash collections for FY 2014 in the amount of $945.2 million, a decrease of $98.7 million, or 9.5 percent, over FY 2013. This decrease in collections was expected due to two unusually large collections totaling over $1.0 billion in FY 2013 that resulted from the Commission’s enforcement cases related to unlawful manipulative conduct and false reporting of LIBOR and other benchmark interest rates. Of the $945.2 million in FY 2014 cash collections, $769.1 million was transferred to the Treasury and $176.1 million was transferred into the CPF.

Historical experience has indicated that a high percentage of custodial receivables prove uncollectible. An allowance for uncollectible accounts has been established and included in the accounts receivable on the Balance Sheet. The allowance is based on past experience in the collection of accounts receivables and an analysis of outstanding balances. Accounts are re-estimated quarterly based on account reviews and a determination that changes to the net realizable value are needed.

As explained in the Total Assets and the Total Liabilities discussions of the Balance Sheet section above, the significant swing in the Change in Custodial Receivables/Liabilities of approximately $65.6 million, or 93.95 percent, was primarily the result of a $65 million custodial receivable that was established in September 2013 for a LIBOR-related enforcement action against ICAP Europe Limited and subsequently collected in October 2013.

-

Limitations of Financial Statements

Management has prepared the accompanying financial statements to report the financial position and operational results of the CFTC for FY 2014 and FY 2013 pursuant to the requirements of Title 31 of the U.S. Code, section 3515 (b).

While these statements have been prepared from the books and records of the Commission in accordance with GAAP for Federal entities and the formats prescribed by OMB Circular A-136, Financial Reporting Requirements, these statements are in addition to the financial reports used to monitor and control budgetary resources, which are prepared from the same books and records.

The statements should be read with the understanding that they represent a component of the U.S. government, a sovereign entity. One implication of this is that the liabilities presented herein cannot be liquidated without the enactment of appropriations, and ongoing operations are subject to the enactment of future appropriations.

Other Information

Other Information contains the CFTC awards, consumer protection advisory on fraud, information about the CFTC Whistleblower Program, and contacts and acknowledgements.

-

CFTC Awards

-

CFTC Consumer Protection: Fraud Awareness, Prevention and Reporting

Trading Futures and Options: Protection Against Fraud

The CFTC is the Federal agency that regulates the trading of commodity futures and option contracts in the United States and takes action against firms or individuals suspected of illegally or fraudulently selling commodity futures and options. The CFTC’s fraud awareness, prevention and reporting initiatives involve: developing an outreach effort designed to help individual investors/traders identify and avoid fraud, or encourage them to report known or suspected instances of it.

About the Futures Markets

- Individual investors/traders or “retail customers” rarely ever trade commodity futures and options.

- Trading commodity futures and options is a volatile, complex, and risky venture.

- Many individual traders lose all of their initial payment, and they could owe more than the initial payment.

- Some individual investors/traders unknowingly fall for completely fraudulent schemes which cause tremendous financial loss and emotional hardships.

Before you trade

Know the basics in futures trading

- Consider your financial experience, goals and resources and determine how much you can afford to lose above and beyond your initial payment.

- Understand commodity futures and options contracts and your obligations in entering into them.

- Understand your exposure to risk and other aspects of trading by thoroughly reviewing disclosure documents your broker is required to give you.

- Know that trading on margin can make you responsible for losses much HIGHER than the amount you initially invested.

- Immediately contact CFTC if you have a problem or question.

Watch out for these warning signs

- Get-rich-quick schemes that sound too good to be true. Once your money is gone, it may be impossible to get it back.

- Predictions or guarantees of large profits. Always get as much information as you can about a firm or individual’s track record and verify that information.

- Firms or individual who say there is little risk. Written risk disclosure statements are important to read thoroughly and understand.

- Calls or emails from strangers about investment or trading opportunities.

- Requests for immediate cash or money transfers by overnight express, the Internet, mail, or any other method.

What should you do?

Visit the our Web site for more information:

www.cftc.gov/ConsumerProtectionReport possible violations of commodity futures trading laws:

Call the CFTC’s Division of Enforcement at:

866-FON-CFTC (866-366-2382)Submit our online form located at:

www.cftc.gov/ConsumerProtection/FileaTiporComplaintSend us a letter addressed to:

CFTC, Office of Cooperative Enforcement

1155 21st Street, NW, Washington, DC 20581 -

CFTC Whistleblower Program

The CFTC Whistleblower

Program—created by the Dodd-

Frank Act—allows for payment

of monetary awards to eligible

whistleblowers, and provides

anti-retaliation protections for

whistleblowers, who share

information with

or assist the CFTC.How does the whistleblower program work?

- The CFTC will pay monetary awards to eligible whistleblowers who voluntarily provide us with original information about violations of the Commodity Exchange Act that lead us to bring enforcement actions that result in more than $1 million in monetary sanctions.

- The CFTC can also pay whistleblower awards based on monetary sanctions collected by other authorities in actions that are related to a successful CFTC enforcement action, and are based on information provided by a CFTC whistleblower.

- The total amount of a whistleblower award will be between 10 and 30 percent of the monetary sanctions collected in either the CFTC action or the related action.

Who can be a whistleblower?

- A whistleblower can be any person who sends us original information, from a corporate office or insider, to a trader or market observer, to an investor or fraud victim.

How can I become a whistleblower?

To become a whistleblower, you must complete and submit a Form TCR either electronically, by mail or by facsimile.

To submit a Form TCR electronically, visit http://www.cftc.gov, and click on the “File a Tip or Complaint” button on the right-hand side of the page. Use the first link under the description of the whistleblower program.

To submit a Form TCR by mail or facsimile, print a Form TCR from the “Whistleblower Program” webpage on http://www.cftc.gov, and use the following address or number:

Commodity Futures Trading Commission

Whistleblower Office

1155 21st Street, NW, Washington, DC 20581

Fax: (202) 418-5975Am I protected against retaliation?

The Dodd-Frank Act prohibits retaliation by employers against individuals who provide us with information about possible violations of the Commodity Exchange Act, or who assist us in any investigation or proceeding based on such information.

Learn more about the anti-retaliation provisions by reading Appendix A to the Whistleblower Rules.

How can I learn more?

Visit the “Whistleblower Program” webpage at http://www.cftc.gov/ConsumerProtection/WhistleblowerProgram/index.htm, which has copies of our rules, filing forms, notices and frequently asked questions.

-

Contacts and Acknowledgements

Contacts

Additional copies of the

Commodity Futures Trading Commission