CFTC Mission

To protect market users and the public from fraud, manipulation, abusive practices and systemic risk related to derivatives that are subject to the Commodity Exchange Act (CEA), and to foster open, competitive, and financially sound markets.

CFTC Chairman Gary Gensler.

CFTC Chairman Gary Gensler.

Getty Images CFTC Chairman Gary Gensler

CFTC Chairman Gary Gensler

with U.S. President Barack Obama and U.S. Treasury Secretary Timothy Geithner at the White House.

Obama urged Congress to bolster

federal supervision of oil markets.

April 17, 2012. Getty Images CFTC Chairman Gary Gensler participates in the Financial Stability Oversight Council meeting at the U.S. Treasury Department. Members of FSOC voted during the meeting on a report to Congress regarding a study of contingent capital required by the Dodd-Frank Act. July 18, 2012.

CFTC Chairman Gary Gensler participates in the Financial Stability Oversight Council meeting at the U.S. Treasury Department. Members of FSOC voted during the meeting on a report to Congress regarding a study of contingent capital required by the Dodd-Frank Act. July 18, 2012.

Getty Images CFTC Chairman Gary Gensler speaking at the Securities Industry and Financial Markets Association annual meeting, October 23, 2012. Getty Images

CFTC Chairman Gary Gensler speaking at the Securities Industry and Financial Markets Association annual meeting, October 23, 2012. Getty Images CFTC Chairman Gary Gensler testifying with Securities and Exchange Commission Chairman Mary Schapiro before the Senate Banking, Housing and Urban Affairs Committee, May 22, 2012. Getty Images

CFTC Chairman Gary Gensler testifying with Securities and Exchange Commission Chairman Mary Schapiro before the Senate Banking, Housing and Urban Affairs Committee, May 22, 2012. Getty Images

A Message from

the Chairman

I am pleased to present the Summary of Performance and Financial Information for Fiscal Year 2012. It chronicles a critical time in the history of the Commodity Futures Trading Commission (CFTC or Commission), a year of transition and real progress toward ensuring that the futures and swaps markets are transparent and work for the American public.

The New Era of Swaps Market Reform

This past year has been a very active year for the CFTC. We have made significant progress in bringing comprehensive oversight to the once opaque swaps market.

The swaps marketplace had operated without the basic transparency and common-sense reforms of the financial markets that Americans have benefitted from since the 1930s.

Those historic reforms put in place in the aftermath of the Great Depression established a foundation of transparency, competition and market integrity for the futures and securities markets. This democratization of our financial markets has led to many decades of economic growth and innovation.

The 2008 financial disaster caused great damage. Eight million American jobs were lost, millions of Americans lost their homes, and thousands of businesses closed their doors.

In response, Congress and the President borrowed from what has worked best in the futures markets in passing the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act).

The CFTC is now close to completing the Dodd-Frank rule set with 41 finalized rules of the road for the swaps market. Last month, at the start of Fiscal Year 2013, the new era of swaps market reform began.

Also of note, the CFTC finished an agency-wide reorganization in Fiscal Year 2012.

As we begin 2013, the agency is increasingly shifting to the implementation of rules, as well as the direct oversight of the swaps market. We will require the necessary resources to oversee this vast market.

Given this new era of swaps market reform, it’s the natural order of things that market participants have questions and have sought further guidance. This regularly occurs as we move to market implementation from congressional legislation and agency rulemaking.

We welcome inquiries from market participants. My fellow commissioners and I, along with the CFTC staff, are all committed to sorting through issues as they arise. Fine-tuning is expected.

The CFTC also will continue to consult broadly on appropriately phasing in compliance. The Commission has included phased compliance schedules within many of our rules. Extensive information on the compliance schedule for each of the CFTC’s reforms is available on our website.

I believe it’s also critical that we continue our efforts to put in place aggregate position limits across futures and swaps, as Congress directed the CFTC to do.

Promoting Transparency

Dodd-Frank reforms are bringing needed transparency to the swaps market.

Transparency lowers costs for investors, consumers and businesses. It increases liquidity, efficiency and competition. And it shifts some of the information advantage from swap dealers to businesses across the country that use these markets to lock in a price or rate and hedge a risk.

In 2012, the agency completed significant transparency rules and bright lights have begun to shine on the swaps market. Swaps transactions are being reported to regulators through swap data repositories. The public also will benefit from real-time reporting of the price and volume of transactions beginning in 2013, based on the CFTC’s completed rules. Regulators and the public will have their first full window into the swaps marketplace.

In addition, the CFTC will initiate a new weekly report so that the public can benefit from seeing aggregate data in the swaps market. This week, the CFTC put out to public comment the first draft proposal of this report. For years, the public has benefited from the futures market data we have published in our weekly Commitment of Traders reports, and our goal is to provide similar transparency to the public for the swaps market. After reviewing the public input, we intend to issue this swaps data regularly in 2013.

In the coming months, the CFTC is working to finalize reforms that promote pre-trade transparency, including rules on minimum block sizes and trading platforms called swap execution facilities. Market participant compliance for these rules will be phased throughout 2013.

Lowering Risk and Democratizing the Market through Clearing

Another significant Dodd-Frank reform is bringing swaps into central clearing, which will lower the risk of the highly interconnected financial system.

For over a century, through good times and bad, central clearing in the futures market has lowered risk to the broader public.

Central clearing also equalizes access to the market and democratizes it by eliminating the need for market participants to individually determine counterparty credit risk, as now the clearinghouse stands between buyers and sellers.

In 2012, the CFTC largely finished the clearing rule set. Clearinghouses have adopted risk management reforms, including critical customer protection enhancements. The so-called “LSOC rule” (legal segregation with operational comingling) for swaps prevents clearing organizations from using the collateral attributable to cleared swaps customers who haven’t defaulted to cover losses of defaulting customers. In addition, clearinghouses have to collect margin on a gross basis.

To complete the process of bringing swaps into central clearing, the Commission is working to finalize the initial set of clearing determinations regarding which interest rate swaps and credit default swap indices should be required to be cleared. This would lead to required clearing by swap dealers and the largest hedge funds as early as February 2013. Compliance would be phased in for other market participants through the summer of 2013.

In 2013, the CFTC also will be considering possible clearing determinations for physical commodity swaps.

Lowering Risk through Swap Dealer Oversight

Dodd-Frank reform also means comprehensive oversight of swap dealers, which will lower their risk to the rest of the economy.

As the result of CFTC rules completed in 2012, swap dealers have begun the process of registering and, for the first time, will come under comprehensive regulation. We anticipate many dealers will register in early 2013.

Once registered, swap dealers will report their trades to both regulators and the public. In addition, they will implement crucial back office standards that lower risk and increase efficiency. Swap dealers also will be required to implement sales practices that prohibit fraud, treat costumers fairly, and improve transparency.

Moving forward, in consultation with international regulators, the CFTC will move to finalize guidance on the cross-border application of swaps market reform and an accompanying release on phased-compliance for foreign swap dealers.

The CFTC also is collaborating on a global approach to margin requirements for uncleared swaps through the Basel Committee on Banking Supervision and the International Organization of Securities Commissions (IOSCO).

I would anticipate the CFTC, in coordination with domestic prudential regulators and international regulators, would take up the final rules on margin in 2013, so as to benefit from this international work.

Once these margin rules as well as related rules on capital are completed, I would envision that compliance for market participants would be phased in throughout 2013.

Customer Protection

Segregation of customer funds is a core foundation of customer protection in both the futures and swaps markets.

The CFTC in Fiscal Year 2012 completed a number of important reforms to enhance the protection of customer funds. These include the completed amendments to rule 1.25 regarding the investment of customer funds, as well as the LSOC and gross margining rules.

The Commission also worked closely with market participants and self-regulatory organizations (SROs) on new rules for customer protection at the National Futures Association (NFA). These include requiring Futures Commission Merchants (FCMs) to hold sufficient funds in Part 30 secured accounts (funds held for U.S. foreign futures and options customers trading on foreign contract markets) to meet their total obligations to customers trading on foreign markets computed under the net liquidating equity method. In addition, FCMs must maintain written policies and procedures governing the maintenance of excess funds in customer segregated and Part 30 secured accounts. Withdrawals of 25 percent or more would necessitate pre-approval in writing by senior management and must be reported to the designated SRO and the CFTC.

These steps were significant, but market events this year have further highlighted that the Commission must do everything within our authorities and resources to strengthen oversight programs and the protection of customers and their funds.

In the fall of 2012, the Commission sought public comment on further enhancements to protect customer funds.

This proposal is about ensuring customers have confidence that the funds they post as margin or collateral are fully segregated and protected.

It is the direct result of significant input from the public and market participants that the CFTC gathered throughout 2012, working with the Futures Industry Association, the NFA and the self-regulatory organizations.

The proposal, which the CFTC looks forward to finalizing in 2013, would strengthen the controls around customer funds at FCMs. It also would set new regulatory accounting requirements that would provide stronger protections for customer money held by FCMs and would raise minimum standards for independent public accountants who audit FCMs. And it would provide regulators with daily direct electronic access to FCMs’ bank and custodial accounts for customer funds.

Benchmark Interest Rates

In 2012, the CFTC brought the most significant case in our history against Barclays for attempting to manipulate the London Interbank Offered Rate (LIBOR) and violating the Commodity Exchange Act’s false reporting provision.

Looking forward to 2013, one of the most critical challenges for the markets, international regulators and the CFTC is how to best ensure benchmark rates, such as LIBOR, are honest and reliable.

As they are a key component of our financial markets, they must work for the rest of the economy. LIBOR is the reference rate for nearly half of U.S. adjustable-rate mortgages; for about 70 percent of the U.S. futures market; and for a majority of our swaps market.

I believe for a benchmark rate for any commodity or swap to be reliable and have integrity, it’s best to be anchored in real, observable transactions.

When market participants submit for a benchmark rate that lacks observable underlying transactions, even if operating in good faith, they may stray from what real transactions would reflect. When a benchmark is separated from real transactions, it is more vulnerable to misconduct.

The underlying market for interbank transactions in London, however, has largely diminished.

The CFTC is consulting with a number of international organizations with regard to next steps for benchmark rates. In particular, the UK Financial Services Authority and the CFTC are co-chairing the IOSCO task force plans to seek public consultation hopefully starting in December 2012. This will include a public roundtable and culminate in a report and recommendations in the spring.

The IOSCO task force will be seeking public input on best practices that should apply to the benchmark process and entities that produce benchmarks, as well as possible mechanisms and protocols that would best ensure for a smooth transition to new benchmarks when and if needed.

Resources

As the CFTC moves from finalizing Dodd-Frank reforms to implementing them, the agency needs additional resources consistent with the agency’s expanded mission and scope.

At 703 on board staff at the start of Fiscal Year 2013, the CFTC’s hardworking staff is just 10 percent more in numbers than at our peak in the 1990s. The futures market has grown more than five-fold since that time, and the swaps market is eight times larger than the futures market.

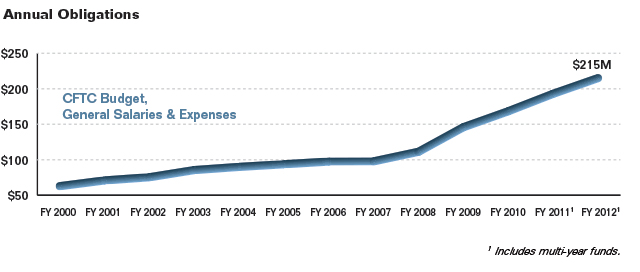

Given this reality, the President requested $308 million to fund 1,015 full time employees and a much-need increase in technology for Fiscal Year 2013. Under the most recent continuing resolution, the agency was funded at a rate of $206.6 million.

With an expanded mission due to the Dodd-Frank mandate, the CFTC completed an agency reorganization in Fiscal Year 2012. This includes a new division for oversight of swap dealers and intermediaries and a reorganization of our critical technology programs.

The CFTC places a strong emphasis on being an effective steward of its operating funds. I am pleased that for the eighth consecutive year, the Commission has received an unqualified opinion on its financial statements. For the sixth consecutive year, the auditors disclosed no material instances of noncompliance with laws and regulations. I can also report that the CFTC had no material internal control weaknesses and that the financial and performance data in this report are reliable and complete under Office of Management and Budget guidance.

Conclusion

The 1930s reforms brought light to the securities and futures markets, helping to promote decades of economic growth and are at the core of our strong capital markets.

The swaps market reforms that are being implemented hold out similar potential. Bright lights of transparency will shine, dealers will come under comprehensive regulation and standardized swaps between financial entities will be centrally cleared.

The public will benefit and our markets will be stronger in this new era.

![]()

Gary Gensler

November 15, 2012

Commission at a Glance

The Commission at a Glance presents a high-level summary of CFTC. See below for an overview of CFTC, why the Commission exists, how it operates, and the staff and resources during FY 2012.

Who We Are

The Commission consists of five Commissioners. The President appoints and the Senate confirms the CFTC Commissioners to serve staggered five-year terms. No more than three sitting Commissioners may be from the same political party. With the advice and consent of the Senate, the President designates one of the Commissioners to serve as Chairman.

The Office of the Chairman oversees the Commission’s principal divisions and offices that administer and enforce the Commodity Exchange Act (CEA) and the regulations, policies, and guidance thereunder.

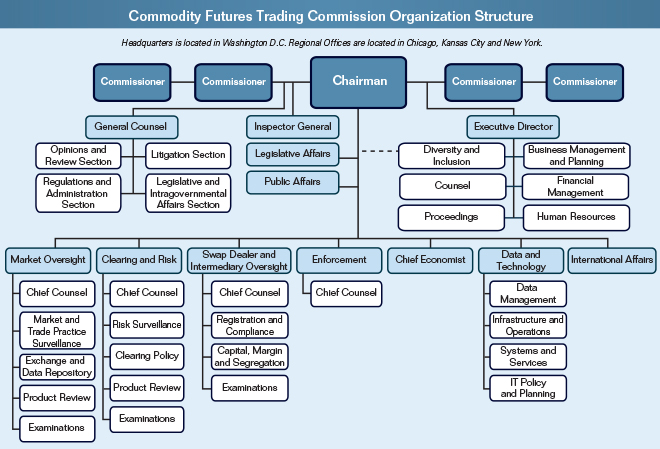

The Commission is organized largely along programmatic and functional lines. The four programmatic divisions—the Division of Clearing and Risk, Division of Enforcement, Division of Market Oversight, and the Division of Swap Dealer and Intermediary Oversight—are partnered with, and supported by, a number of offices, including the Office of the Chief Economist, Office of Data and Technology, Office of the Executive Director, Office of the General Counsel, and the Office of International Affairs. The Office of the Inspector General is an independent office of the Commission.

The Commission is headquartered in Washington D.C. Regional offices are located in Chicago, Kansas City and New York.

Why We Exist

CFTC Mission

To protect market users and the public from fraud, manipulation, abusive practices and systemic risk related to derivatives that are subject to the Commodity Exchange Act (CEA), and to foster open, competitive, and financially sound markets.

The Commission administers the CEA, 7 U.S.C. section 1, et seq. The 1974 Act brought under Federal regulation futures trading in all goods, articles, services, rights and interests; commodity options trading; leverage trading in gold and silver bullion and coins; and otherwise strengthened the regulation of the commodity futures trading industry.

On July 21, 2010, President Obama signed the Dodd-Frank Act. The Dodd-Frank Act amended the CEA to establish a comprehensive new regulatory framework to include swaps, as well as enhanced authorities over historically regulated entities. The Dodd-Frank Act was enacted to:

- Reduce systemic risk,

- Increase transparency, and

- Promote market integrity within the financial system.

The U.S. swaps and futures markets are estimated at $281 trillion and $25 trillion, respectively. By any measure, the markets under CFTC’s regulatory purview are large and economically significant. Given the enormity of these markets and the critical role they play in empowering legitimate, prudential, and non-speculative hedging strategies, it is essential to protect the financial stability of the nation to ensure that these markets are transparent, open and competitive.

Estimated notional value of the U.S. markets:

-

Commodity Futures Industry

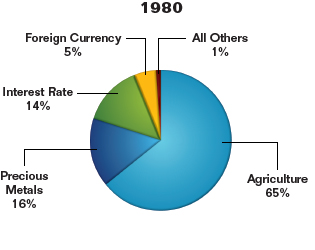

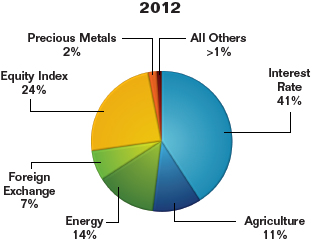

The first derivatives—called futures—began trading at the time of the Civil War, when grain merchants came together and created this new marketplace. When the Commission was founded in 1974, the vast majority of derivatives trading consisted of futures trading in agricultural sector products. These contracts gave farmers, ranchers, distributors, and end-users of products ranging from corn to cattle an efficient and effective set of tools to hedge against price risk.

Commodity and Option Trading Activity

Over the years, however, the derivatives industry has become increasingly diversified. The agriculture sector continues to use the futures markets as actively as ever to effectively lock in prices for crops and livestock months before they enter the marketplace. However, highly complex financial contracts based on interest rates, foreign currencies, Treasury bonds, securities indexes and other products have far outgrown agricultural contracts in trading volume. Over a 32-year span, on-exchange commodity futures and option trading activity in the agricultural sector decreased 54 percent, while the financial sector commodity futures and option contracts increased 53 percent.1

1 A timeline of significant dates in the history of futures regulation before the creation of the CFTC and significant dates in CFTC history from 1974 to the present is located at: http://www.cftc.gov/About/HistoryoftheCFTC/index.htm. (back to text)

-

Industry Growth

Growth in U.S. Futures Trading Between the Years 2000 and 2012 2000 2012 Percent Change Notional Value of Futures/Options Marketsa $12 Trillion $25 Trillion +108% Notional Value of Swaps Marketb $40.5 Trillion $281 Trillion1 +594% Number of Futures and Options Contracts Tradedc 266 2,313 +769% Total Futures and Options Contract Volumed 580 Million 3.12 Billion +439% Volume of Electronic Trading on all U.S. DCMse 9% 84% +75% Customer Funds Held in Futures Commission Merchants (FCM) Accountsf $56.7 Billion $184.2 Billion +225% Sources:

a. CFTC Integrated Surveillance System (back to text)

b. Office of the Comptroller of the Currency (back to text)

c. CFTC Integrated Surveillance System (back to text)

d. Futures Industry Association (back to text)

e. CFTC Trade Surveillance System (back to text)

f. 1-FR Reports filed by FCMs and posted at: http://www.cftc.gov/MarketReports/FinancialDataforFCMs/index.htm. (back to text)

Fundamental changes in technology, products and platforms of U.S. futures trading have increased the Commission’s need for sophisticated technology, specialized skills and additional resources to keep pace. In the futures industry, exchanges, in particular have under gone a decade-long transition from geographically–defined trading pits to electronic platforms with global reach. From 2000 to 2012, electronic trading grew from approximately nine percent of volume to 84 percent on all U.S. designated contract markets (DCMs). Over the same time period, the number of actively-traded futures and options contracts listed on U.S. exchanges increased more than eight-fold, from approximately 266 contracts in 2000 to approximately 2,313 contracts in 2012. Total DCM futures and options trading volume rose from approximately 580 million contracts in 2000 to approximately 3.12 billion in 2012, an increase of 439 percent.

1 As of 2nd quarter of 2012. (back to text)

-

CFTC Regulated Entities

CFTC Regulated Entities as of September 30, 2012 Number of Registered Entities/Registrants As of September 30, 2012 Designated Contract Markets (DCMs) 16 Swap Execution Facilities (SEFs) 0 Foreign Boards of Trade (FBOTs) 21 Associated Persons (APs) 51,068 Commodity Pool Operators (CPOs) 1,172 Commodity Trading Advisors (CTAs) 2,470 Floor Brokers (FBs) 5,650 Floor Traders (FTs) 1,102 Futures Commission Merchants (FCMs) 128 Retail Foreign Exchange Dealers (RFEDs) 14 Introducing Brokers (IBs) 1,354 Swap Dealers (SDs) 0 Major Swap Participants (MSPs) 0 Designated Clearing Organizations (DCOs) 17 Clearing Members 191 Systemically Important DCOs (SIDCOs) 2 Swap Data Repositories1 (SDRs) 3 The Commission’s regulatory scope encompasses trading entities, clearing entities, and data repositories and the sole registered futures association, NFA. For the overwhelming number of market participants, the Commission’s role is as a second-line regulator, where the agency relies on the designated self-regulatory organizations (DSROs) to perform critical regulatory responsibilities. The Commission’s direct regulatory activities in registration, product reviews, and examinations are primarily focused on the DCMs, derivatives clearing organizations (DCOs), Swap Data Repositories (SDRs), NFA, and soon, Swap Execution Facilities (SEFs). The Commission also conducts limited scope direct examinations of intermediary trading entities, as resources are available. While the DSRO’s are obligated to conduct surveillance and enforcement activities for entities under their purview, the Commission conducts surveillance and enforcement activities across all market participants.

1 Number of SDR registrants are those entities with provisional registration status. (back to text)

-

Dodd-Frank Reforms

"The Wall Street Reform Bill will—for the first time—bring comprehensive regulation to the swaps marketplace. Swap dealers will be subject to robust oversight. Standardized derivatives will be required to trade on open platforms and be submitted for clearing to central counterparties. The Commission looks forward to implementing the Dodd-Frank Bill to lower risk, promote transparency and protect the American public."

– CFTC Chairman Gary Gensler

In July 2010, the U.S. Congress addressed the economic risks of swaps when it passed the Dodd-Frank Act. Though the CFTC and its predecessor agencies have regulated derivatives since the 1920s, its jurisdiction was limited to futures. Now, the Commission, along with the Securities and Exchange Commission (SEC), is tasked with bringing its regulatory expertise to the swaps marketplace. These products, which have not previously been regulated in the United States, were at the center of the 2008 financial crises. The historical Dodd-Frank Act authorizes the CFTC to:

Regulate Swap Dealers

- Swap dealers will be subject to capital and margin requirements to lower risk in the system.

- Swap dealers will be required to meet robust business conduct standards to lower risk and promote market integrity.

- Swap dealers will be required to meet recordkeeping and reporting requirements so that regulators can police the markets.

Increase Transparency and Improve Pricing in the Derivatives Marketplace

- Instead of trading out of sight of the public, standardized derivatives will be required to be traded on regulated exchanges or swap execution facilities.

- Transparent trading of swaps will increase competition and bring better pricing to the marketplace. This will lower costs for businesses and their consumers.

Lower Risk to the American Public

- Standardized derivatives will be moved into central clearinghouses to lower risk in the financial system.

- Clearinghouses act as middlemen between two parties to a transaction and take on the risk that one counterparty defaults on their obligations.

- Clearinghouses have lowered risk in the futures marketplace since the 1980s. The Dodd-Frank Act will bring this crucial market innovation to the swaps marketplace.

-

How We Operate

Strategic Response

The Commission’s updated Strategic Plan was published in February 2011 and is located at http://www.cftc.gov/reports/strategicplan/2015/index.htm. It integrated the expanded responsibilities under the Dodd-Frank Act. As a set of guiding principles for implementing new regulatory and mission activities, this plan provides direction during a time of uncertainty. These strategic goals were constructed in a focused way, lending credence to unifying goals found within the CEA and Dodd-Frank Act.

The CFTC organizational programs support the strategic plan goals through nine key mission activities identified by the Commission.

In FY 2012, the Commission spent $115.7 conducting mission activities in support of the Commission’s top four strategic plan goals and spent $83.2 conducting mission support activities in support of regulatory and organizational excellence.

Mission and Mission Support Activities Cost and Staffing for Fiscal Year 2012 Strategic Goals (Abbreviated) Strategic Goal 1: Market Integrity

Strategic Goal 2: Financial Integrity

Strategic Goal 3: Robust Enforcement

Strategic Goal 4: Cross-Border Cooperation

2012 Mission Activities Dollars in Millions FTE 1. Registration and Registration Compliance $10.1 32 2. Product Reviews $5.2 19 3. Surveillance, including Data Acquisition and Analytics $42.2 118 4. Examinations $17.3 76 5. Enforcement $37.9 165 6. International Policy Coordination $3.0 14 Strategic Goals (Abbreviated) Strategic Goal 5: Regulatory and Organizational Excellence 2012 Mission Support Activities Dollars in Millions FTE 1. Economic and Legal Counsel $25.4 108 2. Data Infrastructure and Technology Support $31.1 38 3. Agency Direction, Management and Administration $26.7 117 TOTAL $198.9 687 -

Mission Activities

Registration and Registration Compliance

The Commission performs a thorough review of the registration applications of all entities seeking to be registered as DCMs and DCOs. Multi-disciplinary review teams of attorneys, industry economists, trade practice analysts and risk analysts ensure that the Commission undertakes a thorough analysis of such applications to ensure compliance with the applicable statutory core principles and Commission regulations. Site visits may be required to validate needed technical and self-regulatory capabilities.

Product Reviews

The Commission reviews new product filings as well as issuing no-action letters related to product issues. The CFTC’s traditional scope of work includes reviewing new futures and options contract filings, reviewing contract rule submissions, and developing new rules and policies to accommodate innovations in the industry. Currently, the Commission conducts due diligence reviews of new contract filings to ensure that the contracts are not readily susceptible to manipulation or price distortion, and that the contracts are subject to appropriate position limits or position accountability. The Commission also analyzes amendments to contract terms and conditions to ensure that the amendments do not render the amended contracts readily susceptible to manipulation and do not otherwise affect the value of existing positions.

Surveillance, including Data Acquisition and Analytics

The Commission performs three broad types of surveillance: market and trade practice, financial and risk, and business analytics. The Commission monitors trading and positions of market participants on an on-going basis. Commission staff screen for potential market manipulations and disruptive trading practices, as well as trade practice violations. The Commission also monitors changing market conditions and developments, such as shifting patterns of commercial or speculative trading or the introduction of new trading activities, to assess possible market impacts on internal review techniques and/or evaluate the impact such changes may have on exchange trading rules and contracts. The Commission also conducts risk and financial surveillance of DCOs, clearing futures commission merchants, and other market participants such as swap dealers, major swap participants, and large traders that may pose a risk to the clearing process. CFTC also maintains a business analytics platform for performing data analysis. The platform allows staff analyzing industry data to keep pace with the continuing growth in industry data volume and complexity. The Commission established a Strategic Plan objective to ensure that information technology systems support the Commission’s existing and expanded responsibilities to ensure financially sound markets, mitigate systemic risk, and monitor intermediaries.

Examinations

Examinations are formal, structured assessments of regulated entities’ operations or oversight programs to assess on-going compliance with statutory and regulatory mandates. Regular examinations are the most effective method of ensuring that the entities’ are complying with the core principles established in the CEA (as amended). Examinations are performed by multi-disciplinary teams of individuals, attorneys, industry economists, trade practice analysts, risk analysts and accountants depending on the scope.

Enforcement

The Commission protects market participants and other members of the public from fraud, manipulation and other abusive practices in the commodities, futures and swaps markets. Its cases range from quick strike actions against Ponzi enterprises that victimize investors across the country, to sophisticated manipulative and disruptive trading schemes in markets the Commission regulates including oil, gas, precious metals and agricultural goods.

International Policy Coordination

The global nature of the futures and swaps markets makes it imperative that the United States consult and coordinate with foreign authorities. The Commission is actively communicating internationally to promote robust and consistent standards and avoid conflicting requirements, wherever possible. The Commission participates in numerous international working groups regarding swaps, including the IOSCO Task Force on over-the-counter (OTC) Derivatives, which the CFTC co-chairs. The CFTC, SEC, European Commission and European Securities Market Authority are intensifying discussions through a technical working group. The Commission also is consulting with many other jurisdictions such as Hong Kong, Singapore, Japan, and Canada.

Discussions have focused on the details of the Dodd-Frank rules, including mandatory clearing, trading, reporting and regulation of derivatives market intermediaries. The Commission’s international outreach efforts directly support global consistency in the oversight of the swaps markets.

Economic and Legal Counsel

The Commission supports an in-depth, analytical research program that focuses on innovations in trading technology, developments in trading instruments, and the role of market participants in the futures, options, and swap markets. A team of specialized economists supports the Commission’s numerous divisions by analyzing these constantly evolving components of markets to help anticipate and mitigate significant regulatory, surveillance, clearing, and enforcement challenges. Economic expertise is especially important for the development and implementation of new financial regulations related to the Dodd Frank Act and the oversight of a new swaps regime.

The Commission’s legal services include: 1) engaging in defensive, appellate, and amicus curiae litigation; 2) interpreting the CEA; 3) providing legal advice and support for Commission Divisions; 4) drafting and assisting other Divisions in preparing Commission regulations; 5) assisting the Commission in the performance of its adjudicatory functions; and 6) providing advice on legislative and regulatory issues.

Data Infrastructure and Technology Support

The Commission’s over-arching IT strategy is to increase the integration of IT into the Commission operating model, which is described in Goal Five of the Strategic Plan. This strategy has become increasingly more important and complex as the Commission’s regulatory scope has expanded faster than its resources. In order to do this rapidly with the most practical investment, the Commission’s approach is to manage data as an enterprise asset, promote and adopt industry data standards, give priority to services that provide the greatest mission benefit, architect services using small components that can be assembled and reassembled with agility, and deliver solutions in short, iterative phases. The first area of focus must be on data understanding and ingestion—particularly because CFTC has a unique imperative to aggregate various types of data from multiple industry sources across multiple markets, much of which is new to the Commission staff. Receipt and analysis of the first wave of registrant reporting will give Commission staff insight into the markets and business process, which can be used to firm-up requirements and designs for internal surveillance systems. Likewise, the same business analytics tools used for data understanding and ad hoc mining of mature datasets will also be used to automate transparency reporting.

Agency Direction, Management, and Administration Support

As stated in the CFTC’s Strategic Plan, the Commission’s ability to achieve its mission of protecting the public, derivative market participants, U.S. economy and the U.S. position in global markets is driven by well-informed and reasoned executive direction, strong and focused management, and an efficiently-resourced, dedicated, and productive workforce. These attributes of an effective organization combine to lead and support the critical work of the Commission to provide sound regulatory oversight and enforcement programs for the U.S. public. To ensure the Commission’s continued success, continuity of operations, and adaptation to the ever-changing markets it is charged with regulating, the Commission must lead effectively and maintain a well-qualified workforce supported by a modern IT infrastructure and working environment.

-

Our People

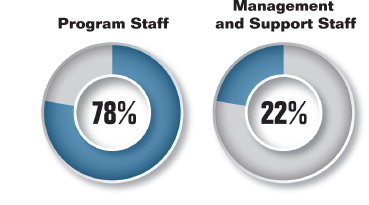

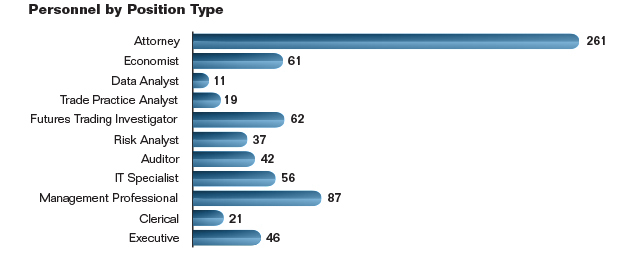

Collectively, the Commission employs 703 full-time permanent employees that comprise 549 programmatic staff (attorneys, economists, auditors, risk and trade analysts, and other financial specialists) and 154 management and support staff to accomplish five strategic goals and nine key mission activities in the regulation of commodity futures, options and swaps.

Collectively, the Commission employs 703 full-time permanent employees that comprise 549 programmatic staff (attorneys, economists, auditors, risk and trade analysts, and other financial specialists) and 154 management and support staff to accomplish five strategic goals and nine key mission activities in the regulation of commodity futures, options and swaps.Personnel by Position Type

Among the full-time personnel, the majority of Commission staff is analytical professionals with strong academic records and specialized skills in the commodities industry.

Attorneys across the CFTC’s divisions and offices represent the Commission in administrative and civil proceedings, assist U.S. Attorneys in criminal proceedings involving violations of the CEA, develop regulations and policies governing clearinghouses, exchanges and intermediaries, and monitor compliance with applicable rules. In response to the globalization of the derivatives markets, attorneys represent the CFTC internationally in multilateral regulatory organizations and in bilateral initiatives with individual foreign regulators. Commission attorneys also participate in country dialogues organized by the U.S. Department of the Treasury. Much of the Commission’s legal work involves complex and novel issues.

Auditors, Risk Analysts, Trade Practice Analysts, and Attorneys examine records and operations of derivatives exchanges, clearinghouses, and intermediaries for compliance with the provisions of the CEA and the Commission’s regulations. Derivatives trading investigators and specialists perform regulatory and compliance oversight to detect potential fraud, market manipulations and trade practice violations. Risk analysts also perform analyses, which include stress testing, to evaluate financial risks at the trader, firm, and clearinghouse levels.

Economists and Data Analysts monitor trading activities and price relationships in derivatives markets to detect and deter price manipulation and other potential market disruptions. These analysts also monitor compli-ance with position limits. Economists and analysts evaluate filings for new derivatives contracts and amendments to existing contracts to ensure that they meet the Commission’s statutory and regulatory standards. Economists also analyze the economic effect of various Commission and industry actions and events, evaluate policy issues and advise the Commission accordingly.

Management Professionals support the CFTC mission by performing strategic planning, information technology, human resources, staffing, training, accounting, budgeting, contracting, procurement, and other management operations.

-

Our Resources

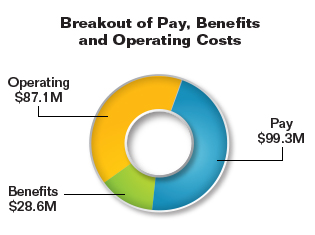

Pay, Benefits and Operating

Personnel costs were 59.5 percent of the Commission’s total obligations in FY 2012.

Technology Portfolio

In FY 2012, The Commission invested $66 million for development, modernization, and enhancements to its surveillance and enforcement systems and general operations and maintenance to its infrastructure.

Performance Highlights

The Performance Highlights present a high-level summary of CFTC's FY 2012 performance. See below for an overview of the Strategic Plan, five strategic goals, as well as the tactical goal for Dodd-Frank Act rule making.

Strategic Plan Overview

FY 2011 – 2015 Strategic Goals Goal 1 Protect the public and market participants by ensuring market integrity, promoting transparency, competition and fairness and lowering risk in the system. Goal 2 Protect the public and market participants by ensuring the financial integrity of derivatives transactions, mitigation of systemic risk, and the fitness and soundness of intermediaries and other registrants. Goal 3 Protect the public and market participants through a robust enforcement program. Goal 4 Enhance integrity of U.S. markets by engaging in cross-border cooperation, promoting strong international regulatory standards, and encouraging ongoing convergence of laws and regulation worldwide. Goal 5 Promote Commission excellence through executive direction and leadership, organizational and individual performance management, and effective management of resources. The FY 2011 - 2015 Strategic Plan, released in February 2011, incorporated enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) which gave CFTC unprecedented oversight responsibility of the swaps marketplace. This new responsibility is in addition to CFTC’s mission of ensuring the fair, open, and efficient functioning of the futures market and represents approximately an eight times growth to the CFTC’s regulatory portfolio. The CFTC 2011 - 2015 Strategic Plan remains consistent with prior year’s goals, but expands its scope to address the regulation of swaps and the resource growth accompanied with this new mission. The Strategic Plan is available at http://www.cftc.gov/ucm/groups/public/@aboutcftc/documents/file/2015strategicplan.pdf.

Objective 0.1 Financial Reform Legislation

The focused rule writing efforts required by the Dodd-Frank Act continue to be treated as a tactical goal that has an Objective, Strategy and Performance Measure. In addition, CFTC staff continues to be diverted from their usual functions to work on Dodd-Frank Act related activities throughout FY 2012. Where proposed and interim final rules have been issued, the Commission remains strong in its position to afford as much opportunity as practicable for public comment both through written submissions and through public meetings. The Commission fully considers the comments and continues to offer this opportunity as additional proposed rules are developed. The CFTC has and will continue to work with the SEC and other regulators to maximize consistency, minimize overlap or duplication, and develop the best possible final rules.

Objective 0.1 Key Results

The Dodd-Frank Act set a timeframe of 360 days (or less in a few instances) for completion of the rules. The Dodd-Frank Act was signed by the President on July 21, 2010, making July 16, 2011 the final date for completion of all the rules. The Commission was unable to complete all rules, within this time, for several reasons:

- The Commission operated under a Continuing Resolution for most of FY 2011 and was unable to hire needed staff and apply critical effort and skills to the completion of this objective.

- To ensure development and implementation of rules that are well balanced between risk mitigation and cost to the industry and public, significant, and open interaction with Congress, industry, and the public was necessary and appropriate.

- While some rules are fairly straight forward, many are intricate and raise interrelated and complex issues. Staff requires appropriate time to analyze, summarize, and consider all comments and aspects of a proposed rule, discuss the proposed rule and comments with the Commissioners, gain feedback, and develop draft final rules for deliberation by the Commission.

Despite the above limitations, the Commission was able to accomplish the following Dodd-Frank Act related rulemaking tasks within the 360 day time frame:

- Issued 54 proposed rules and issued seven final rules.

- Received, reviewed, and analyzed over 27,000 comments.

- Held a second comment period for more than 25 rules.

- Held more than 14 technical conferences.

Actions taken by the Commission since July 2011:

- July – September 2011, issued nine final rules and four proposed rules.

- October 2011 – September 2012, issued 24 final rules and 18 proposed rules and orders.

Strategic Goal One – Market Integrity

2012 Accomplishments

- Completed review process on 229 new product certifications, 490 rule certifications, 21 foreign stock index certifications, and 34 product-related rule filing reviews.

- Designated 2 contract markets and provisionally registered one swap data repository.

- Developed new surveillance analysis tool to evaluate price movements and market events including tools to connect transaction and position databases for determining price formation, pre-arranged trading violation detection and block trading violation detection.

Strategic Goal Two – Clearing Integrity

2012 Accomplishments

- Performed risk analysis and stress-testing on 550,000 large-trader and clearing member positions to ascertain those with significant risk and confirm that such risks are being appropriately managed.

- Implemented new systems to support Internal Revenue Service and credit default swap stress testing and margin analysis and to provide tools for valuation and portfolio analysis. Made progress in updating systems to support expanded financial and risk surveillance activity and increased financial reporting.

- Proposed new regulations, and amendments to existing regulations, to enhance protections for customers, and to strengthen the safeguards surrounding the holding of money, securities, and other property deposited by customers with futures commission merchants and designated contract markets.

Strategic Goal Three – Protect Market Users and the Public

2012 Accomplishments

- Filed 102 enforcement actions and opened more than 350 new investigations, among the highest annual count of new investigations in CFTC history.

- Obtained orders imposing more than $900 million in sanctions and more than $450 million in civil monetary sanctions.

- Established the Whistleblower Office. Launched a new web portal at www.cftc.gov where individuals can file tips and complaints electronically.

Strategic Goal Four – Cross-Border Cooperation

2012 Accomplishments

- As co-chair of an International Organization of Securities Commissions – Committee on Payment and Settlement Systems (IOSCO-CPSS) task force on over-the-counter (OTC) derivatives regulation, authored a report on data reporting and aggregation requirements.

- Co-chaired the IOSCO committee on commodity futures markets and took a leading role in developing a final report that established principles for price reporting agencies in oil. This report was requested by IOSCO and the G-20 as a means to enhance transparency in global oil markets.

- Participated in several bilateral meetings with European Financial regulators led by the U.S. Treasury to discuss, among other things, the E.U. Data Protection Directive, crisis management, Basel II and III, the Volcker rule and OTC derivatives, China Strategic and Economic dialogues with China and India, dialogues under North American Free Trade Agreement, and U.S. Treasury-led dialogues with the European Commission.

Strategic Goal Five – Organizational and Management Excellence

2012 Accomplishments

- Implemented an automated hiring system to replace the manual hiring process thereby increasing hiring efficiencies and speed.

- Established the Consumer Outreach Office to develop education initiatives that help customers protect themselves against fraud.

- Reengineered its budget program activity code structure to provide a method for collecting time, labor and expense data that is aligned with the Commission’s budget and mission critical activities.

- In addition to scaling up storage, processing, and communication bandwidth to support increased activity related to the Dodd-Frank Act, the Commission also migrated internet connections to a Department of Homeland Security-sanctioned Managed Trusted Internet Protocol Service and began implementing continuous monitoring of information security controls in order to enhance cyber-security.

Financial Highlights

The Financial Highlights present a high-level summary of CFTC's FY 2012 financials. See below for the message from the Chief Financial Officer and other financial highlights including an overview of the financial statements.

A Message from the Chief Financial Officer

The public accounting firm, KPMG LLP, on behalf of the Inspector General, reported that the Commission’s financial statements were presented fairly, in all material respects, and were in conformity with U.S. generally accepted accounting principles (GAAP). For the sixth consecutive year the Commission had no material weaknesses, and was compliant with laws and regulations.

The CFTC leverages a financial management systems platform operated by the U.S. Department of Transportation’s Enterprise Service Center, an Office of Management and Budget (OMB) designated financial management service provider. As a consequence, the CFTC is able to accumulate, analyze, and present reliable financial information, or provide reliable, timely information for managing current operations and timely reporting of financial information to central agencies. Furthermore, our system is in substantial compliance with the Federal Financial Management Improvement Act (FFMIA) of 1996 (although CFTC is not required to comply with FFMIA, it has elected to do so).

Mark Carney

Chief Financial Officer

November 15, 2012Summary of FY 2012 Financial Statement Audit

Summary of Financial Statement Audit Audit Opinion: Unqualified Restatement: No Material Weakness Beginning Balance New Resolved Consolidated Ending Balance 0 0 0 Summary of Management Assurances

Effectiveness of Internal Control over Financial Reporting (FMFIA § 2) Statement of Assurance: Unqualified Material Weakness Beginning Balance New Resolved Consolidated Reassessed Ending Balance 0 0 0 Effectiveness of Internal Control over Operations (FMFIA § 2) Statement of Assurance: Unqualified Material Weakness Beginning Balance New Resolved Consolidated Reassessed Ending Balance 0 0 0 Conformance with Financial Management System Requirements (FMFIA § 4) Statement of Assurance: Systems conform to financial system management requirements Non-Conformance Beginning Balance New Resolved Consolidated Reassessed Ending Balance 0 0 0 Compliance with Federal Financial Management Improvement Act (FFMIA) Agency Auditor Overall Substantial Compliance Yes Yes 1. System Requirements Yes Yes 2. Accounting Standards Yes Yes 3. USSGL at Transaction Level Yes Yes Financial Summary

The following chart is an overview of the Commission’s financial position. The Commission’s financial statements and notes are available in the Financial Section of the FY 2012 CFTC Agency Financial Report located at: http://www.cftc.gov/ucm/groups/public/@aboutcftc/documents/file/2012afr.pdf.

CFTC Financial Highlights

For Fiscal Years 2012 and 20112012 2011 Condensed Balance Sheet Data Fund Balance with Treasury $82,557,690 $81,785,717 Investments 77,135,901 – Accounts Receivable 20,976 1,109,626 Prepayments 1,803,497 2,574,173 Custodial Receivables, Net 4,140,347 2,574,173 General Property, Plant, and Equipment, Net 53,410,435 42,346,895 Deferred Costs 1,234,223 6,254,873 TOTAL ASSETS $220,303,069 $134,130,510 FECA Liabilities $764,243 $528,512 Accounts Payable 7,217,772 7,092,349 Accrued Funded Payroll and Annual Leave 16,477,676 15,464,338 Custodial Liabilities 4,140,347 2,574,173 Depost Fund Liabilities 77,098 57,127 Deferred Lease Liabilities 24,808,042 21,974,782 Other 19,050 19,649 TOTAL LIABILITIES 53,504,228 47,710,930 Cumulative Results of Operations - Earmarked 99,996,749 23,755,000 Cumulative Results of Operations 20,452,619 17,998,424 Unexpended Appropriations 46,349,473 44,666,156 Total Net Position 166,798,841 86,419,580 TOTAL LIABILITIES AND NET POSITION $220,303,069 $134,130,510 Condensed Statements of Net Cost Gross Costs $207,618,265 $187,648,360 Earned Revenue (227,504) (88,720) TOTAL NET COST OF OPERATIONS $207,390,761 $187,559,640 Net Cost of Operations by Strategic Goal Goal One – Market Integrity $59,198,584 $48,390,387 Goal Two – Clearing Integrity 54,647,465 43,701,396 Goal Three – Protect Market Users and Public 60,972,883 61,144,442 Goal Four – Cross-Border Cooperation 6,947,591 8,440,184 Goal Five – Organizational and Management Excellence 25,654,238 25,883,231 $207,390,761 $187,559,640 Limitations of Financial Statements

Management has prepared the accompanying financial statements to report the financial position and operational results for the CFTC for FY 2012 and FY 2011 pursuant to the requirements of Title 31 of the U.S. Code, section 3515 (b).

While these statements have been prepared from the books and records of the Commission in accordance with GAAP for Federal entities and the formats prescribed by OMB Circular A-136, Financial Reporting Requirements, these statements are in addition to the financial reports used to monitor and control budgetary resources, which are prepared from the same books and records.

The statements should be read with the understanding that they represent a component of the U.S. government, a sovereign entity. One implication of this is that the liabilities presented herein cannot be liquidated without the enactment of appropriations, and ongoing operations are subject to the enactment of future appropriations.

Balance Sheet

The Balance Sheet presents, as of a specific point in time, the economic value of assets and liabilities retained or managed by the Commission. The difference between assets and liabilities represents the net position of the Commission.

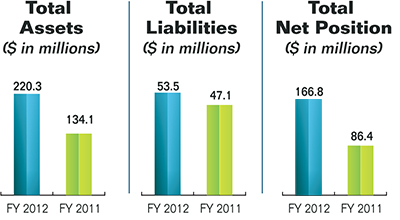

The Balance Sheet presents, as of a specific point in time, the economic value of assets and liabilities retained or managed by the Commission. The difference between assets and liabilities represents the net position of the Commission.For the year ended September 30, 2012, the Balance Sheet reflects total assets of $220.3 million. This is a 64.25 percent increase from FY 2011. The increase is primarily due to large increases in Customer Protection Fund collections and in the Plant, Property, and Equipment balance.

The CFTC litigates against defendants for alleged violations of the CEA and Commission regulations. Violators may be subject to a variety of sanctions including civil monetary penalties, injunctive orders, trading and registration bars and suspensions, and orders to pay disgorgement and restitution to customers. Section 748 of the Dodd-Frank Act amended the CEA by adding Section 23, entitled “Commodity Whistleblower Incentives and Protection.” Among other things, Section 23 establishes a whistleblower program that requires the Commission to pay an award, under regulations prescribed by the Commission and subject to certain limitations, to eligible whistleblowers who voluntarily provide the Commission with original information about a violation of the CEA that leads to the successful enforcement of a covered judicial or administrative action, or a related action. The Commission’s whistleblower awards are to equal, in the aggregate amount, at least 10 but not more than 30 percent of the monetary sanctions actually collected in the Commission’s action or a related action. To provide funding for the Commission’s whistleblower award program, the Dodd-Frank Act established the Commodity Futures Trading Commission Customer Protection Fund. In addition, the Fund can be used to finance customer education initiatives. As of September 30, 2012, the Fund had a balance of $100 million. In FY 2012, the Commission, for the second time, received a two-year appropriation to ensure fiscal certainty in the implementation of the Dodd-Frank Act. The Commission carried over $5.9 million of its FY 2012/2013 appropriation and is using these funds to continue operations during the first quarter of FY 2013.

The Commission’s General Property, Plant and Equipment balance was $11.1 million more in FY 2012 than it was at the end of FY 2011. The increase was attributable to technology modernization and space renovations made in New York and Washington, D.C.

The Commission enters into commercial leases for its headquarters and regional offices. In FY 2012, the agency extended and expanded its lease in New York, NY. These leasing arrangements allowed for monthly rent payments to be deferred until future years as well as provided for landlord contributions to space renovations. These amounts are reflected as a Deferred Lease Liability on the Balance Sheet. Additionally, as should be expected from a small regulatory agency; payroll, benefits, accounts payable and annual leave make up the majority of the remaining CFTC liabilities.

Statement of Net Cost

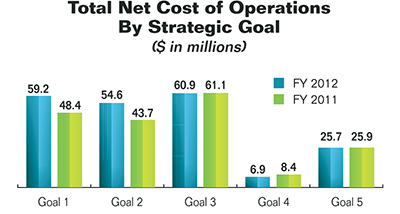

This statement is designed to present the components of the Commission’s net cost of operations. Net cost is the gross cost incurred less any revenues earned from Commission activities. The Statement of Net Cost is categorized by the Commission’s five strategic goals which were revised in FY 2011 to add a new goal: Enhance the integrity of U.S. Markets by engaging in cross-border cooperation to promote strong international regulatory standards. Moreover, for clarity, management realigned most Division of Clearing and Intermediary Oversight work into strategic Goal Two and most Division of Enforcement work into Goal Three.

This statement is designed to present the components of the Commission’s net cost of operations. Net cost is the gross cost incurred less any revenues earned from Commission activities. The Statement of Net Cost is categorized by the Commission’s five strategic goals which were revised in FY 2011 to add a new goal: Enhance the integrity of U.S. Markets by engaging in cross-border cooperation to promote strong international regulatory standards. Moreover, for clarity, management realigned most Division of Clearing and Intermediary Oversight work into strategic Goal Two and most Division of Enforcement work into Goal Three.The Commission experienced a 10.6 percent increase in the total net cost of operations during FY 2012.

Strategic Goal One, which tracks activities related to market oversight, continues to require a significant share of Commission resources at 29 percent of net cost of operations in FY 2012. The $59.2 million reflects a continuation of management’s effort to address market volatility.

Strategic Goal Two is representative of efforts to protect market users and the public. In FY 2012, the net cost of operations for this goal was $54.6 million or 26 percent. The funding for this goal is primarily to support the Division of Enforcement with new and ongoing investigations in response to market activity. Investigations into crude oil and related derivative contracts, and suspected Ponzi schemes have been extremely resource intensive.

Strategic Goal Three is representative of efforts to ensure market integrity. In FY 2012, the net cost of operations for this goal was $61 million or 29 percent, an increase of eight percent from FY 2011. The increase is reflective of the emphasis necessary to develop concrete measures that will bring transparency, openness and competition to the swaps markets while lowering the risk they pose to the American public.

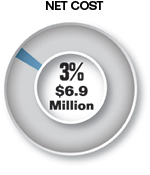

Strategic Goal Four is representative of efforts to increase cross-border cooperation to promote strong international regulatory standards. The net cost of this work, in prior years was subsumed within Goal Five. In FY 2011, the net cost of operations for this goal was $6.9 million or three percent. CFTC is dramatically expanding its cross-border presence through cooperative agreements and active participation on international standards setting organization committees.

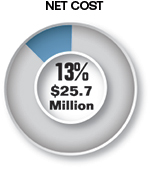

Strategic Goal Five is representative of efforts to achieve organizational excellence and accountability. Included in this goal are the efforts of the Chairman, Commissioners, and related staff to ensure more transparency in the commodity markets, and lay the groundwork for the future. Additionally, these costs are reflective of the planning and execution of human capital, financial management, and technology initiatives. In FY 2012, the net cost of operations for this goal was $25.7 million or 12 percent.

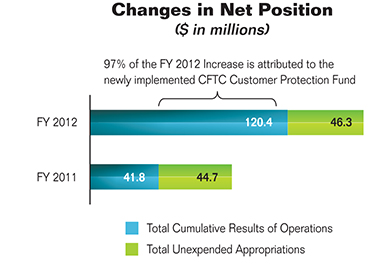

Statement of Changes in Net Position

The Statement of Changes in Net Position presents the agency’s cumulative net results of operation and unexpended appropriations for the Fiscal Year. CFTC’s Net Position increased by $80.3 million, or 90.3 percent, in FY 2012. The dramatic increase is primarily attributed to cumulative net results of operations which rose by $78.7 million (the earmarked funds of Consumer Protection Fund accounted for $76.2 million of that increase) and Total Unexpended Appropriations which reflects a yearly increase of $14.2 million in the cumulative amount of Unexpended Appropriations as of September 30, 2012. This is not unexpected as the earmarked funds for the Customer Protection Fund were not deposited until late September. The Commission had also been operating under a continuing resolution for about seven months and obligated most of its non-compensation and benefit budget in the fourth quarter of the fiscal year.

The Statement of Changes in Net Position presents the agency’s cumulative net results of operation and unexpended appropriations for the Fiscal Year. CFTC’s Net Position increased by $80.3 million, or 90.3 percent, in FY 2012. The dramatic increase is primarily attributed to cumulative net results of operations which rose by $78.7 million (the earmarked funds of Consumer Protection Fund accounted for $76.2 million of that increase) and Total Unexpended Appropriations which reflects a yearly increase of $14.2 million in the cumulative amount of Unexpended Appropriations as of September 30, 2012. This is not unexpected as the earmarked funds for the Customer Protection Fund were not deposited until late September. The Commission had also been operating under a continuing resolution for about seven months and obligated most of its non-compensation and benefit budget in the fourth quarter of the fiscal year.Statement of Budgetary Resources

This statement provides information about the provision of budgetary resources and its status as of the end of the year. Information in this statement is consistent with budget execution information and the information reported in the Budget of the U.S. Government, FY 2012.

This statement provides information about the provision of budgetary resources and its status as of the end of the year. Information in this statement is consistent with budget execution information and the information reported in the Budget of the U.S. Government, FY 2012.The $205.3 million appropriation received in FY 2012 represented no increase for the Commission. This permitted the Commission to continue to fund benefits and compensation, lease expenses, printing, services to support systems users, telecommunications, operations, and maintenance of IT equipment. In FY 2012, gross outlays were in line with the gross costs of operations due to increased hiring, space renovations, and technology spending.

Statement of Custodial Activity

Total Cash Collections ($ in millions) Registration and Filing Fees $1.8 Fines, Penalties, and Forfeitures $259.7 General Proprietary Receipts $0.3 Total $261.5

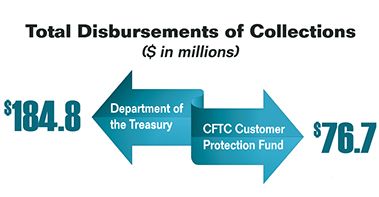

This statement provides information about the sources and disposition of collections. With the inception of the CFTC Customer Protection Fund, CFTC transfers earmarked funds to it and Non-exchange revenue to the Treasury general fund. Collections are primarily represented by fines, penalties, and forfeitures assessed and levied against businesses and individuals for violations of the CEA or Commission regulations. They also include non-exchange revenues include registration, filing, appeal fees, and general receipts. The Statement of Custodial Activity reflects total cash collections in the amount of $261.5 million. Of which $184.8 million was transferred to U.S. Department of Treasury and $76.7 was transferred into the Customer Protection Fund. This amount represents an increase of $70.9 million from FY 2011, when the Commission collected $5.7 million.

Historical experience has indicated that a high percentage of custodial receivables prove uncollectible. The methodology used to estimate the allowance for uncollectible amounts related to custodial accounts is that custodial receivables are considered 100 percent uncollectible unless deemed otherwise. An allowance for uncollectible accounts has been established and included in the accounts receivable on the Balance Sheet. The allowance is based on past experience in the collection of accounts receivables and an analysis of outstanding balances. Accounts are re-estimated quarterly based on account reviews and a determination that changes to the net realizable value are needed.

FY 2012 Commissioners

-

Gary Gensler, Chairman

Gary Gensler was sworn in as the Chairman of the Commodity Futures Trading Commission on May 26, 2009. Chairman Gensler previously served at the U.S. Department of the Treasury as Under Secretary of Domestic Finance (1999-2001) and as Assistant Secretary of Financial Markets (1997-1999). He subsequently served as a Senior Advisor to the Chairman of the U.S. Senate Banking Committee, Senator Paul Sarbanes, on the Sarbanes-Oxley Act, reforming corporate responsibility, accounting and securities laws.

As Under Secretary of the Treasury, Chairman Gensler was the principal advisor to Treasury Secretary Robert Rubin and later to Secretary Lawrence Summers on all aspects of domestic finance. The office was responsible for formulating policy and legislation in the areas of U.S. financial markets, public debt management, the banking system, financial services, fiscal affairs, Federal lending, Government Sponsored Enterprises, and community development. In recognition of this service, he was awarded Treasury’s highest honor, the Alexander Hamilton Award.

Prior to joining Treasury, Chairman Gensler worked for 18 years at Goldman Sachs where he was selected as a partner; in his last role he was Co-head of Finance. Chairman Gensler is the co-author of a book, The Great Mutual Fund Trap, which presents common sense investment advice for middle income Americans.

He is a summa cum laude graduate from the University of Pennsylvania’s Wharton School in 1978, with a Bachelor of Science in Economics and received a Master of Business Administration from Wharton School’s graduate division in 1979. He lives with his three daughters outside of Baltimore, Maryland.

Jill E. Sommers, Commissioner

Jill E. Sommers was sworn in as a Commissioner of the Commodity Futures Trading Commission on August 8, 2007 to a term that expired April 13, 2009. On July 20, 2009 she was nominated by President Barack Obama to serve a five-year second term, and was confirmed by the United States Senate on October 8, 2009.

Commissioner Sommers serves as the Primary Sponsor of the Commission’s Global Markets Advisory Committee, which meets periodically to discuss issues of concern to exchanges, firms, market users and the Commission regarding the regulatory challenges of a global marketplace.

Commissioner Sommers has worked in the commodity futures and options industry in a variety of capacities throughout her career. In 2005 she was the Policy Director and Head of Government Affairs for the International Swaps and Derivatives Association, where she worked on a number of over-the-counter derivatives issues. Prior to that, Ms. Sommers worked in the Government Affairs Office of the Chicago Mercantile Exchange (CME), where she was instrumental in overseeing regulatory and legislative affairs for the exchange. During her tenure with the CME, she had the opportunity to work closely with congressional staff drafting the Commodity Futures Modernization Act of 2000.

Commissioner Sommers started her career in Washington in 1991 as an intern for Senator Robert J. Dole (R-KS), working in various capacities until 1995. She later worked as a legislative aide for two consulting firms specializing in agricultural issues, Clark & Muldoon, P.C. and Taggart and Associates.

A native of Fort Scott, Kansas, Ms. Sommers holds a Bachelor of Arts degree from the University of Kansas. She and her husband, Mike, currently reside in the Washington, D.C. area and have three children ages 10, 9, and 8.

Bart Chilton, Commissioner

Bart Chilton was nominated by President Bush and confirmed by the U. S. Senate in 2007. In 2009, he was re-nominated by President Obama and reconfirmed by the Senate. He has served as the Chairman of the CFTC’s Energy and Environmental Markets Advisory Committee (EEMAC). His career spans 25 years in government service—working on Capitol Hill in the House of Representatives, in the Senate, and serving in the Executive Branch during the Clinton, Bush and Obama Administrations.

Prior to joining the CFTC, Mr. Chilton was the Chief of Staff and Vice President for Government Relations at the National Farmers Union where he represented family farmers. In 2005, Mr. Chilton was a Schedule C political appointee of President Bush at the U. S. Farm Credit Administration where he served as an Executive Assistant to the Board. From 2001 to 2005, Mr. Chilton was a Senior Advisor to Senator Tom Daschle, the Democrat Leader of the United States Senate, where he worked on myriad issues including agriculture and transportation policy.

From 1995 to 2001, Mr. Chilton was a Schedule C political appointee of President Clinton where he rose to Deputy Chief of Staff to U. S. Secretary of Agriculture Dan Glickman. In this role, Mr. Chilton became a member of the Senior Executive Service (SES)—government executives selected for their leadership qualifications to serve in the key positions just below the most senior Presidential appointees. As an SES member, Mr. Chilton served as a liaison between Secretary Glickman and the Federal work force at USDA.

From 1985 to 1995, Mr. Chilton worked in the U. S. House of Representatives where he served as Legislative Director for three different Members of Congress on Capitol Hill and as the Executive Director of the bipartisan Congressional Rural Caucus.

Mr. Chilton has served as a strong advocate for consumers and businesses alike and is the author of Ponzimonium: How Scam Artists are Ripping Off America.

Mr. Chilton was born in Delaware and spent his youth in Indiana, where he attended Purdue University (1979-1982). He studied political science and communications and was a collegiate leader of several organizations. Mr. Chilton and his wife, Sherry Daggett Chilton, split their time between Washington, D.C. and Arkansas.

Scott O’Malia, Commissioner

Scott O’Malia was confirmed by the U.S. Senate on October 8, 2009, as Commissioner of the Commodity Futures Trading Commission, and was sworn in on October 16, 2009. He is currently serving a five-year term that expires in April 2015.

Born in South Bend, Indiana and raised in Williamston, Michigan, Commissioner O’Malia learned about commodity prices firsthand growing up on a small family farm. As a Commissioner of the Commodity Futures Trading Commission (CFTC), he brings both his agricultural background and experience in energy markets, where he has focused his professional career.

Before starting his term at the CFTC, Commissioner O’Malia served as the Staff Director to the U.S. Senate Appropriations Subcommittee on Energy and Water Development, where he focused on expanding U.S. investment in clean-energy technologies, specifically promoting low-cost financing and technical innovation in the domestic energy sector.

From 2003 to 2004, Commissioner O’Malia served on the U.S. Senate Energy and National Resources Committee under Chairman Pete Domenici (R-N.M.), as Senior Policy Advisor on oil, coal and gas issues. From 1992 to 2001, he served as Senior Legislative Assistant to U.S. Sen. Mitch McConnell (R.-Ky.), now the Senate Minority Leader. During his career, O’Malia also founded the Washington office of Mirant Corp., where he worked on rules and standards for corporate risk management and energy trading among wholesale power producers.

In his time at the CFTC Commissioner O’Malia has advanced the use of technology to more effectively meet the agency’s oversight responsibilities and is seeking the reestablishment of the long dormant CFTC Technology Advisory Committee (C-TAC). As Chairman of the newly reinstated Committee, Commissioner O’Malia intends to harness the expertise of the C-TAC membership to establish technological ‘best practices’ for oversight and surveillance considering such issues as algorithmic and high frequency trading, data collection standards, and technological surveillance and compliance.

Commissioner O’Malia earned his Bachelor’s Degree from the University of Michigan. He and his wife, Marissa, currently live in Northern Virginia with their three daughters.

Mark Wetjen, Commissioner

Mark P. Wetjen was sworn in as a Commissioner of the U.S. Commodity Futures Trading Commission on October 25, 2011. Commissioner Wetjen brings to the agency seven years of experience working for the Majority Leader of the U.S. Senate, Senator Harry Reid, whom he advised on all financial-services-related matters, including the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Commissioner Wetjen worked closely with the relevant congressional committees on Title VII of the Act, which the CFTC is charged with implementing. Before his service in the U.S. Senate, Commissioner Wetjen was a lawyer in private practice and represented clients in a variety of litigation, transactional and regulatory matters.

Born and raised in Dubuque, Iowa, Commissioner Wetjen received a bachelor’s degree from Creighton University and a law degree from the University of Iowa College of Law. He lives with his wife, Nicole, and son on Capitol Hill.