Keynote of Chairman Rostin Behnam at the 2023 U.S. Treasury Market Conference

“Not Flashy, but Foundational”

November 16, 2023

Remarks prepared for delivery

Introduction[1]

Good afternoon. It is a pleasure to join you today at the Federal Reserve Bank of New York.

The New York City Marathon took place just over a week ago. Though the course did not wind its way through the Financial District, it covered all five boroughs, and hosted just under 52,000 runners from 148 countries.[2] Over 2 million in-person spectators set an all-time record for subway ridership,[3] securing its standing as the largest marathon in the world.

Marathons and marathon training—with an estimated 1.1 million finishers worldwide annually and 50 million Americans participating in some form of running or jogging[4]—yield a lot of data. This is especially true now that most of us have swapped out a traditional wrist watch for a smart watch, allowing us to effortlessly share data on dozens of physical activities with services like Strava[5] who aggregate, analyze, and socialize it.

Strava provides its subscribers a means to track their progress, connect with others, and explore greater opportunities, but it also provides a vast universe of data and metrics that can help answer questions well beyond where you can map out a quick 10k before work. A recent analysis of Strava data across six major marathons aimed at learning more about qualifying for the prestigious Boston Marathon[6] yielded some fascinating insights.

For example, the data showed that despite the instinct to just go all out, all the time, there was a strong positive correlation between keeping training runs slower and ultimately hitting goal pace on race day. The slower runs help build capillary beds and a stronger heart, increasing endurance capabilities over time. Whereas running too fast causes muscle and bone breakdown that cannot be overcome by recovery. [7]

The courses mattered too, both in terms of conditions and who was out there running: dynamics and demographics. Things like elevation changes, relative humidity, and the overall caliber of runners also impacted performance.

The data highlighted the benefits of running negative splits: running the second half of the race faster than the first. And not surprisingly, experience matters. There is a definitive learning arc when it comes to pacing and fueling for race day that can only really be learned through the process of racing.[8]

None of this is flashy, but it is foundational.

This is the 9th Annual Treasury Market Conference. We come together every year to share our insights and experiences because of the Treasury market’s unique role in the global economy. At our first conference in 2015, CFTC Chairman Timothy Massad differentiated the structural elements between the cash Treasury and Treasury futures markets. [9] He also highlighted findings of a recent joint report on significant volatility events in the U.S. Treasury market,[10] and how the availability of data and continued efforts towards strengthening monitoring would be critically impacted by increased automated trading and cyber risk. That was nearer to the beginning of our current data arc at the Commission—we were just warming up.

We are over a decade past the course-altering impacts that the Dodd-Frank Act had on market data. And, with the rapid evolution of technologies far beyond the automated trading that captured our attention just a few years ago, the CFTC’s data program is now running negative splits as we move forward and engage with the Administration and within our regulated markets.

The President’s recent Executive Order on the Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence (AI),[11] is meeting us mid-stride. The Executive Order (EO) directs developers to share safety test results and other critical information with the U.S. Government, while the Government works to develop standards, tools and tests to ensure safe, secure and trustworthy AI systems.

As a derivatives market regulator, the CFTC understands all manner of risk. We build our capabilities in lock step with the market’s trajectory-- recognizing that with any new challenge comes promise and peril. Using our experiences to hone processes and policies necessary to meet the course wherever it veered, we are now well-positioned to take an early lead. As I will elaborate on a little later, we have already developed and deployed safe and secure AI and machine learning (ML) algorithms. And, we are working alongside the Administration and with international AI governance frameworks to ensure AI advances in the futures markets benefit from our experiences.

I cannot stress enough the importance of teamwork when it comes to ensuring that the latest innovations in financial markets are evaluated for fitness within the regulatory fold. As I have said before, the entrance of market structures and participants who are eager to deploy all manner of fintech must comply with the rules of the road. This is especially true when it comes to protecting customers, consumers, and the larger financial markets from fraud, money laundering, and other financial crimes. When the use of digital assets and related enabling technologies for illicit finance purposes threatens national security and may fund acts of war and terrorism, we must continue to aggressively demand that all market entrants implement and comply with know-your-customer (KYC) and anti-money laundering (AML) procedures and Customer Information Programs (CIPs). The CFTC is doing its part by bringing enforcement cases like BitMex[12] and Binance.[13] However, I believe we are capable of more if given additional authority to in the KYC, AML, and CIP space and welcome the opportunity to work with Congress on solutions.

Today, I want to begin with some current insights into the U.S. Treasury Market. I will then talk about our progress with data infrastructure, organization, and analytics and how that foundational building has prepared us to move forward from automated trading to address the risks and opportunities presented by incorporating AI and ML into our day-to-day operations and policymaking.

Course Matters: Basis Trading

The U.S. Treasury market’s stats ensure it maintains a comfortable lead even in the world of elites. Indeed, the brand message for the Treasury market is that it remains “the deepest and most liquid market in the world and a central component of the financial system.” [14] With roughly $25 trillion outstanding, investors rely on Treasuries as a safe haven in times of market stress. Sought after for their historic stability, certain Treasuries serve as benchmarks for other fixed income securities and rates. The U.S. Government relies on the sale of Treasury securities to finance its operations and manage debt, while the U.S. Treasury repo market serves as a conduit for monetary policy. It bears repeating that the U.S Treasury market affects global financial markets and economic stability. (Like the NYC marathon, it reigns supreme in terms of participants and spectators.)

Turning to CFTC regulated markets, Treasury futures markets are robust with vibrant open interest, volumes, and number of traders. For example, for the 10-year futures contract, open interest is on the order of 4.6 million contracts, with approximately 2,500 traders trading more than 1.7 million contracts on average per day. Demographically, there is a healthy field of traders with different businesses and risk profiles whose provision of liquidity enables effective risk transfer and hedging by banks, asset managers, and other institutional market participants.

|

Treasury Futures Markets Snapshot as of 11/2023 |

|||

|

Futures Contract |

Open Interest |

Daily Trading Volume |

# of Traders |

|

2-Year |

3.7 Million |

628,000 |

~1,000 |

|

5-Year |

5.2 Million |

1.3 Million |

~1,500 |

|

10-Year |

4.6 Million |

1.7 Million |

~2,500 |

Source: CFTC Data.

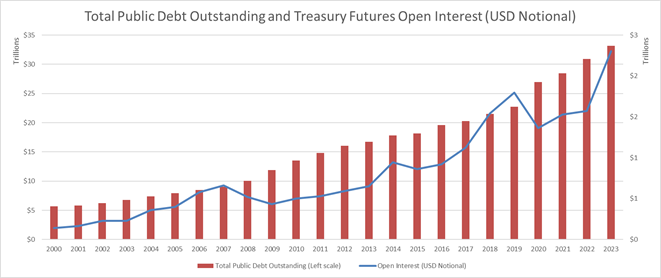

The Treasury futures market has kept pace with the Treasury cash market’s increasing size. For example, open interest for Treasury futures at the end of fiscal year 2023 was just over 19 million contracts (notional of $2.3T USD), compared with 2013’s open interest of under 6 million contracts (notional of $650B USD). This corresponds to the growth in the US government public debt outstanding from about $17 trillion to about $33 trillion over the same time period.

Source: U.S. Department of the Treasury and CFTC calculations

Participant growth has widened in the futures market. The head count of “Large Traders” holding positions in 10-year Treasury note futures and enumerated in the CFTC’s Commitments of Traders reports (CoT) grew from about 300 in 2013 to over 400 currently. I note this because the record position sizes held by certain types of traders should be placed in this context. That is, to understand and appreciate the headlines, it’s helpful to analyze the data.

News stories have focused on potential impacts of the Treasury cash-futures basis trade,[15] and the highlight is often the one signal of the trade that is publicly reported every week in near real time through the CoT: Treasury futures positions held by Asset Managers and Leveraged Funds. The breathless stories exclaim how the trade is “at extreme levels” and follows the same trending behavior as in 2018-2019.[16] With reports of top U.S. regulators “zeroing in on dangers,”[17] and “considering options,” we should take a closer look at the highlight reel and hone in.

While there is a record number of contracts, this is consistent with historical relations between the size of the futures market and the size of the cash market. Large positions by Asset Managers and Leveraged Funds should be interpreted in the context of a larger amount of cash Treasury securities to manage by market participants—remember, the course matters.

The CoTs provide the headlines, showing a large increase in net shorts by Leveraged Funds, and large increases in net longs by Asset Managers, roughly over the past year. Getting into the story, we are checking off the more obvious questions to understand the field, like: (1) Are positions getting larger because more participants are getting in, or is it because existing participants are holding larger positions?; (2) Is there dramatic fluctuation in the participants driving aggregate position changes, or is it “the usual cast of characters?”; and (3) How heterogeneous, and how concentrated, are the participants within these groupings of trader types?

We dive into the data to shed light on some of these questions and compare the futures positioning in the 2-Year note futures contract in March vs. September 2023. This was a period when the net short positions held by Leveraged Funds increased from just under 500,000 contracts to nearly 1.4 million contracts, well noted by the financial press.[18] Net longs held by Asset Managers simultaneously increased from 700,000 contracts to 1.2 million contracts. To a large extent, these two categories of traders are dominating the market activity. Open Interest grew from 2.3 million contracts to 3.9 million contracts.

So, are new traders coming in or are these the experienced traders maintaining their fitness? The data provides insight into dynamics and demographics. At the end of March there were just over 400 Large Traders; by the end of September there were just over 500. Roughly 100 entities eliminated positions between those dates, and roughly 200 added new positions, so the net result was about a hundred more. But this change in the field was not the major driver of aggregate position changes.

Like most contracts, the bulk of contract holdings are concentrated in entities holding large positions. For example, going back to March, about 10% of the entities (25 largest shorts and 25 largest longs) held over half of the open positions. Put another way, the top 50 entities held about 60% of the open positions. And the top 100 entities—or roughly one quarter of the traders, held about 70%.

Further exploring the field, in both March and September, the largest net longs and net shorts were predominately in one direction or the other. Most—but not all—of the 25 largest net shorts were Leveraged Funds, and most—but not all—of the 25 largest net longs were Asset Managers. Comparing their identities reveals that there was not a dramatic turnover of the positions. Like elites on the course, many of the entities holding large positions in the spring remain and held onto even larger positions in the fall.

Not only are they holding larger positions, but the largest 25 net short Leveraged Funds nearly doubled their positions from March to September; the positions moved from 1.4 million to 2.5 million contracts net short. The largest 25 net longs also increased their positions, but not to the same extent. Additionally, the largest net longs in March increased their positions from 1.1 million to 1.4 million, suggesting a more concentrated increase among the shorts than among the longs.

Back to the headlines having weaved through a bit of the data, the CFTC can add the context, provide some insights, and determine whether and what next steps are warranted. There is other relevant data, and the Basis trade spans multiple regulatory agencies, with none seeing the full picture and understanding the true risks. We all must remain vigilant. The CFTC is monitoring for any anomalies, conducting surveillance, and reaching out to registrants and participants for additional insight. Continuously scanning the road ahead, and informed by what we have encountered along the way, we keep an eye towards ensuring market resiliency and integrity.

It is important to remember that we are here today because of a long history of collaboration and mutual appreciation for our role in monitoring for financial stability and systemic risk. We will continue to participate in and support the FSOC Hedge Fund Working Group and continue with regular discussions of Treasury market activity within the Treasury Inter Agency Working Group.

Hitting Goal Pace: The Data Arc

Like marathoners seeking a Boston qualifier (or “BQ”), regulators have taken varying approaches to achieving the data transparency goals envisioned by the Dodd-Frank Act. The CFTC has been successful in bringing about profound increases in transparency in both the swaps and in the secondary Treasury market over the past several years. In the swaps market, the crisis-induced time trials incented us to go out a little fast, but with some tweaks and incremental adjustments, we now have data on every swaps market transaction that has occurred in the past decade.

The volume of data covers an incredible breadth of market activity – from standardized, exchange-traded swap transactions to modifications of existing bespoke off-facility transactions. We started the race course with an ambitious vision for how data could help address some of the underlying causes of the 2008 financial crisis. Along the way, we built out the internal structures, developed relationships, and established regulations and policies to ensure that our performance adjusted to address market dynamics and risk in an increasingly global economy.

The Dodd-Frank Act required confidential data regarding swaps transactions to be reported to trade repositories and anonymized data for each swap transaction to be publicly disseminated in real time. Reacting to the then increasing opaqueness of the financial sector, these requirements sought to ensure that relatively raw data was (1) available to, and shareable by, regulators for oversight purposes, and (2) that anonymized data was accessible to the public to perform price discovery and information-generation functions.

Dodd-Frank’s vision for swaps data was based off then existing, smaller initiatives in the swaps and corporate bond market: the trade information warehouse maintained by DTCC and TRACE reporting for corporate bonds. These new data requirements were far more ambitious than those prior efforts, and with a proven track record in the futures markets, the CFTC took to the streets.

But, there were hurdles.

Foremost, the intrinsic opacity of the swaps markets was by design, and many large players benefited from the lack of transparency. In the absence of uniform data standards and a lack of industry consensus on how reporting should occur, large and small players alike were not motivated to push past the competition and be first to cross the line on compliance.

The Commission nevertheless charged ahead with rulemakings, using the largely principles-based approach characteristic of the futures markets.

As swaps data began flowing into the Commission and out to the public, it became clear that the principles-based approach had not inspired the industry to coalesce around defined standards. We needed to engage the participant field and pivot to a more rules-based approach.

The Commission adjusted and pursued a multilateral approach through international bodies like IOSCO, the Bank for International Settlements Committee on Payments and Market Infrastructures (CPMI) and the Financial Stability Board (FSB) to create governance bodies that could ultimately create data standards needed to address the shortcomings.

Harmonization efforts began with the G20’s 2011 call for the creation of a new global identifier, the legal entity identifier (LEI), to be used to identify counterparties to financial transactions reported to trade repositories.[19] Within a few years, regulators recognized further need for harmonization to ascertain a comprehensive view of the OTC derivatives market. The FSB therefore recommended that authorities work to standardize other important data elements reported to trade repositories[20].

The CPMI-IOSCO Harmonisation Group (HG) was established in November 2014. Over several years, it issued Technical Guidance for a Unique Transaction Identifier (UTI), a Unique Product Identifier (UPI), and other Critical Data Elements (CDE). The guidance provided authorities with uniform definitions, formats, and allowable values that can be universally adopted to represent the terms of reportable OTC derivatives contracts.

The CFTC has maintained the lead in these efforts, and currently acts as co-chair of the international governance body[21] for these harmonized data elements. The CFTC was the first to implement LEI in its swaps reporting, and in 2020, revised its swaps reporting rules to incorporate many of the harmonized data elements including UTI and many of the CDE data elements.[22] In January 2024, the CFTC will be the first regulator globally to adopt UPI in its swaps reporting.[23] The CFTC is also in the process of updating other futures and swaps data-related rules[24] to further standardize the data we receive as well as incorporate additional standards, such as LEI and UPI.

With the passing of the Financial Data Transparency Act (FDTA) during 2022, Congress voiced a clear directive for financial regulators to coalesce around common standards like the LEI. Data standardization not only improves the quality of the data received, but it enhances the efficiency of how we use the data to regulate our markets. While the CFTC has made great progress, standards like the LEI have not made their way into many other financial regulatory data reporting requirements. As regulators implement the FDTA, domestic data standardization will grow – as will the potential for linking previously distinct data sets to capture new insights. Take that, Strava!

As the Commission continued along its data journey with the implementation of its 2020 swap data rules in December 2022, we were simultaneously preparing for the arrival of improved, more standardized, swaps data. The Commission has been amending its historical data reporting requirements – such as reports by futures commission merchants – to incorporate standards already present in the swaps data, like the LEI. And, as the Commission moves its historical datasets to a cloud environment, we are developing an architecture that stores our datasets in such a way that all of our data is linked by common standards and associated with individual regulatory requirements. This singular source for data will help us view our markets more holistically – and better see the connections between the futures and the swaps markets and the risks that move seamlessly throughout.

Picking up the Pace

The CFTC has, under my direction, moved to the cloud, achieved significant cybersecurity progress, increased the visibility of, and added new leaders to, our Division of Data, and launched a CFTC-wide technical training initiative. Our goal is the long run: building capabilities over time, under the right conditions, and with the right people and pace towards organizational maturity and technical achievement. Simply put, it’s a marathon, not a sprint.

As a federal agency, we also have required organizational benchmarks, including our Enterprise Data Governance Committee (EDGC), a decision-making body of senior agency executives that facilitates data governance at the Commission. The EDGC is intended to comply with the Foundations for Evidence-based Policymaking Act of 2018 and related Office of Management Budget guidance.

We are continuing to incorporate zero trust architecture and data cataloging activities to transform the end-user computing landscape at CFTC and, critically, protect against supply chain type attacks and insider risk. Recent events highlight the importance of up-to-date security measures.[25] Among other things, this past year, the CFTC implemented an endpoint detection and threat response capability which continuously monitors end-user devices to allow CFTC’s Security Operations Center, to detect and respond to cyber threats such as ransomware and malware. It also provides CFTC enhanced threat intelligence, proactive defense capabilities, and real time and historical visibility into network activity. This augments the CFTC’s ability to effectively track sophisticated attacks, uncover incidents, conduct triage, validate and prioritize attacks, and perform faster and precise remediation activities. In addition to continuing to train all CFTC employees through regular phishing exercises, current priorities include establishing the insider risk program to detect insiders who pose a risk to sensitive information; and mitigate the risks through administrative, investigative or other response actions.

The recent cyberattack on ICBC Financial Services (Industrial and Commercial Bank of China’s U.S. broker) highlights the importance of ensuring registered entities operating in our markets employ up-to-date cybersecurity measures.[26] Fortunately, the cyberattack was discovered quickly, contained, and the manual processing fallbacks appear to have worked as designed. While the full extent and impact of event is still being unpacked, it is a stark reminder of how critical robust cybersecurity measures are to the financial safety of our registrants, as well as the integrity and resilience of our markets. This is one area where the regulators may be able to take a lead.

AI is, and will be, an important part of these efforts – and one that holds significant potential, particularly for supporting our regulatory and enforcement objectives. At my direction, the Commission has been busy building a forward-looking AI culture that complements our existing advanced analytics capabilities. That culture begins with talent.

In a few weeks, the CFTC will welcome a new Chief Data Officer. While an official announcement is forthcoming, I am pleased to report that I originated, and the CFTC hired, its first Chief Data Scientist (CDS), who will lead our AI training and implementation. Our CDS is a long-time CFTC employee who has served in many positions and demonstrates incomparable institutional knowledge of the CFTC data sets. His analytics capabilities paired with demonstrated thought leadership and communication style will expertly pace us in the months and years to come.

In addition to adding new talent, we are investing in existing CFTC staff. Upskilling is a major priority, and we are taking an analytical approach to that as well. Guided by internal surveys, our CDS is meeting with Division-level leadership to implement anenhanced analytics and AI training program to address opportunities identified by management and self-identified by analysts and economists whose boots—or I suppose sneakers—are on the ground.

The Commission is leveraging the significant investments we have been making to move the CFTC’s massive regulatory databases to the AWS cloud. The cloud is a gamechanger—it is the BQ. It makes big data and big computing technologies accessible to smaller agencies like ours. More importantly, it enables our analysts and investigators to access the most advanced algorithms and AI at scale to perform analysis of unprecedented size and scope.

The Commission’s use of AI is not hypothetical. This summer, the Division of Data staff and contractors successfully built and deployed an AI model to detect data anomalies that were not previously detected in exchange reported regulatory data. The output of this AI model streamlines the task of “cleaning” the data so that analysts and economists can expedite their day-to-day surveillance and long-term projects, thus building efficiencies. I cannot underscore my excitement about this great success. A project that started a few months into my chairmanship has yielded unprecedented results, and will act as a foundation for future growth and development that will take the CFTC forward on an upward trajectory.

The Commission is currently exploring other AI use cases. We have a process in place for exploring AI use cases targeted on helping us better monitor, regulate, surveil, identify pockets of stress, and ultimately enforce compliance by identifying violative conduct. This process strategically aims to identify the highest return-on-investment projects to pursue.

Not surprisingly, AI and advanced analytics hold particular promise in the enforcement space. The Division of Enforcement currently uses big data and advanced analytical techniques to identify spoofing behavior and other disruptive trading strategies in our markets. Existing algorithms have already identified multiple potential spoofing cases including more complex spoofing techniques like cross-market spoofing, which have led to enforcement actions. Augmenting existing algorithms with AI will only enhance our ability to efficiently and accurately identify unlawful trading behavior in our markets.

The CFTC has also entered the gates of natural language processing (NLP). The breakthroughs in NLP and large language models (LLMs) of the last years have stimulated a vibrant market for NLP code, tools and services. The CFTC has many straightforward NLP use cases around digitization and enhanced search and process automation for the thousands of pages of documentation we receive every year in the form of PDF files, emails, and other unstructured formats. This work has a higher entry fee so to speak, and will be prioritized over the next few years

Keep Training

My AI vision for the Commission complements the directives set forth by the Administration and embodies what I believe to be good government. We are guided by three priorities: (1) promoting responsible AI and innovation; (2) understanding the application of AI for markets, market participants, and the larger financial system and the impacts on all stakeholders, especially the public we serve; and (3) identifying trends and their impacts within our markets and the broader economy.

Members of my team, our Division of Data, and Office of Technology Innovation (OTI) are proactively engaging with domestic and international regulatory bodies and maintaining an open door with the innovative community. Last week, the CFTC, in partnership with the Consumer Financial Protection Bureau, hosted the Global Financial Innovation Network’s (GFIN’s) Annual General Meeting at our DC headquarters. GFIN brings together over 70 global organizations to provide an efficient forum for innovative firms to engage with regulators who are similarly focused on cooperative efforts to support financial innovation and serve the best interests of consumers.[27]

The Commission also partnered with the U.S. Agency for International Development (US AID) to develop a three-day course for an upcoming consulting trip to Ho Chi Minh to advise Vietnam's State Securities Commission on AI in the financial markets. The materials dig deep into the origins of FinTech and route through decades of developments, ultimately bringing us to our current vista.

Over the years, we have learned that we can achieve our greatest regulatory and policy successes through engagement aimed at collecting data and information towards serving a clear purpose, unequivocally tied to protecting markets, market participants, customers, and consumers through the identification of potential risk. As a result of our ongoing work on AI and ML, and in response to the risks outlined by the EO, the CFTC staff will soon announce the formation of an internal Task Force focused on AI in the derivatives markets.

I anticipate that in the new year, the AI Task Force will issue a request for comment (RFC) aimed at gathering information about the current and potential uses of AI by our registered entities, registrants, and market participants in areas such as trading, risk management, and cybersecurity. The RFC will focus on concerns such as safety and security, mitigation of bias, and customer protection. The CFTC will use the responses to inform our supervisory oversight and evaluate the need for future guidance, rulemakings. As always, my approach will be to move forward only after gathering information and data, engaging with stakeholders, evaluating the risks, and ensuring that the we can make any market transition seamless.

The Finish Line

Having roughly taken you through five boroughs of thinking about our marathon data journey, my guess is that you are ready to cross the finish line. These remarks were not necessarily fast or flashy, but certainly foundational in our thinking. After much training, the CFTC is truly hitting a high and it is time to use our momentum to build up our capabilities and stand with the elites.

Thank you.

[1] I appreciate the assistance of the CFTC’s Deputy Chief of Staff Laura Gardy, Acting Chief Economist Scott Mixon, Acting Deputy Director of Market Intelligence in the Division of Market Oversight Rahul Varma, Acting Division of Data Director Tom Guerin, Associate Director of Data Standards and Architecture in the Division of Data Kate Mitchel, Special Counsel to the Chairman Abigail Knauff, and Legal Intern Cyrus Breese in the Office of Chairman Behnam in preparing these remarks.

[2] Press Release, New York Road Runners, TCS New York City Marathon Becomes World’s Largest Marathon in 2023 (Nov. 6, 2023), TCS New York City Marathon Becomes World’s Largest Marathon in 2023 (nyrr.org).

[3] Press Release, New York State Office of the Governor, Governor Hochul Announces Record Subway Ridership on Marathon Sunday (Nov. 6, 2023), Governor Hochul Announces Record Subway Ridership on Marathon Sunday | Governor Kathy Hochul (ny.gov).

[4] Bojana Galic, 126 Running Statistics You Need to Know (updated Oct. 3, 2023, 126 Running Statistics You Need to Know (livestrong.com).

[5] Strava, https://www.strava.com/features (last visited Nov. 2, 2023).

[6] Zoë Rom, Run Slow to Race Fast: What Strava Data Says About Running Easy for Marathon Training (Oct. 13, 2023), Trail Runner, Run Slow To Race Fast: What Strava Data Says About Running Easy for Marathon Training - Trail Runner Magazine.

[7] Id.

[8] Id.

[9] Timothy Massad, CFTC, Remarks of Chairman Timothy Massad before the Conference on the Evolving Structure of the U.S. Treasury Market (Oct. 21, 2015), Remarks of Chairman Timothy Massad before the Conference on the Evolving Structure of the U.S. Treasury Market | CFTC.

[10] See Press Release Number 7197-15, CFTC, Release of Joint Staff Report on October 15, 2014 (July 13, 2015), Release of Joint Staff Report on October 15, 2014 | CFTC.

[11] Exec. Order No. 14,110, 88 Fed. Reg. 75,191 (Oct. 30, 2023), Executive Order on the Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence | The White House.

[12] See Press Release Number 8412-21, CFTC, Federal Court Orders BitMEX to Pay $100 Million for Illegally Operating a Cryptocurrency Trading Platform and Anti-Money Laundering Violations (Aug. 10, 2021), Federal Court Orders BitMEX to Pay $100 Million for Illegally Operating a Cryptocurrency Trading Platform and Anti-Money Laundering Violations | CFTC.

[13] See Press Release Number 8680-23, CFTC, CFTC Charges Binance and its Founder, Changpeng Zhao, with Willful Evasion of Federal Law and Operating an Illegal Digital Asset Derivatives Exchange (Mar. 27, 2023), CFTC Charges Binance and Its Founder, Changpeng Zhao, with Willful Evasion of Federal Law and Operating an Illegal Digital Asset Derivatives Exchange | CFTC.

[14] Inter-Agency Working Group on Treasury Market Surveillance, Enhancing the Resilience of the U.S. Treasury Market: 2023 Staff Progress Report (Nov. 6, 2023) at 1, 20231106_IAWG_report.pdf (treasury.gov).

[15] See, e.g., Jamie McGeever, Leveraged funds’ record short Treasuries bets surge again: McGeever, Reuters (Oct. 23, 2023), Leveraged funds' record short Treasuries bets surge again | Reuters.

[16] See, e.g., Robin Wigglesworth, Who’s afraid of the Treasury basis trade?, FT (Sept. 26, 2023), Who’s afraid of the Treasury basis trade?.

[17] See Lydia Beyoud and Katanga Johnson, U.S. Weighs Leaning on Banks to Curb Hedge Fund Leveraged Trading, Bloomberg (Oct. 19, 2023), US Weighs Leaning on Banks to Curb Hedge Fund Leveraged Trading - Bloomberg.

[18] See, e.g. Barth, Daniel, R. Jay Kahn, and Robert Mann (2023). "Recent Developments in Hedge Funds' Treasury Futures and Repo Positions: is the Basis Trade "Back"?," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, August 30, 2023, https://doi.org/10.17016/2380-7172.3355.

[19] G20, Cannes Summit Final Declaration, Leader’s Declaration (Nov. 2011), https://www.fsb.org/wp-content/uploads/g20_leaders_declaration_cannes_2011.pdf.

[20] FSB, Feasibility study on approaches to aggregate OTC derivatives data (Sept. 19, 2014), https://www.fsb.org/wp-content/uploads/r_140919.pdf.

[21] The Committee on Derivative Identifiers and Data Elements (CDIDE) is a sub-committee of the Regulatory Oversight Committee (ROC). See Regulatory Oversight Committee, https://www.leiroc.org/international_bodies.htm (last visited Nov. 13, 2023).

[22] See Real Time Public Reporting Requirements, 85 Fed. Reg. 75422 (Nov. 25, 2020), https://www.cftc.gov/LawRegulation/FederalRegister/finalrules/2020-21568.html; Swap Data Recordkeeping and Reporting Requirements, 85 Fed. Reg. 75503 (Nov. 25, 2020), 2020-21569a.pdf (cftc.gov).

[23] See Order Designating the Unique Product Identifier and Product Classification System to be Used in Recordkeeping and Swap Data Reporting, 88 Fed. Reg. 11790 (Feb. 24, 2023), 2023-03661a.pdf (cftc.gov).

[24] See Reporting and Information Requirements for Derivatives Clearing Organizations, 88 Fed. Reg. 53664 (Aug. 8, 2023), 2023-16591a.pdf (cftc.gov); Large Trader Reporting Requirements, 88 Fed. Reg. 41522 (proposed June 27, 2023), 2023-13459a.pdf (cftc.gov).

[25] See Paritosh Bansal, Inside Wall Street’s scramble after ICBC hack (Nov. 13, 2023), Reuters, Inside Wall Street's scramble after ICBC hack | Reuters.

[26] Id.

[27] Highlighting our work with the Administration, Elizabeth Kelly, Special Assistant to the President, of the National Economic Council, delivered remarks to the GFIN on “Government Leadership on Artificial Intelligence.”

-CFTC-