Keynote of Chairman Rostin Behnam at the 2022 U.S. Treasury Market Conference

November 17, 2022

Remarks as Prepared for Delivery on November 16, 2022

Introduction

Good afternoon. It is a pleasure to join you today in person as we discuss some of the current issues facing the U.S. Treasury Market.[1]

The Russian invasion has been top of mind for most of 2022, chasing the heels of the multi-year Covid-19 pandemic and stacked with monetary and fiscal policy shifts, environmentally and geopolitically driven supply chain disruptions, and Fintech growth, evolution, and failures. In March, I found myself speaking about market developments before a global audience of futures industry professionals. [2] I was cautious but optimistic; taking cues from the past when monetary policy, geopolitics, and technological rifts resulted in tectonic shifts in our markets that compelled resilience and sound policymaking. It is the “critically important, but not always obvious interconnections” within our markets that ensure our maneuverability as regulators so that we can pivot amid predictable ripples and waves of uncertainty.

At the time, the Russian invasion had already resulted in extreme volatility in many of our key markets and, simultaneously, record trading volume on global platforms. Fortunately, I was able to report that the derivatives markets were reacting and operating well and as anticipated given the challenging situation.

Commission staff were actively monitoring compliance by exchanges, self-regulatory organizations, and intermediaries in the areas of trade processing, execution, and clearing. I emphasized that where regulatory obligations also included maintenance of appropriate margin, customer segregation, and capitalization—the pillars of U.S. derivatives regulation—compliance must unfailingly be maintained by all. The CFTC was on highest alert, sifting through data, communicating with registered entities and market participants, and coordinating domestically and globally with our counterparts from a market resiliency and financial stability standpoint.

The CFTC is focused on ensuring that the derivatives markets continue to facilitate price discovery through trading in liquid, fair, and financially secure trading facilities, and, critically, provide a means for managing and assuming price risks.[3] That said, I would like to use my time to discuss recent observations regarding Treasury futures and commodity markets.

Treasury Futures Markets Trends

To monitor and evaluate our markets, CFTC staff engages in three distinct types of research encompassing data, interpretation and insight. First, the Division of Market Oversight (DMO) produces the weekly Commitment of Traders or “COT” reports. These public, data-focused reports provide detailed information on the aggregate holdings of major trader types. By covering most of our largest physical and financial asset classes, it represents not just information that aids the public in understanding the state of the financial world but, more generally, the current state and expectations around the flows of goods. As of November 1, 2022, CFTC staff published data in 289 contract markets representing 70 commodity groups including agriculture, petroleum and its products, natural gas and its products, electricity, and metals and others. The CFTC recently introduced a new reporting platform that includes both an updated interface that simplifies the downloading of COT data and an Applications Program Interface (API) which enables an easier automated download process.[4]

Second, CFTC staff engage in rigorous, public-facing research that aids in interpreting data collected by the agency, such as that included within the COT reports, and providing analysis on how this data may inform the marketplace and our own policy efforts.

Third, CFTC staff conduct rigorous analysis of market activity, which often includes confidential information on the activity of individual market participants.[5]

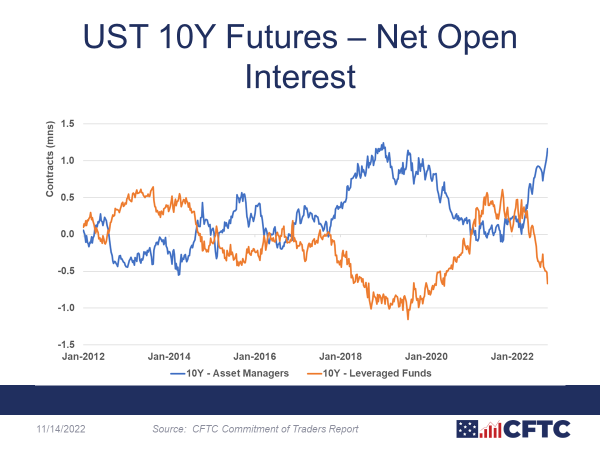

Focusing on the data, the CFTC closely monitors U.S. Treasury futures, a central set of contracts in U.S. markets. CFTC staff finds that the 10-year Treasury note futures contract is probably the most liquid U.S. rates product in risk adjusted terms, followed by the 10-year on-the-run Treasuries. As illustrated by our COT data, asset managers tend to be, on a gross basis, the largest holders of 10-year Treasury note. The chart below illustrates one example of the type of insight that our COT reports bring to the markets. With this data, we can see how asset managers changed their positions over the last ten years in the 10-year Treasury note futures as they adjusted the risk profile of their investment portfolios.

Taking a closer look at these net longs, asset managers broadly increased their Treasury futures positions starting in late 2017 and maintained this positioning until the pandemic hit in 2020. Every outstanding long position must be linked to an outstanding short position; we saw leveraged funds simultaneously hold short positions of similar magnitude to the longs of asset managers during that time period, as demonstrated in the chart. These trends in positioning have been attributed to the large Treasury cash market issuance following the Tax Cuts and Jobs Act of 2017.[6] Further, these net short hedge fund positions are generally understood to have been cash/futures basis trades [long cash/short future], which have been much discussed. It has been suggested that hedge funds were likely positioned to meet asset manager demand during this period, demand that other potential arbitrageurs such as broker-dealers were less willing to provide due to high balance sheet costs, internal risk limits, and leverage constraints.[7]

For roughly the past year, we have seen asset managers, once again, increasing their net long positions in Treasury futures. This time, however, the off-setting short positions are held by a broader group of hedge funds, dealers, and other market participants.

Rigorous interpretation of these facts – understanding the interactions among these groupings, and how they relate to fundamental aspects of Treasury futures market liquidity and resilience – is a focus of ongoing research within the Office of the Chief Economist. As part of the FSOC Hedge Fund Working Group discussion, staff economists have analyzed individual positions in futures for hedge funds and asset managers to understand the execution of strategies and the implications for financial stability. Staff are actively engaged in research projects on Treasury futures, including joint work between staff in both the Office of the Chief Economist and the Federal Reserve Board of Governors in using tens of millions of transaction-by-transaction observations to test hypotheses regarding Treasury market functioning.

In internal analysis, staff have examined the activities of asset managers and leveraged funds in the period leading up to, and during, the market stress of March 2020 coinciding with the onset of COVID-19. We find that neither of these trader groups was homogeneous; participants engaged in a variety of activities that we have analyzed, and continue to analyze. For example, while some hedge funds appear to have engaged in cash/futures basis trading, the positions of those funds varied, and their responses to external events, such as increases in required margin, varied substantially.

Investigating how the broad Treasury market (cash and futures) functions, provides insight into the CFTC perspective on clearing of cash Treasury securities. Dealers have long been central to the Treasury market. CFTC staff work highlights that the inventory of securities held by dealers has grown substantially in the last decade. The cash market itself has grown substantially, and observers have suggested that clearing can help reduce the risk of mis-timed cash flows –a risk that has grown with the size of the market and grows during times of stress.

The majority of CFTC jurisdictional markets are cleared, and all listed contracts are cleared. Nonetheless, we continue to refine our rules in clearing in the swaps space, as we accommodate shifts such as the LIBOR transition. However, these second order issues are dwarfed by the benefits of central clearing when it comes to risk. To dig further in, I would like to share some additional insights from the CFTC’s internal analysis in monitoring and evaluating the risks in cleared derivatives markets and the cash flows resulting from them.

Market Performance and Central Clearing

The market turmoil related to the global pandemic tested the resilience of the derivatives markets and the efficacy of post-financial crisis reforms. The volatility in global financial markets during March and April 2020 and throughout 2022 given geopolitical issues, raised challenges for some market participants as liquidity demands rapidly rose in the face of initial margin increases and variation margin calls.[8]

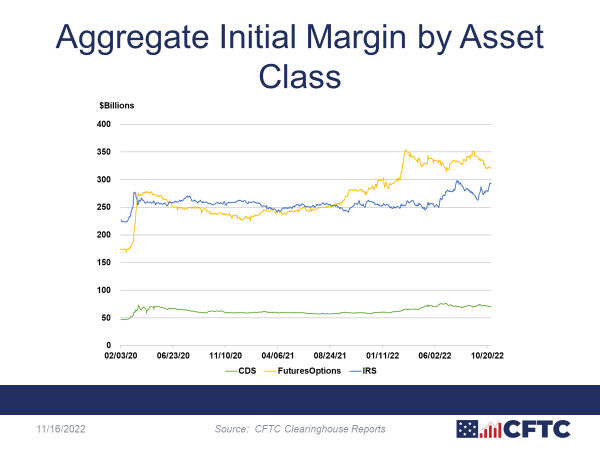

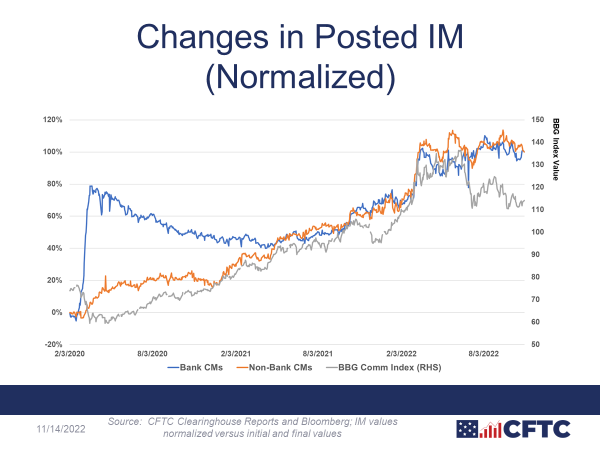

Increases for commodity-related markets this year were most strongly concentrated in the last weeks of February and first weeks of March – the initial period of the Russian invasion of Ukraine. However, they were not isolated to these weeks. With both economic and geo-political concerns rising as we neared the end of last year, and current worries about energy supplies in the winter months of this year, margin demands have actually been elevated from September 2021 until now, as demonstrated in the chart below. Outside of recent months, margin increases over the past year have been primarily driven by physical commodities, often led by energy products. These increases have left margin levels now at or near record highs across all of our major asset classes, with futures-and-options, which include commodities, now representing a plurality of this total.

However, though much of the early part of this year rightly focused, and continues to focus, on the risks associated with volatility in physical commodity markets, clearing shifts in more recent months have actually been more dominated by cleared interest rate products. In fact, total margin posted against our regulated interest rate positions rose by approximately $50 billion in the last few months, an increase very similar to that seen in March in futures markets.

These shifts appear to have left current margin levels at conservative levels relative to recent market conditions. As the chart below demonstrates, even as commodity prices have fallen over the last few months, margin posted at CFTC regulated clearinghouses remains high; this is a common feature of margin models, with central counterparties (CCPs) working to ensure that they are adequately protected even in cases when volatility, or prices, rapidly shift or reverse course.

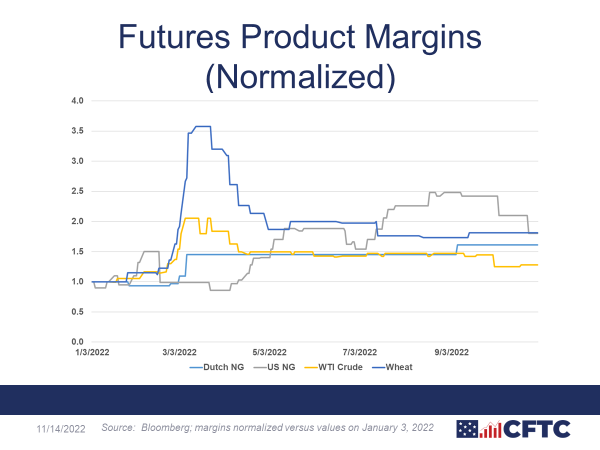

These elevated trends exist at an aggregate level, and at the more granular product level, most notably in energy. The graph below charts margin levels for five key contracts, normalized against margin levels as of last October, roughly a one-year period. Margin for all of the energy contracts remains significantly higher than at the beginning of the period, even in cases like crude oil where prices have fallen far from their recent highs. We believe that, in part because of this, we have observed no margin breaches over the last few months for the major contracts in our markets.

However, these margin increases necessarily result in liquidity calls on both members as well as their clients. Though there is some flexibility in the types of collateral that can be posted to clearinghouses, in practice they usually fall within two categories of high-quality instruments: cash, held either at the central bank or large financial institutions, or, coming back to a main theme of today, sovereign bonds. As of the second quarter 2022, the total amount of sovereigns posted at our clearinghouses exceeded $350 billion, roughly half of all forms of collateral. This puts front-and-center questions about the ease of access to U.S. Treasuries by derivatives market users, and the cost of this access.

These questions about collateral have been far from theoretical this year. Commercial end-users, especially in regions most affected by physical disruptions, have expressed concerns about challenges in collateral access;[9] in some cases, liquidity facilities have been established to aid with this flow, in part providing collateral transformation services for those with non-standard holdings.[10] More recently, rate market movements left participants facing similar questions, for instance when entities like pension funds faced imbalanced flows as a result of hedging strategies.[11] Here, collateral transformation aid may take a different form – switching non-cash assets to cash where payments must be made in specific currency, but the general theme often remains the same. Do entities that need access to collateral like U.S. Treasuries have that access, through what means, and how has that changed through time? One related proposal circulating among our leaders is whether there is a way for CCPs and other clearing agencies serving U.S. clients to access the Federal Reserve deposit accounts as a tool to lower risk in the system given the large flows of collateral, the size of the CCPs, and volatility we are seeing.[12]

We, of course, continue to dig into these questions, now in the light of this year’s events. Recently, the Basel Committee on Banking Supervision (BCBS), Bank for International Settlements’ Committee on Payments and Market Infrastructures (CPMI) and International Organization of Securities Commissions (IOSCO) published a final report on liquidity demands during the early Covid period,[13] a report that included a number of policy themes informed by comment letters from many of you listening. The themes covered areas such as liquidity preparedness, the predictability of liquidity demand, and the value of appropriate demand mitigants. With Treasuries or other sovereign bonds representing such a notable fraction of these liquidity demands and themes, it is a market segment for which forums like these are incredibly important and, for us, necessary to help ensure the connections between it and derivatives remain healthy in the years to come.

Relatedly, a current proposal would, among other things, significantly increase the number of Treasury securities transactions submitted for clearing at covered clearing agencies. Central clearing has been a hallmark of the futures industry for decades, and the implementation of mandatory central clearing for standardized swaps over the last decade has brought effective, risk reducing benefits. Mandatory clearing, however, has not taken effect without raising new challenges. While the market turmoil related to the global pandemic tested the resilience of the derivatives markets and the efficacy of these post-financial crisis reforms, and, today, U.S. CCPs remain among the strongest in the world, we are continually evaluating our regulatory model and assessing opportunities to improve upon it as new challenges emerge. I commend our colleagues for their efforts and am happy to share our expertise in the future.

Beyond the Data

Commodity and financial markets have been especially volatile this year, with exceptional stresses resulting from the onset of, and extended recovery from, the pandemic and Russia’s invasion of Ukraine. We remain in the midst of that aggression, which has led to extreme uncertainty in the global markets for energy, agriculture, and metals, often leading to unanticipated movements in commodity prices because of shifting market sentiment: any decision, at any time can and could move markets in extreme ways. This is coupled with shifting monetary policy tightening by the U.S. Federal Reserve and other principal economies around the world, aimed at slowing inflation levels, and, in doing that, resulting in macroeconomic effects on the same commodities and associated consumer and producers more generally. Price movements in these markets are, for those outside of this country, further affected by exchange rates, with the U.S. dollar recently rising to a 20-year high against many other major currencies, putting additional upward pressure on price increases. While this trend may provide an offset to inflationary pressures, for companies that rely on overseas sales and exports for revenues, a strong-dollar environment can mean lower earnings, compounding the negative impacts of higher U.S. interest rates and inflation.[14] Supply-side decisions bring us to a final factor in energy price pressure and uncertainty, with OPEC’s recent decision to decrease production by 2 million barrels per day even while the Ukraine invasion continues having knock-on effects across all commodities.

According to the OECD, Russia’s aggression against Ukraine has undermined the latter’s capacity to harvest and export crops, sunflower seed and wheat among them. Russia plays a key role in global energy and fertilizer markets, acting as the world’s top exporter of natural gas and nitrogen fertilizers, and the second and third leading supplier of potassic and phosphorous fertilizers, respectively. Since the agri-food sector is highly-energy intensive, the reduced export capacity and rising energy and fertilizer prices translates to higher production costs, further increasing food prices and threatening global food insecurity.[15]

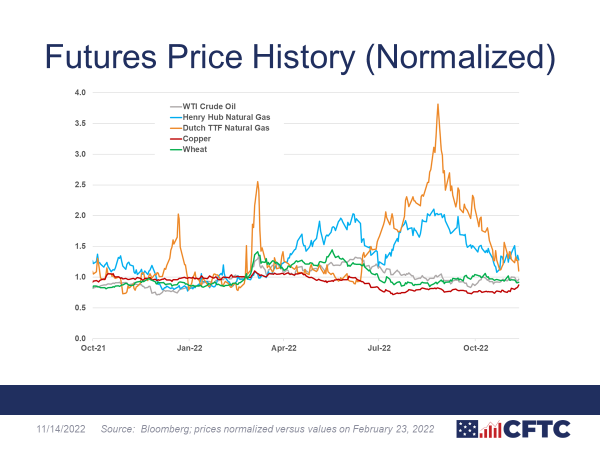

The extreme volatility in key commodity markets is shown in the chart below. Note in particular the exceptionally high prices for European natural gas, where prices in late August reached nearly 4 times the price levels before the invasion, while prices in the U.S. doubled from their pre-invasion levels, as U.S. LNG exports to Europe increased to record levels.

CFTC staff, at my direction, are using every tool the agency has to ensure that commodity markets continue to fairly and transparently serve their intended price discovery and risk management function. We can talk about the data for days, but in times like these, our duty is to ensure that markets are functioning properly so American consumers can be confident that they are not paying a penny extra at the pump, in their homes for heating, or at the grocery store.

Staff have undertaken some deep dives into specific aspects of these markets, for example if managed money traders have an undue impact on the direction of prices. Preliminary analysis across a range of asset classes shows that these traders are a heterogenous group of traders with diverse trading strategies and typically they roll out of contracts before the spot period—which, for metals and agricultural markets is the delivery period. Further, their trading often lags price changes and they are more likely to provide liquidity to other traders than take liquidity.

Properly functioning derivatives markets need liquidity providers to better absorb price spikes that ultimately harm the American consumer. As we have seen with the implementation of the position limits final rule in March 2021, when there is sufficient liquidity in our markets, our markets continue to perform their price discovery functions by being an accurate reflection of supply and demand. During these times of volatility and geopolitical instability, farmers and ranchers and other across the agribusiness sector as well as the energy sector have continued to look to our markets for the risk management and price discovery.

In this regard, the recent position limits rule has provided the CFTC with additional tools to ensure the proper functioning of the commodity markets, by among other things, expanding federal position limits to now include sixteen additional agricultural, energy, and metals futures contracts of particular importance to the U.S. economic (including WTI crude oil and Henry Hub Natural Gas futures) and strengthening the relationships between the Commission and exchanges regarding position oversight and accountability. Additionally, the rule supports risk management by, among other things, expanding the bona fide hedge exemptions for commercial end users – but not financial firms. For example, the rule clarifies that commercial end users may now qualify for hedge exemptions for unfixed price (floating price) transaction, which are common in the agricultural and energy industries and which commercial end users emphasized to staff as important for effective risk management. That said, Congress enacted the position limits regime to ensure derivatives markets function as intended: meeting both price discovery and risk management purposes. I will remain vigilant to ensure our markets and CFTC rules are fit for purpose in achieving the goals Congress mandated.

To summarize, our derivative markets, even during the most stressful periods of this year, functioned as designed. Though highly elevated volatility does commonly result in increases in observed bid-ask spreads and resting depth, at times increasing transaction costs, participants were able to trade in significant volumes and adjust their risk positions effectively, providing reliable price discovery for the global commodity trade. Beyond just the trading platforms, we see that the entire market system, including clearinghouses and clearing members, functioned well and our derivative markets did not transmit significant stress to the broader financial system.

Conclusion

What we have faced these last two-and-a-half years is unprecedented. With respect to the confluence of events shaping our current economy, with particular emphasis on the impact of fuel shortages, the CFTC’s number one responsibility is to ensure that our markets are operating fairly, in an orderly fashion, and free from fraud and manipulation. Collectively, we are doing the best we can in understanding the dynamics of the American consumer, understanding the dynamics of supply constraints, and understanding the very quick pivot towards a return to normal in terms of demand with a much slower supply because of labor supply chain constraints, and geopolitical turmoil.

As 2022 comes to a close, we remain confident that our markets work well and provide an invaluable service to the U.S. economy, but we constantly monitor the markets and we remain vigilant to emerging developments and risks. With shared common goals of supporting robust, resilient markets that support financial stability and stimulate growth, as current external events present more persistent and pressing risks to our jurisdictional markets, this year’s Conference provides an invaluable opportunity to broadly share our observations. I appreciate the opportunity to participate and look forward to ongoing engagement.

[1] I appreciate the assistance of the CFTC’s Acting Chief Economist, Scott Mixon, Deputy Director of Risk Surveillance in the Division of Clearing and Risk, Richard Haynes, and Acting Deputy Director of Market Intelligence in the Division of Market Oversight, Rahul Varma in preparing these remarks.

[2] Rostin Behnam, Chairman, CFTC, Keynote of Chairman Rostin Behnam at the FIA Boca 2022 International Futures Industry Conference, Boca Raton, Florida (Mar. 16, 2022), Keynote of Chairman Rostin Behnam at the FIA Boca 2022 International Futures Industry Conference, Boca Raton, Florida | CFTC.

[3] See Commodity Exchange Act § 3(a); 7 U.S.C. § 3(a).

[4] See Press Release Number 8612-22, CFTC, CFTC Launches New Commitments of Traders Reports (Oct. 20, 2022), CFTC Launches New Commitments of Traders Reports | CFTC.

[5] See, e.g.¸ Commodity Exchange Act Section 8, 7 U.S.C. § 12

[6] See Ayelen Banegas, Philip J. Momin, and Lubomir Petrasek, FEDs Notes, Sizing hedge funds’ Treasury market activities and holdings (Oct. 6, 2021), The Fed - Sizing hedge funds' Treasury market activities and holdings (federalreserve.gov).

[7] Id.

[8] See BCBS-CPMI-IOSCO, Review of margining practices – Consultative report at 2 (Oct. 26, 2021), Review of margining practices (bis.org).

[9] See, e.g. Costa Mourselas and Samuel Wilkes, Esma to meet with clearing industry over EU energy crisis, Risk.net (Sept. 6, 2022), Esma to meet with clearing industry over EU energy crisis - Risk.net; Costas Mourselas, Banks face capital hit on broader energy market collateral, Risk.net (Sept. 12, 2022), Banks face capital hit on broader energy market collateral - Risk.net.

[10] See¸ e.g. Costa Mourselas, ICE to accept EUAs as collateral, Risk.net (Sept. 26, 2022), Ice to accept EUAs as collateral - Risk.net.

[11] See, e.g., Nathan Tipping, Illiquid assets throw UK pensions off balance, Risk.net (Nov. 2, 2022), Illiquid assets throw UK pensions off balance - Risk.net; Costas Mourselas, Pension Funds face intraday margin calls from anxious clearers, Risk.net (Oct. 26, 2022), Pension funds face intraday margin calls from anxious clearers - Risk.net.

[12] See, e.g., Philip Alexander, Sharon Thiruchelvam, and Tom Osborn, Behnam urges wider CCP access to Fed deposit accounts, Risk.net (Apr. 1, 2022), Behnam urges wider CCP access to Fed deposit accounts - Risk.net.

[13] Basel Committee on Banking Supervision (BCBS), Bank for International Settlements’ Committee on Payments and Market Infrastructures (CPMI) and International Organization of Securities Commissions (IOSCO), Review of margining practices (Sept. 2022), Review of margining practices (bis.org). The CFTC co-chaired this report with the Bank of England. It represents one example of a follow-on to the CFTC’s interim staff report on cleared derivatives markets, issued in July of 2021 which provided a preliminary analysis and findings related to activity in our regulated cleared markets during March and April of 2020 as part of our ongoing analytical work to assess the COVID-19 shock on central counterparties (CCPs), clearing members, and their clients. See CFTC, CFTC Interim Staff Report: Cleared Derivatives Markets: March – April 2020 (July 2021), InterimStaffClearedDerivativesMarket0420_0621.pdf.

[14] See Taylor Tepper, Why is the U.S. Dollar so Strong Right Now?, Forbes Advisor (Sept. 30, 2022), Why Is The U.S. Dollar So Strong Right Now? – Forbes Advisor.

[15] OECD, OECD Policy Responses: Ukraine Tackling Policy Challenges, The impacts and policy implications of Russia’s aggression against Ukraine on agricultural markets (Aug. 5, 2022), The impacts and policy implications of Russia’s aggression against Ukraine on agricultural markets (oecd.org).

-CFTC-