Keynote Address of Commissioner Dawn D. Stump at FIA-SIFMA AMG Asset Management Derivatives Forum

February 6, 2020

Decades – The Yesterday, Today, and Tomorrow of Derivatives Regulation

Thank you for the kind introduction. Before I begin, please allow me to remind you that the views I express today in these remarks are my own and do not represent the views of the Commodity Futures Trading Commission (the “CFTC” or “Commission”) or my fellow Commissioners. I see many familiar faces out there. Some of you have known me for a long time, including Walt, whom I have known for more than 20 years. That makes us seem really old, Walt. We are the generation that had only just started our careers in public policy when, at the turn of the century, Congress – with bipartisan support – explicitly instructed the CFTC not to regulate over-the-counter (“OTC”) derivatives because, at the time, many such products were considered bespoke and lacking the standardized elements befitting a market infrastructure like that supporting the futures markets.

But OTC products transformed over a few short years, taking on more standardized forms. It was logical that the evolution of these products would eventually require a more common set of execution, clearing, and reporting obligations. Unfortunately the eventual impetus for this mandate was the financial crisis. In 2008, I had a front row seat to the calamity of the crisis. I was a Congressional staffer and distinctly recall thinking things had changed quickly and should be a lesson as to why the law should constantly be reviewed and refined: In less than a decade this market had transformed to a point that the law was outdated. As you know, Title VII of Dodd-Frank[1] was the response. Another decade has passed since then, and I am proud to have the opportunity to serve at the agency responsible for implementing many of the reforms. Experience tells me that we cannot simply idle the regulations of the past decade or they will soon be outdated and unfit for their intended function.

Now that I have taken you on a trip down my memory lane, the younger folks in the room are trying to do the math to determine whether I am closer to their age or that of their parents. Here are a few hints: I remember writing my name on library cards; in college I used a phone book to look up the number for pizza delivery; most of my early career is documented on floppy disks; and a video of my wedding is trapped on a VHS tape that my family cannot watch because the technology to view it is obsolete. And the final clue: I am actually older than the CFTC. As you might have heard, the Agency is celebrating its 45th birthday this year, and so today I want to focus my remarks on where we have been, where we are now, and where we are going – the yesterday, today, and tomorrow of derivatives regulation.

Stakeholder Engagement

I want to start with you all, the recently expanded set of stakeholders we serve. Some of you have worked with the CFTC for decades in the regulated futures space, while others have only recently become acquainted with the CFTC, post financial crisis, after Congress expanded the CFTC’s authorities to include the swaps market. I find that sometimes these two communities – those who have engaged with the CFTC pre and post crisis – have very different perceptions when it comes to dealing with regulators, and admittedly, the CFTC itself has struggled to bridge these cultures. Sometimes I wonder if much of this is rooted in misunderstanding.

Show of hands, how many of you have survived raising teenagers? Then you know it is a new misunderstanding every day. A few months ago, one of my children responded to a text as follows: “Mom, don’t trip…SMH.” Recognizing SMH as “shaking my head,” I deduced that “don’t trip” was undoubtedly a critical reaction rather than any concern about my falling down and hurting myself. After consulting with Google and Siri, I learned that “don’t trip” means “don’t stress,” so the translation was “don’t stress, calm down, chill out, and please picture my 13 year old self shaking my head in disgust.” But I had quite the opposite reaction as I still had no answer to my original question which very simply was whether his math homework was complete. Was I to surmise that yes, it was done and he was offended at the suggestion that he needed prompting from me? Or was I to assume that no, math was not a priority at the moment because Xbox required his attention? As you can imagine, the misunderstanding culminated in a less than optimal outcome in which the goal of completing homework somehow was lost to a discussion about respect.

So it is sometimes with derivatives regulation. The focus is lost to misunderstanding. Historically, the CFTC’s focus has been on farmers, ranchers, and commercial end-users because they were the primary users of the markets we regulate. More recently, though, the growth of managed assets in our markets, combined with regulatory changes brought about largely as a result of Dodd-Frank, has caused CFTC activities and requirements to have a much greater impact on the buy-side than ever before. This manifests itself in both: (1) the extent to which asset managers can become subject to CFTC registration and regulation; and (2) the extent to which CFTC regulations, although not specifically addressed to asset managers, can have significant implications for them because of today’s substantial buy-side participation in the markets regulated by the CFTC.

Learning from the experience of the past decade, we are working to refine regulatory expectations in the asset management area. The recent amendments to Part 4[2] and codification of no-action relief letters for swap execution facilities (“SEFs”) concerning error trades and intended to be cleared blocks on SEF[3]are examples of: (1) focusing the Commission’s limited and valuable resources on areas of the most significant regulatory interest; (2) protecting US investors and the US markets; (3) reducing unnecessary regulatory burdens for dual registrants; (4) increasing regulatory certainty; and (5) harmonizing the Commission’s rules regarding commodity pool operators and commodity trading advisors with those of its sister regulators, in particular the Securities and Exchange Commission ( “SEC”), where the regulatory goals overlap and where consistent with the Commission’s statutory mandate.

The asset management community is also impacted significantly by the implementation and timing of uncleared margin rules. The Commission has undertaken a review of these rules, and staff issued an advisory this past July clarifying that documentation requirements for uncleared swaps would not apply until a firm exceeds the $50 million initial margin threshold with a particular swap dealer. The Commission continues to work towards further staggering of the implementation phases.

Just as current teenage slang is a bit new to me, I realize that the CFTC is not as well known to some of you as, say, other agencies such as the SEC. Please do not hesitate to come and talk with us about developments in the markets, CFTC regulatory initiatives, and issues of importance to you and your clients that are relevant to the work we do. To achieve the best results, we must strive to keep our eye on the ball of integrating the newly-regulated OTC marketplace into our structure, while preserving what I consider one of our best historical attributes of the CFTC – a spirit of cooperation between the public and private sectors to accomplish well-regulated, efficient markets. To achieve this we must: (1) be receptive to considering various viewpoints; (2) update our regulations and policies when necessary to keep current; and (3) enforce the rules such that our expectations are clear and focused.

Cross-Border Issues

In the 1980’s, the CFTC created a regime for allowing US customers to access foreign futures and options markets.[4] Such access was, and still is, predicated upon a determination that the foreign regime has a comparable regulatory scheme. Pursuant to Part 30 of the Commission’s regulations, persons located outside the US who are subject to a comparable regulatory framework in the country in which they are located may seek an exemption from the application of certain Commission regulations, including those with respect to registration. This framework has served US customers well.

But the CFTC’s approach to cross-border swaps regulation has had a different trajectory. While implementing Dodd-Frank, the CFTC suffered from first-mover disadvantage and often applied its rules extraterritorially. I cannot imagine that this was intended to be a permanent state because in Dodd-Frank, Congress was clear regarding the CFTC’s authority and the limits on that authority with respect to cross-border swaps activities.

For example, Congress specifically authorized the CFTC to exempt from registration, conditionally or unconditionally, derivatives clearing organizations (“DCOs”) and SEFs that the Commission determines are subject to comparable, comprehensive supervision and regulation by the appropriate government authorities in their home countries.[5] I believe this explicit authorization from Congress for the CFTC to defer to comparable foreign regulatory regimes is significant. Furthermore, Section 2(i) of the Commodity Exchange Act (“CEA”) limits the applicability of swaps provisions added to the CEA by Dodd-Frank, and any rule prescribed or regulation promulgated thereunder.[6] In fact, Section 2(i) starts with the presumption that the CEA and the Commission’s regulations do not apply to activities outside the United States unless specific criteria are met.[7]

But since the CFTC’s rules took effect well before other jurisdictions were able to finalize their reforms, the mismatched timing resulted in some unfortunate challenges. First, because the CFTC did not exempt from SEF registration non-US trading platforms based on comparable, comprehensive supervision and regulation, those swaps trading platforms excluded US persons from participating for fear that the presence of a single US person would subject the platform to CFTC regulation. There has been much subsequent discussion about the potential for undesirable market fragmentation in such scenarios.

Second, in a stark departure from the CFTC’s historical cross-border approach of mutual recognition, the CFTC’s cross-border interpretive guidance for swap dealers (“Cross-Border Guidance”)[8] was at one point described as applying the “Intergalactic Commerce Clause of the US Constitution” by former Commissioner Jill Sommers.[9] Through an aggressive interpretation of CEA Section 2(i), the Cross-Border Guidance issued in July 2013 took expansive views on what swaps non-US entities (and their counterparties) had to count against the de minimis swap dealer registration threshold and the Dodd-Frank requirements that applied to non-US entities that registered as swap dealers. Objections intensified four months later in November 2013, when DSIO issued its “ANE Advisory” stating that a non-US swap dealer regularly using personnel located in the US to arrange, negotiate, or execute a swap with a non-US person counterparty generally would be required to comply with certain Dodd-Frank requirements.[10] Through no-action relief and Commission action, though, the ANE Advisory has never taken effect.

Finally, perhaps one of the most contentious issues among global regulators stems from the fact that the CFTC required registration of any central counterparty (“CCP”) seeking to clear swaps for US customers, without assessing whether that CCP was subject to comparable, comprehensive supervision and regulation in its home country, as the statute provided. The perception, whether accurate or not, that the CFTC substantially overreached poisoned the agency’s relationships with its international regulatory colleagues, and those relationships have not fully recovered to this day.

Today, many other countries have made tremendous progress in implementing the reforms agreed to by the G-20 leaders in Pittsburgh in 2009.[11] That means it is time for the CFTC to return to what we know from experience has worked well: global regulatory coordination and deference to regimes with comparable regulation. I am pleased that the CFTC is, in fact, implementing this approach. Likewise, I expect other jurisdictions to rely on the CFTC’s abilities and respect our expertise. Such a two-way street will best fulfill the mission the G-20 leaders agreed to in Pittsburgh almost ten years ago.

First, with respect to swaps trading, the CFTC has issued SEF equivalence determinations exempting certain trading facilities authorized in the EU,[12] certain trading facilities regulated by the Monetary Authority of Singapore,[13] and certain electronic trading platforms authorized in Japan[14] from SEF registration.

Similarly, as other jurisdictions have implemented their swap regulatory reforms over the past several years, the CFTC has issued substituted compliance determinations that have removed some of the sharp “intergalactic” edges of the Cross-Border Guidance for swap dealers. By now, firms have adapted to the Cross-Border Guidance and should not be forced to endure the disruption and costs that would ensue from a sweeping change in approach. The Commission recently issued a proposal that generally codifies the Cross-Border Guidance[15] – and providing certainty through rulemaking is good government. But the proposal also would makes some important changes: (1) tightening up the definition of a US person and harmonizing it with the SEC’s definition; and (2) proposing a new category of entity called “significant risk subsidiaries” to capture firms that are not US persons or guaranteed by US persons, but whose swap dealing activities could impact the US financial system – defined objectively as opposed to the vague and confusing “conduit affiliates” in the Cross-Border Guidance or the too-expansive category of foreign consolidated subsidiaries that the CFTC proposed in 2016. The proposal also includes a statement that the CFTC will not consider ANE transactions by non-US swap dealers any differently than other swap transactions of such entities.

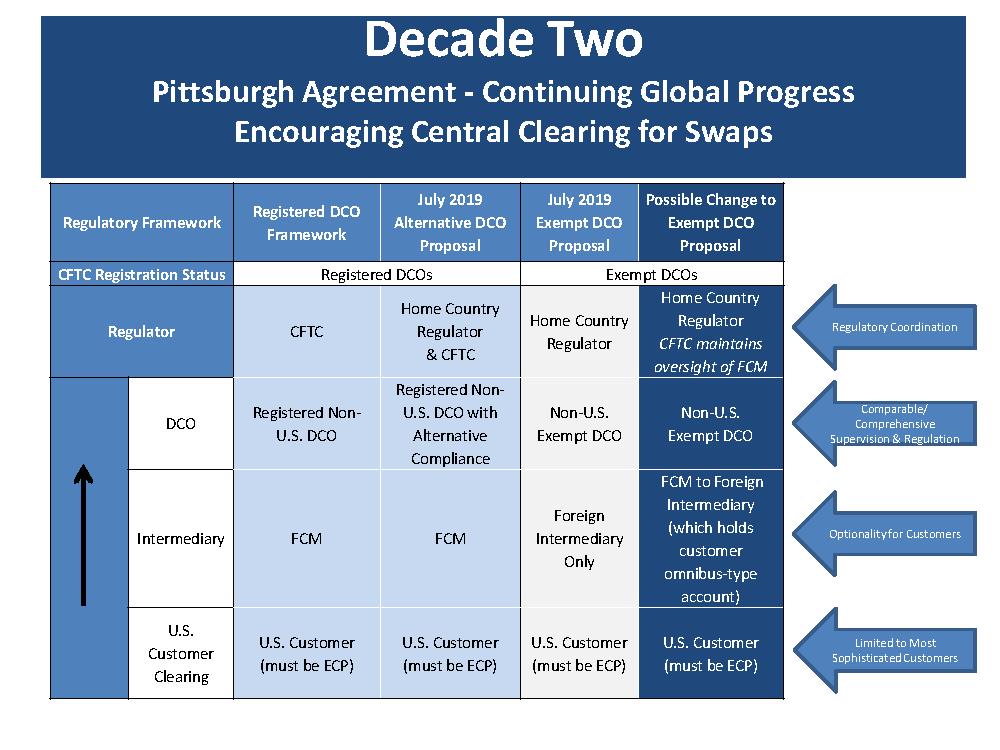

Finally, the CFTC is currently considering revised approaches to permitting US customers to access non-US CCPs.[16] I supported the Commission’s release last summer of two proposals regarding US customer access to non-US CCPs. I believe they are a step in the right direction when it comes to deferring to non-US regulators that have implemented regulatory regimes comparable to the CFTC’s. But I am concerned that those proposals are too rigid to pragmatically facilitate increased swaps clearing by US customers.

Under the Alternative Compliance Proposal, non-U.S. DCOs can permit customer access only if a futures commission merchant (“FCM”) is directly facilitating the clearing. The other available option – provided for in the Exempt DCO Proposal – completely disallows the FCM from being involved in customer clearing. Such a bright line test limits customer options when accessing CCPs, and I think we all know that the reform goals were to encourage, rather than further complicate, central clearing. We must recognize the sophistication of the customers in this space. Those trading swaps must be eligible contract participants. We should provide them with workable options, rather than dictate the relationships they must have and the level of legal risk they may take.

I am interested to hear from this group – clearing members and your customers on the buy side – regarding options we should consider and the complicating factors that may affect our ability to provide those options. For example, should we create for swaps a regime akin to the CFTC’s Part 30 regime for futures? What challenges might that entail? Can we overcome them and create a workable framework for US customers to access non-US CCPs through their preferred FCM? My personal view is that you all, as some of the most sophisticated customers in our markets, should be allowed to make decisions in coordination with your clearing members about the most efficient means of accessing a comparably and comprehensively supervised and regulated foreign CCP. The chart below compares how US customers are currently permitted to access non-US CCPs, the Alternative Compliance Proposal, the Exempt DCO Proposal, and a possible change to the Exempt DCO Proposal for consideration.

Data Protection

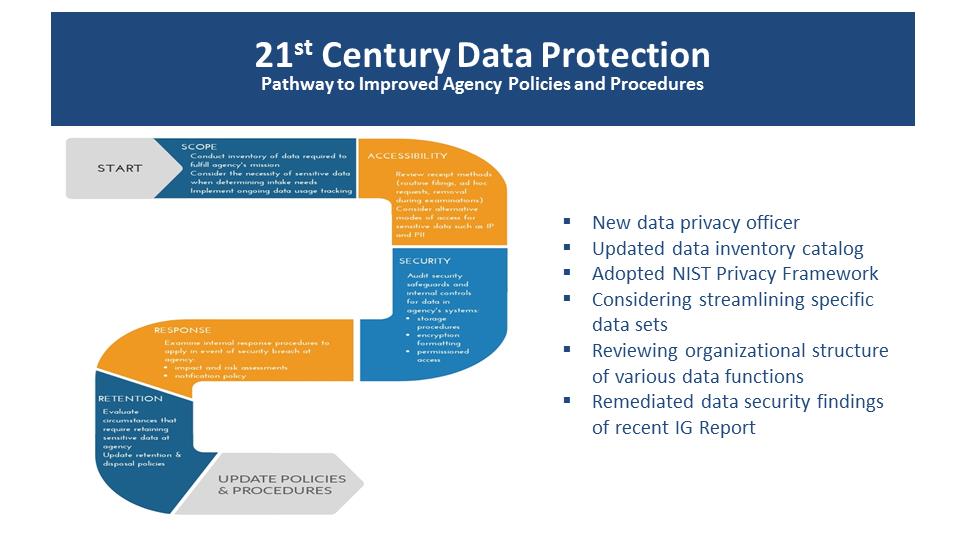

As you may have heard, data protection is a priority for me, and I have initiated what we refer to as the Data Protection Initiative[17]. It is hard to fathom the state of play back in 1975 in terms of data submission, retention, and protection. In our world of instant access to information from the palm of our hand, it is difficult to imagine regulatory information being physically transmitted via the Postal Service or later the fax machine. As for data retention, the Commission recently changed its recordkeeping rule to remove antiquated terms, such as microfiche, as allowable formats for data retention. At the CFTC’s creation, concerns about data protection were different and were limited mostly to physical security. We can assume that there was considerably less data being delivered to us simply due to the challenges in quickly and easily providing voluminous amounts of physical information.

Today, not only have the original futures markets the Commission was tasked with overseeing grown tremendously, but Dodd-Frank incorporated the massive swaps market, and all of its associated data, within the remit of the agency. Additionally, the Agency’s data collection efforts have increased commensurate with the growth, speed, and technological advancement of derivatives trading. The associated risks with ingesting and protecting sensitive data have also expanded. Like many of you, we are a data rich target, and that requires a top to bottom review of our approach. The Data Protection Initiative is designed to address these issues, as depicted below.

Regardless of how much data we collect and how it is reported, the CFTC needs to have a holistic data strategy that includes policies and procedures governing data in a uniform manner across all parts of the Agency to ensure that data is protected. Who knows what the future will hold in terms of the mechanism for the collection and protection of data? Perhaps blockchain technology could develop in such a way that both regulators and reporting counterparties could benefit from its adoption and facilitate easier, faster, and less costly reporting. Maybe regulators could eventually receive permissioned access and hypothetically serve as a node on the distributed ledger.

I briefly mentioned our recently expanded data needs per Dodd-Frank and want to elaborate a bit on an upcoming swap data reporting rulemaking that may be of interest to you, and certainly is relevant to the conversations we are having on data protection. A decade ago, the G-20 leaders in Pittsburgh identified a need for regulators and central banks to be aware of and understand swaps market activity across jurisdictions. As we prepare to propose rules to improve swap data reporting, I am hopeful that we can recognize that this recent data intake requires particular attention to protection. Three specifics I would like to see: (1) refine the number of required data elements to be reported to only those with an identified use-case by the Commission; (2) reasonable streamlining that will effectively decrease the number and type of messages being submitted by reporting counterparties, ingested by swap data repositories, and reviewed by Commission staff; and (3) extend the time delay for Part 45 regulatory reporting to 24 hours to allow for counterparties to exchange confirmations with each other and report the data more completely and correctly. This would harmonize the CFTC timing requirements with those of both the European Securities and Markets Authority (“ESMA”) and the SEC.

Position Limits

And now for something completely different: A word about position limits. This is an issue that certainly has spanned decades of derivatives regulations – it even predates the CFTC.

The CFTC and its predecessor agency have had a position limits regime for futures and options on futures since the 1930s. Although there have been twists and turns over time, the basics of the regime consisting of federal spot and non-spot month limits for contracts in certain agricultural commodities, and exchange-set limits or position accountability rules for others, has generally worked well.

But some have argued that the position limits regime was insufficient to prevent excessive speculation in the derivatives markets for energy during 2007-2008, and that this led to sharp increases in energy prices paid by consumers at that time. CFTC studies have not borne this out, and other studies have been inconclusive. Yet, since then, energy prices have dropped due to developments wholly unrelated to the futures markets (such as shale drilling, and further development of liquefied natural gas).

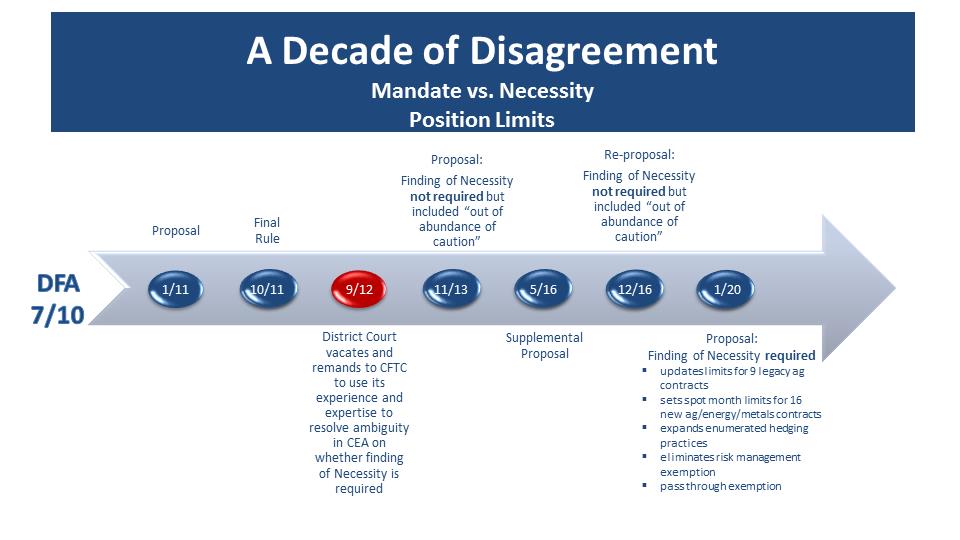

These market dynamics, though, do not change the fact that in Dodd-Frank, Congress amended the CEA’s position limit provisions, and the CFTC has been trying to implement those amendments ever since: (1) final rules adopted in 2011[18] but vacated by a federal court in 2012[19]; (2) another proposal in 2013[20]; (3) a supplemental proposal in early 2016[21]; (4) a re-proposal in late 2016[22]; and (5) a new proposal that the Commission just issued on January 30, 2020.[23]

As depicted in the diagram below, much of the legal debate over the years has focused on whether a finding that position limits are necessary is a prerequisite to the CFTC’s mandate to establish limits.

For the reasons that I provided in my Statement on the recent proposal, I believe that such a necessity finding is required.[24] But regardless of one’s views on the necessity of position limits in general, market participants need and deserve certainty. And the CFTC’s position limits regime is in need of updating in certain areas, such as: (1) deliverable supply estimates underlying federal spot-month limits; and (2) the list of enumerated bona fide hedging practices.

The key elements of the new position limits proposal are as follows:

New (higher) federal spot and non-spot month limits for the nine legacy agricultural contracts currently subject to such limits;

New spot month limits (but not non-spot month limits) for 16 other physically-settled agricultural, energy, and metals contracts;

An expanded definition of bona fide hedging positions and transactions;

In general, significant reliance on exchanges to administer position limits; and

A new 10/2-day review process for CFTC review of exchange recognitions of non-enumerated bona fide hedges.

I believe that overall, the proposal is reasonable in its design, balanced in its approach, and workable in practice for both market participants and the Commission. There certainly are areas for improvement, and commenters should focus on those. It is a good proposal – tell us where and how we can make it better.

Finally, no-action relief from the Division of Market Oversight is currently in place for certain aspects of the position aggregation rules that the Commission finalized in late 2016. Last July, DMO extended this relief through August 2022. The no-action relief was issued so that the Commission and its staff could study the operation of the recent position aggregation amendments and determine whether further rule changes are warranted. I support such an examination.

Closing

When I first moved to Washington, DC, there was an establishment named simply “Decades,” where my friends and I spent many of our weekends. As the name suggests, patrons could hear music from the 70’s, 80’s, or 90’s depending on the floor you chose. I preferred the 80’s level, where one could be mindful of the nostalgia generated by the songs and also be grateful that “big hair” was no longer a fashion trend.

As music has changed over the decades, so have our markets, yielding many positive results. Regulation of evolving markets requires adaptation, but we should not abandon the classics that still serve us well, such as: (1) global regulatory coordination; (2) a culture of a compliance partnership among regulators and market infrastructure providers, as opposed to reliance on enforcement of subjective rules; and (3) principles rather than prescription, which will help avoid constantly outdated regulatory obligations.

As we enter this new decade and celebrate the CFTC’s 45 years, I would say we have much to be proud of. We also have much work ahead to ensure that our regulations remain appropriately attuned to preserving the integrity of the markets you have built.

[1] See Dodd-Frank Wall Street Reform and Consumer Protection Act, Public Law 111-203, 124 Stat. 1376 (2010) (“Dodd-Frank”).

[2] See Registration and Compliance Requirements for Commodity Pool Operators and Commodity Trading Advisors: Registered Investment Companies, Business Development Companies, and Definition of Reporting Person, 84 Fed. Reg. 67343 (Dec. 10, 2019); and Registration and Compliance Requirements for Commodity Pool Operators (CPOs) and Commodity Trading Advisors: Family Offices and Exempt CPOs, 84 Fed. Reg. 67355 (Dec. 10, 2019).

[3] Amendments to Certain Swap Execution Facility Requirements and Real-Time Reporting (adopted Jan. 30, 2020) (publication in Federal Register pending), available at https://www.cftc.gov/PressRoom/PressReleases/8112-20.

[4] See 17 C.F.R. Part 30.

[5] See CEA § 5b(h), 7 U.S.C. 7a-1(h) (authorizing the CFTC to exempt DCOs from registration for the clearing of swaps); CEA § 5h(g), 7 U.S.C. 7b-3(g) (authorizing the CFTC to exempt SEFs from registration).

[6] See CEA § 2(i), 7 U.S.C. 2(i) (“The provisions of [the CEA] relating to swaps that were enacted by the Wall Street Transparency and Accountability Act of 2010 (including any rule prescribed or regulation promulgated under that Act), shall not apply to activities outside the United States unless those activities (1) have a direct and significant connection with activities in, or effect on, commerce of the United States; or (2) contravene such rules or regulations as the Commission may prescribe or promulgate as are necessary or appropriate to prevent the evasion of any provision of [the CEA] that was enacted by the Wall Street Transparency and Accountability Act of 2010.”).

[7] See id.

[8] Interpretive Guidance and Policy Statement Regarding Compliance with Certain Swap Regulations, 78 Fed. Reg. 45292 (July 26, 2013).

[9] See Cross-Border Application of Certain Swaps Provisions of the Commodity Exchange Act, 77 Fed. Reg. 41214, 41239 (proposed July 12, 2012) (Statement of Commissioner Sommers, expressing the view that in drafting the CFTC’s proposed cross-border interpretive guidance, “staff had been guided by what could only be called the ‘Intergalactic Commerce Clause’ of the United States Constitution . . .”).

[10] See CFTC Staff Advisory No. 13-69, Applicability of Transaction-Level Requirements to Activity in the United States (Nov. 14, 2013), available at http://www.cftc.gov/idc/groups/public/@lrlettergeneral/documents/letter/13-69.pdf.

[11] See Leaders’ Statement from the 2009 G-20 Summit in Pittsburgh, Pa. (Sept. 24-25, 2009) (“G-20 Pittsburgh Leaders’ Statement”), available at https://www.treasury.gov/resource-center/international/g7-g20/Documents/pittsburgh_summit_leaders_statement_250909.pdf.

[12] See In the Matter of the Exemption of Multilateral Trading Facilities and Organised Trading Facilities Authorized Within the European Union from the Requirement to Register with the Commodity Futures Trading Commission as Swap Execution Facilities, Order of Exemption, available at https://www.cftc.gov/International/ForeignMarketsandProducts/ExemptSEFs#European%20Union (Dec. 8, 2017); In the Matter of the Exemption of Multilateral Trading Facilities and Organised Trading Facilities Authorized Within the European Union from the Requirement to Register with the Commodity Futures Trading Commission as Swap Execution Facilities, Amendment to Appendix A to Order of Exemption, available at https://www.cftc.gov/International/ForeignMarketsandProducts/ExemptSEFs#European%20Union (Dec. 3, 2018).

[13] See In the Matter of the Exemption of Approved Exchanges and Locally-Incorporated Recognised Market Operators Authorized within Singapore from the Requirement to Register with the Commodity Futures Trading Commission as Swap Execution Facilities, Order of Exemption, available at https://www.cftc.gov/International/ForeignMarketsandProducts/ExemptSEFs#Singapore (Mar. 13, 2019).

[14] See In the Matter of the Exemption of Electronic Trading Platforms Registered Within Japan from the Requirement to Register with the Commodity Futures Trading Commission as Swap Execution Facilities, Order of Exemption, available at https://www.cftc.gov/International/ForeignMarketsandProducts/ExemptSEFs#Japan (July 11, 2019).

[15] Cross-Border Application of the Registration Thresholds and Certain Requirements Applicable to Swap Dealers and Major Swap Participants, 85 Fed. Reg. 952 (proposed Jan. 8, 2020).

[16] See Registration with Alternative Compliance for Non-U.S. Derivatives Clearing Organizations, 84 Fed. Reg. 34819 (proposed July 19, 2019) (“Alternative Compliance Proposal”); Exemption from Derivatives Clearing Organization Registration, 84 Fed. Reg. 35456 (proposed July 23, 2019) (“Exempt DCO Proposal”).

[17] See Statement of Commissioner Dawn D. Stump Announcing Further Progress in the CFTC’s Data Protection Initiative (Nov. 21, 2019), available at https://www.cftc.gov/PressRoom/SpeechesTestimony/stumpstatement112119.

[18] Position Limits for Futures and Swaps, 76 Fed. Reg. 71626 (Nov. 18, 2011).

[19] International Swaps and Derivatives Association v. U.S. Commodity Futures Trading Commission, 887 F.Supp. 2d 259 (D.D.C. 2012).

[20] Position Limits for Derivatives, 78 Fed. Reg. 75680 (proposed Dec. 12, 2013).

[21] Position Limits for Derivatives: Certain Exemptions and Guidance, 81 Fed. Reg. 38458 (proposed June 13, 2016).

[22] Position Limits for Derivatives, 81 Fed. Reg. 96704 (proposed Dec. 30, 2016).

[23] Position Limits for Derivatives (adopted Jan. 30, 2020) (publication in Federal Register pending), available at https://www.cftc.gov/PressRoom/PressReleases/8112-20.

[24] Statement of Commissioner Dawn D. Stump Regarding Proposed Rule: Position Limits for Derivatives, Jan. 30, 2020, available at https://www.cftc.gov/PressRoom/SpeechesTestimony/stumpstatement013020.