- Overview of the FY 2014 Budget & Performance Plan

- Summary of FY 2014 Budget Request by Mission Activity

- Summary of FY 2014 Budget Request by Division

- Summary of FY 2014 Budget Request by Object Class

- Crosswalk from FY 2013 Budget to FY 2014 Request

- Crosswalk from FY 2013 Continuing Resolution to FY 2014 Request

- Statement of Availability on Basis of Obligations

- Statement of Availability on Basis of Appropriation by Program

- Mission Activities

- Divisions

The Commission reviews new product filings as well as issues no-action letters. The CFTC's traditional scope of work includes reviewing new futures and options contract filings, reviewing contract rule submissions, and developing new rules and policies to accommodate innovations in the industry. Currently, the Commission conducts due diligence reviews of new contract filings to ensure that the contracts are not readily susceptible to manipulation or price distortion, and that the contracts are subject to appropriate position limits or position accountability. The Commission also analyzes amendments to contract terms and conditions to ensure that the amendments do not render the contracts readily susceptible to manipulation and do not otherwise affect the value of existing positions. In order to prioritize work with its constrained staffing, the Commission implemented a procedure that assigns greater review priority to contracts that have achieved certain thresholds of trading volume and open interest.

The Commission also has responsibility for reviews of aggregate position limits for physical commodity derivatives. Because it has the authority to gather data and impose regulations across trading venues, the Commission is uniquely situated to establish uniform position limits and related requirements for all economically-equivalent derivatives.

In addition, the Commission has several new product-review responsibilities under the Dodd-Frank Act. The Commission will need to evaluate transaction and pricing data collected by SDRs. This data will be used by the Commission to determine appropriate block trade threshold levels that registered SEFs, DCMs, and market participants may use to delay public reporting of swap transaction data. The Commission must also evaluate market data and contract characteristics to determine whether a swap contract that is listed on a DCM or SEF has been "made available to trade." The Commission also will be performing mandatory clearing determinations, and assessing swaps presented to DCOs to determine their acceptability for clearing.

- The majority of rules associated with the product review of swaps were published in the last quarter of FY 2012. Much of the foundational work for swaps contract reviews will be performed in FY 2013, but the Commission anticipates on-going product reviews during FY 2014 and beyond as new contracts are created to meet market needs.

- In addition, the Commission anticipates that it will begin to analyze, by asset class, the percentage and volume of previously non-transparent swaps now cleared, the level of risk transfer, the potential relative movement of institutions to new financial products, and the implied overall credit and market risk in FY 2014 to ensure that the Commission's regulations reflect an appropriate understanding of the market segments most prone to market failure. The Commission anticipates reallocating resources directed toward product review activities between 2013 and 2014, commensurate with a surge of new activity in 2013, and a return to more of a steady-state requirement in 2014.

Summary

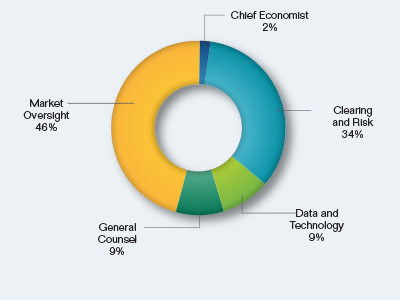

Organizationally, the Commission's activities related to products reviews and assessment of product-related rules will support the requirements of five Divisions:

| FTE | Salaries and Expenses | IT | Total | |

|---|---|---|---|---|

| Chief Economist | 1 | $240 | $0 | $240 |

| Clearing and Risk | 15 | 3,580 | 0 | 3,580 |

| Data and Technology | 0 | 0 | 950 | 950 |

| General Counsel | 4 | 950 | 0 | 950 |

| Market Oversight | 20 | 4,770 | 0 | 4,770 |

| Total | 40 | $9,540 | $950 | $10,490 |

Product Reviews Request by Division