- Overview of the FY 2014 Budget & Performance Plan

- Summary of FY 2014 Budget Request by Mission Activity

- Summary of FY 2014 Budget Request by Division

- Summary of FY 2014 Budget Request by Object Class

- Crosswalk from FY 2013 Budget to FY 2014 Request

- Crosswalk from FY 2013 Continuing Resolution to FY 2014 Request

- Statement of Availability on Basis of Obligations

- Statement of Availability on Basis of Appropriation by Program

- Mission Activities

- Divisions

The Division of Market Oversight (DMO) program fosters markets that accurately reflect the forces of supply and demand for the underlying commodities and are free of disruptive activity. To achieve this goal, program staff perform market surveillance; review new exchange applications and examine existing exchanges to ensure their compliance with the applicable core principles; evaluate new products to ensure they are not susceptible to manipulation; review exchange rules and actions to ensure compliance with the CEA and CFTC regulations; and carry out the mandates of the Dodd-Frank Act related to oversight of swaps trading.

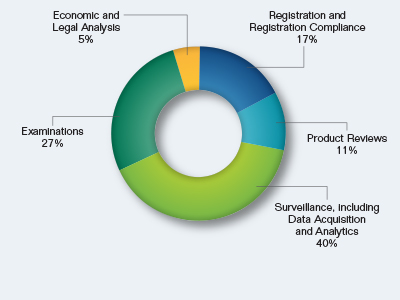

FY 2014 Budget Overview by Mission Activity

| FTE | Salaries and Expenses | IT | Total | |

|---|---|---|---|---|

| Registration and Registration Compliance | 31 | $7,390 | $0 | $7,390 |

| Product Reviews | 20 | 4,770 | 0 | 4,770 |

| Surveillance, including Data Acquisition and Analytics | 71 | 16,920 | 0 | 16,920 |

| Examinations | 47 | 11,210 | 0 | 11,210 |

| Economic and Legal Analysis | 8 | 1,910 | 0 | 1,910 |

| Total | 177 | $42,200 | $0 | $42,200 |

Market Oversight Request by Mission Activity

Top FY 2012 Accomplishments

Completed final rulemakings related to the Dodd-Frank Act:

- Position Limits for Futures and Swaps – published November 18, 2011 and became effective January 17, 20121;

- Registration of Foreign Boards of Trade (Part 48) – published December 23, 2011 and became effective February 21, 2012;

- Real Time Public Reporting of Swap Transaction Data (Part 43) - published January 9, 2012 and became effective March 9, 2012;

- Swap Data Recordkeeping and Reporting (Part 45) - published January 13, 2012 and became effective March 13, 2012;

- Swap Data Recordkeeping and Reporting Requirements: Pre-Enactment and Transition Swaps – published June 12, 2012 and became effective August 13, 2012;

- Update to Core Principles and Other Requirements for Designated Contract Markets (Part 38) – published June 19, 2012 and became effective August 20, 2012; and

- Commodity Options – published April 27, 2012 and became effective June 26, 2012.

Implemented the Large-Trader Reporting for Physical Commodity Swaps regulation.

Provided no action relief to facilitate smooth transition to the new swap reporting regime.

Completed reviews of 229 new product certifications, 34 product-related certifications, 490 rule filings and 21 foreign stock index certifications.

Market surveillance built working prototypes of new tools aimed at bringing disparate data together and visualizing it, thus reducing the amount of time needed to understand a market event. Multiple new engines were created to detect potential trading violations.

Redesigned CFTC Form 40 (Statement of Reporting Trader), CFTC Form 102 (Identification of Special Accounts), and developed new CFTC Form 71 (Identification of Omnibus Accounts and Sub-Accounts) as part of a proposed rulemaking on OCR and electronic forms.

Top FY 2013 President's Budget & Performance Planned Outcomes

Completion of remaining Dodd-Frank rulemakings:

- Finalize SEF Rulemaking (Part 37);

- Finalize rulemaking establishing a framework for determining whether a swap that is subject to mandatory clearing has been "made available for trading";

- Finalize Core Principle 9 Update to Designated Contract Market Requirements Rulemaking (Part 38); and

- Finalize block trades for swaps rulemaking.

Continue review of new SDR registration applications.

Implement swap data reporting to SDRs.

Begin review of new SEF registration applications.

Begin review of foreign board of trade (FBOT) applications.

Implement swap block trade provisions for real-time reporting.

Adopt standards for blocks in futures markets.

Re-propose a rulemaking establishing position limits for futures and swaps.

Top FY 2014 President's Budget & Performance Planned Outcomes

Continued registration of new applicants: SDRs, SEFs, FBOTs, and DCMs.

Integrate swaps data into surveillance program.

Implement Federal speculative limits for physical commodities.

Start examinations of SEFs and SDRs.

Determinations as to which swaps are subject to mandatory clearing are "made available for trading."

1 On September 28, 2012, the Positions Limits Rule was vacated and remanded to the Commission for further proceedings. (back to text)