- Overview of the FY 2014 Budget & Performance Plan

- Summary of FY 2014 Budget Request by Mission Activity

- Summary of FY 2014 Budget Request by Division

- Summary of FY 2014 Budget Request by Object Class

- Crosswalk from FY 2013 Budget to FY 2014 Request

- Crosswalk from FY 2013 Continuing Resolution to FY 2014 Request

- Statement of Availability on Basis of Obligations

- Statement of Availability on Basis of Appropriation by Program

- Mission Activities

- Divisions

The Division of Swap Dealer and Intermediary Oversight (DSIO) program oversees the registration and compliance activities of intermediaries and the futures industry SROs, which include the U.S. derivatives exchanges and the NFA. Program staff develops regulations concerning registration, fitness, financial adequacy, sales practices, protection of customer funds, cross-border transactions and anti-money laundering programs, as well as policies for coordination with foreign market authorities and emergency procedures to address market-related events that impact intermediaries. With the passage of the Dodd-Frank Act, DSIO is responsible for the development of, or monitoring for compliance with, regulations addressing registration requirements, business conduct standards, capital adequacy, and margin requirements for swap dealers and major swap participants.

Registration and Registration Compliance

DSIO is responsible for appropriate oversight of the NFA's registration of swap dealers, major swap participants, FCMs, and other market participants. While the surge of registrations of new entities will be essentially complete in FY 2013, the 2014 level of effort is driven by expected increases in workload due to the cross-border scope of the Dodd-Frank Act and rule filings as the increased number of entities continue to implement and refine their rules of operation under the new regulatory framework.

Examinations

DSIO is responsible for ensuring that swap dealers, MSPs, FCMs and other intermediaries meet the applicable financial and customer protection requirements set forth in the CEA and Commission regulations. DSIO examinations are performed by highly specialized auditors that perform a broad spectrum of critical duties to include:

- Direct compliance examinations for FCMs and oversight/annual performance assessments of SRO financial surveillance programs;

- Evaluations of NFA methodologies and processes for monitoring CPO and CTA compliance with CEA and Commission regulations;

- Daily financial surveillance of market activities and associated reporting;

- Continuous industry and stakeholder engagement, communications, and relationship building; and;

- Development and promotion of best practices standards.

As indicated above, this increase supports the expanded examinations of entities in the CFTC's traditional markets as well as the inclusion of new entities under the Dodd-Frank Act.

FY 2014 Budget Overview by Mission Activity

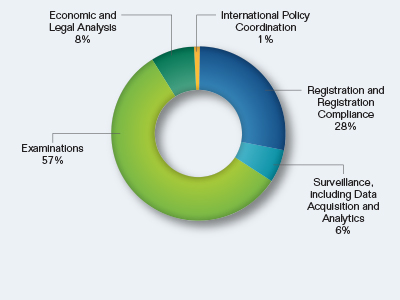

| FTE | Salaries and Expenses | IT | Total | |

|---|---|---|---|---|

| Registration and Registration Compliance | 44 | $10,490 | $0 | $10,490 |

| Surveillance, including Data Acquisition and Analytics | 9 | 2,150 | 0 | 2,150 |

| Examinations | 88 | 20,980 | 0 | 20,980 |

| Economic and Legal Analysis | 12 | 2,860 | 0 | 2,860 |

| International Policy Coordination | 1 | 240 | 0 | 240 |

| Total | 154 | $36,720 | $0 | $36,720 |

Swap Dealer and Intermediary Oversight Request by Mission Activity

Top FY 2012 Accomplishments

DSIO was the lead division in the Commission's efforts to adopt regulations concerning the registration process for swap dealers and MSPs and the following key final rules and regulations required by the Dodd-Frank legislation:

- establishing conflicts of interest requirements for swap dealers, MSPs, FCMs, and introducing brokers (IBs);

- establishing for the designation, qualifications, and duties of the chief compliance officers (CCOs) of FCMs, swap dealers, and MSPs; and

- establishing business conduct standards rules for swap dealers and major swap participants governing their dealings with counterparties generally, and additional requirements when they deal with "Special Entities".

In the wake of their collapse, DSIO, in coordination with staff members in the Division of Clearing and Risk and the Office of General Counsel, worked closely with the trustees of both MF Global and Peregrine to facilitate the orderly transfer of customers and the positions and margin collateral to other FCMs.

DSIO completed drafting proposed amendments to existing regulations to enhance protections for customers and to strengthen the safeguards surrounding the holding of money, securities and other property deposited by customers with FCMs and with (DCOs. The proposals are the result of the Commission's efforts to coordinate and consult with the futures industry on enhancing customer protections, including two public roundtables that were hosted by Commission staff. The proposals also expand upon previous Commission actions to enhance customer protections including the rolling back of certain exemptions from the investment standards for customer funds under Regulation 1.25 and the adoption of the legal segregation with operational commingling (LSOC model) for cleared swap transactions.

The proposal would enhance the protection of customers and customer funds by:

- Amending Part 30 of the regulations to require FCMs to hold sufficient funds in secured accounts to meet their total obligations to both U.S.-domiciled and foreign-domiciled customers trading on foreign contract markets, computed under the net liquidating equity method;

- Prohibiting FCMs from holding any positions in a Part 30 secured account other than customers' foreign futures and option positions and associated margin collateral;

- Requiring FCMs to hold sufficient proprietary funds in segregated accounts and Part 30 secured accounts to reasonably ensure that the firms are properly segregated and secured at all times, and to cover margin deficiencies in customers' trading accounts;

- Requiring FCMs to maintain written policies and procedures governing the maintenance of excess funds in customer segregated and Part 30 secured accounts, and requiring FCMs to obtain the pre-approval of management prior to the withdrawal of 25 percent or more of the excess funds held in segregated or secured accounts if the withdrawals were not for the benefit of the FCMs' customers;

- Requiring FCMs to provide the Commission and their respective designated self-regulatory organizations (DSROs) with daily reporting of the segregation and Part 30 secured amount computations, and semi-monthly reporting of the location of customer funds and how such funds are invested under Regulation 1.25;

- Requiring FCMs and DCOs to provide the Commission and DSROs, as applicable, with read-only direct electronic access to bank and custodial accounts holding customer funds;

- Requiring FCMs to adopt policies and procedures on supervision and risk management of customer funds;

- Requiring FCMs to provide potential customers with additional disclosures addressing firm specific risks; and

- Enhancing the standards for the SROs' examinations of member FCMs.

The proposals were published for public comment in the Federal Register in November 2012.

DSIO evaluated and enhanced its regulatory oversight processes model for oversight of DSROs to include a more robust approach that incorporates governance, risk assessment processes and control reviews.

DSIO redefined the role of its Examinations function to adjust to the changing environment by providing more clarity on financial review procedures, more targeted examinations and closer coordination with the SEC and the DSROs.

Top FY 2013 President's Budget & Performance Planned Outcomes

DSIO will initiate registration of swap dealers and MSPs to begin implementation of regulatory oversight operations of the swaps industry. In doing so, DSIO will continue to respond to requests for interpretation or other requests for relief or information resulting from the Dodd-Frank rulemakings and support integration of swap dealer's and MSPs into the CFTC's regulatory structure for existing futures market registrants. In this regard, DSIO anticipates numerous requests from industry participants and other members of the public regarding clarification or relief from the swap dealer and major swap participant registration requirements. Staff further anticipates requests for interpretation of other rulemakings including business conduct regulations. DSIO further anticipates completing additional Dodd-Frank rulemakings that would impose capital requirements on swap dealers and MSPs, and coordinating with DCR to complete a rulemaking establishing margin requirements for uncleared swap transactions.

In conjunction with other CFTC components, DSIO will support efforts to best incorporate foreign-domiciled entities that would otherwise be required to register as swap dealers or MSPs as those terms are defined under the CEA and Commission regulations. This effort could include an assessment of the comparability of developing swap regulations in foreign jurisdictions in a manner consistent with the Commission's current Part 30 program.

DSIO will continue to support Commission-wide efforts to collaborate with the SEC, NFA and other relevant stakeholders to harmonize registrant reporting requirements to avoid or mitigate potential duplication or unnecessary delays in the regulatory and compliance process.

DSIO will work closely with NFA on the development of a comprehensive program for the oversight and assessment of swap dealer and MSP compliance with the new business conduct standards established by the Commission under the Dodd-Frank Act. The program will be administered by the NFA, in consultation with DSIO staff. In addition to NFA conducting direct examinations, DSIO staff also will conduct direct examinations of swap dealers and major swap participants to assess their compliance with business conduct standards. DSIO direct examinations may be conducted jointly with NFA or on a separate basis.

DSIO will develop a program for staff to follow, assess and validate the NFA's oversight of swap dealers' and major swap participants' compliance with the Dodd-Frank requirements, including business conduct, capital, margin, and segregation requirements.

DSIO will perform a review of the financial surveillance programs of the major SROs, the NFA and the CME Group. The reviews will include an assessment of the SRO's oversight of member compliance with minimum financial and related reporting requirements, as well as certain non-financial requirements including sales practices and disciplinary programs. The results of this review will be used to identify areas of weakness and develop solutions for improvement.

DSIO will take on the additional responsibilities imposed by the Dodd-Frank Act and the Commission's swap dealer and MSP rulemakings, while also continuing to address issues arising from the futures market and futures market participants. DSIO will respond to formal and informal requests for interpretation of existing regulations impacting futures markets and futures market participants.

DSIO staff also will review rule submissions by futures markets SROs as required by the Dodd-Frank Act and Commission regulations.

Top FY 2014 President's Budget & Performance Planned Outcomes

Develop and issue rulemakings, orders, interpretations, and other regulatory work product related to SCs, MSPs, FCMs, IBs, commodity pool operators, commodity trading advisors, and associated persons.

Conduct annual reviews of SRO oversight programs, including NFA's program for the oversight of swap dealers and major swap participants.

Conduct direct reviews of Commission registrants, including FCMs, swap dealers, and major swap participants to assess their compliance with applicable regulations governing financial requirements and business conduct standards.

Review commodity pool financial data submitted by commodity pool operators for the purpose of assessing whether the financial positions of a commodity pool may pose systemic risk issues.

Review, evaluate and make determinations concerning applications submitted by FCMs, swap dealers, and MSPs to use proprietary models to compute regulatory capital and margin for uncleared swap transactions.